We will get to OLP in a second. Let us first define the opportunity. We have many (100s/1000s) of officers retiring or leaving service honourably at a reasonable age (Between say 40-50) Keep in mind most successful entrepreneurs are around the 45 yr mark. We have limited number of employment choices for them post service, there aren’t enough ICIs, ENGROs and Nishat’s or even AWTs, Fauji Foundations, DHAs or CSD Stores that need head of Security, Internal admin, Government relations or HR. (SIGH) this has to stop.

Why? Because we have built a mould that needs to be broken. How many branches does the military have? How many officers are trained in strategy, war games, mission readiness, surprise attacks, logistics, real time assessment, engineering, health, peace keeping, technology, defence systems, secrecy, legal affairs, counter intelligence etc? So the best we typically offer them and extract value is because of the recognition their titles bring? It is an un-fair equation for all. Let me elaborate.

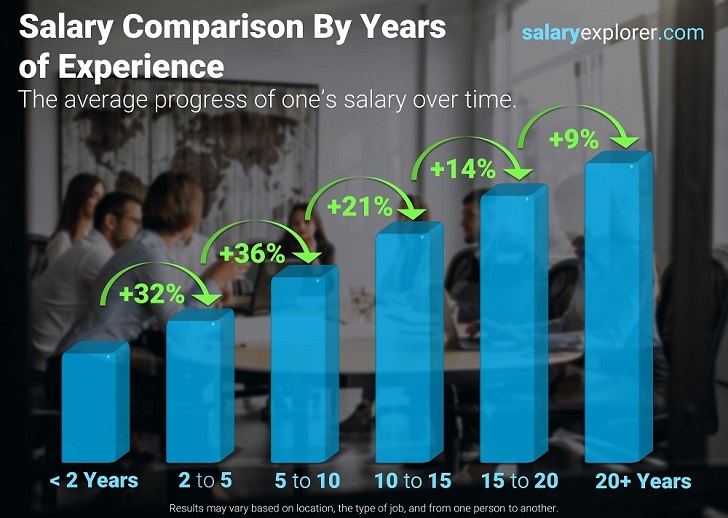

We invest in our officers and they are considered some of the best trained in the world. An officer is trained in adaptability, risk management, motivation, leadership and most importantly commitment and loyalty…all sought after skills in the corporate world and missing from young founders/founding teams. The skills need to be complimented with training in tech, digital and future skills to ensure that we are not losing the best amongst us to admin and security roles.

We are doing them a dis service of epic proportions by making them in-charge of CCTVs and Reference letters. We need to have a far better appreciation of their service, their duty & their commitment to our sovereignty. They have paid for us by their service as they stood in place of us and we have paid for theirs when they did by supporting them. Lets not get emotions get the best of us. Let us try to figure out how to propel this in to a strategic benefit for the country, retired service people and our economy. Yes you read that right. Our Economy.

Since we have a framework of what post retirement means, we do not challenge the status quo or build new channels. Most officers will struggle economically, but they dont have too. If we had a structured approach to on-board them and used their retirement as a feeder opportunity in to the new economic activity and reality of the post Corona World. That funnel is missing and we dont need to really re invent the wheel. But I want to actively build that funnel with others who want to.

Former Army & Intelligence forces recognition is a badge of honour in some countries when people launch startups. Others like the US where I was classically trained in the art of being productive had a great program at a little known company called GE. That program took in fresh grads(like my self at the time) and discharged service people and put them in to training programs. GE is known to have some of the best corporate leadership development and training programs in the world and some of their top internal talent that has come from the program has gone on to run and build some of the largest companies in the world.

Therein comes OLP. We need to have a startup vehicle that does Officer Leadership Programs, so that we train, re train, re launch and re activate people coming off-ramp from the forces to on-ramp in to companies + pairing with startups in the defence/manufacturing and other sectors locally and internationally as SMEs/Advisors/Coaches/Mentors/Operators/Supervisors/Partners/Shareholders. We need to breathe new life and build bridges between Adjudent General, (AG) branch that has the Welfare and Rehabilitation, W&R Directorate. We have to think beyond welfare and think of it more of a Unicorn Breeder. When you have arguably last level data on people their specialisation and service history. Whats missing is “Establishment|M” a for profit entity that on one end works with startups, industry, academia, incubators, accelerators, international partners to source requirement for talent + expertise + also train people in specialised vertical & skills to become chargeable in the corporate world and grow to be an in house incubator + accelerator.

The Three Areas of Establishment|M|

One that would pair existing startups and companies + founders with off-ramp(retiring) talent, for deployment locally.

Secondly, take off ramp talent and pair them with co-founders/talent/capital to launch their own companies add to that those who have immovable and value locked resources like land etc that can be brought in as founders equity.

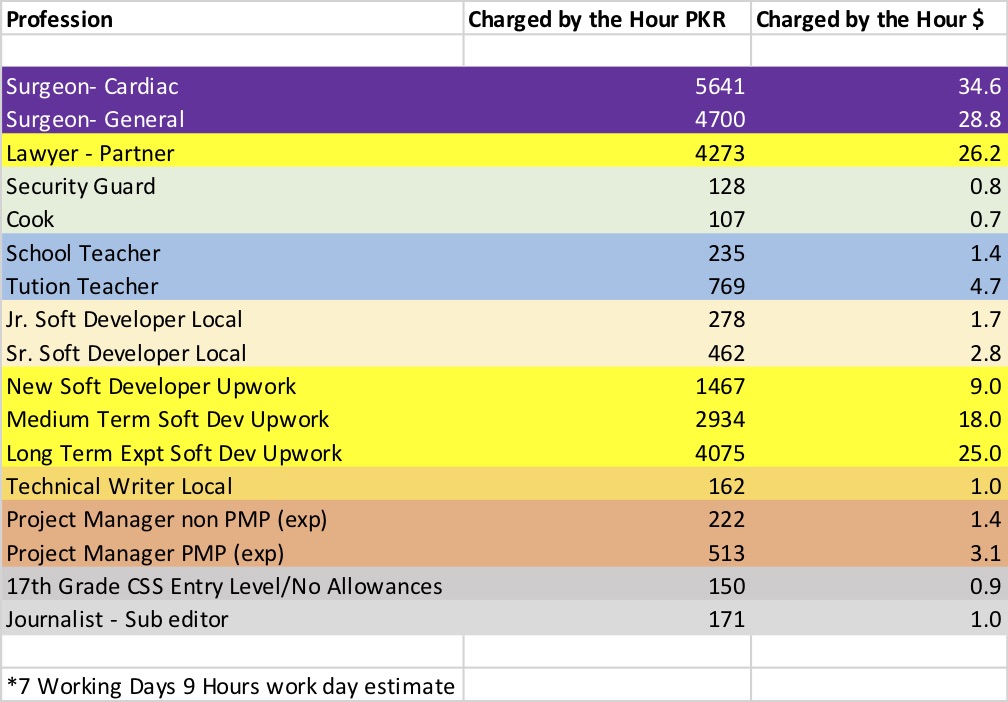

Thirdly, take a mix of the above and deploy them for international work with partners and platforms needing specialised resources from the many verticals of services these officers are retiring from. So think re-deployment on to upwork but for military/tech/educational careers. There are 100s/1000s of military/lineage jobs online for developing countries where defence /tactical/strategic/3PL/maintenance/ offshore experience is key.

Before 3 comes 1 (B3C1)

So before the three stages, Establishment|M will run a cohort style incubation process for all the talent it intakes. Structured courses/bootcamps of a different kind to up skill and upscale the talent and to define and allocate their user journeys within the three potential streams. By harnessing what our military men and women already possess, and enabling them to be productive building blocks of Pakistan’s digital and economic future, we would have ensured that not only do we honour their service, rather continue it in other forms long after they leave their uniforms behind.

There may be raw talent who want to be entrepreneurs and want to start companies/businesses etc, there may be talent that has hard to acquire skill that want to make it billable, there may be a mix of the two that is looking to be matched to global opportunities but do not have a starting point to locate those opportunities or to engage with them.

Some say that when you are dealing with officers there may be a hesitation to be re-trained or even ego, I say, let me prove you wrong. Every smart officer, which is every officer, will truly work to make them selves deployable and be dependable as they have always been but this time for them selves first.

OLP(Officer Leadership Program)| Not your average Boot Camp

The mission for ESTABLISHMENT|M through the Officer Leadership Program, is to find the best and the brightest of those officers as they are leaving active duty and to transfer their loyalties to its platform and them selves to build a better economic future for all. Most specifically for the officers, their families, their future partners employers & employees.

The goal is to produce executives/talent who can bring the natural leadership skills they displayed in the Pakistan military to the right careers via ESTABLISHMENT|M. This is not a placement service. Far from it. This is a part accelerator part incubator part re-deployment platform away from the already established and scarce roles that are not value additive as they could be.

The pitch to the officers is simple “From this point forward, when you are in any kind of environment, you have to think that the best entrepreneurs are in the room with you, watching your every move. When you are wearing anything that’s got ‘E|M|’ on its label, you’re representing a new company and a new loyalty, to your self, to grow your second career. “

It is an allegiance that the former officers will understand and embrace we just have to create the environment and provide the tools instead of shoe-horning them in to existing moulds and career choices which pale in comparison to both their talent and the availability of said roles. Why not create a new ecosystem a new pie and breed unicorns instead?

How does this start?

Keeping in touch

The program seeks to enlist soon-to-be-civilian officers. The company will not start the formal review process until the officers have filed their retirement papers, but program should keep in contact with interested officers for a year or more prior to their departure from the military so there can be a proper/planned in-take and off-take scenario. So that the skills and aspirations are mapped. Given the sensitivity and privacy the info can be collected but anonymised and kept with the relevant military department but a working system be developed. Those are all operating mechanics. The reason to put all this out there is to socialise the idea and get feedback to making sure any such company, program, bootcamp or service in any form is useful to all the constituents and that others copy it.

How can this be operationalised?

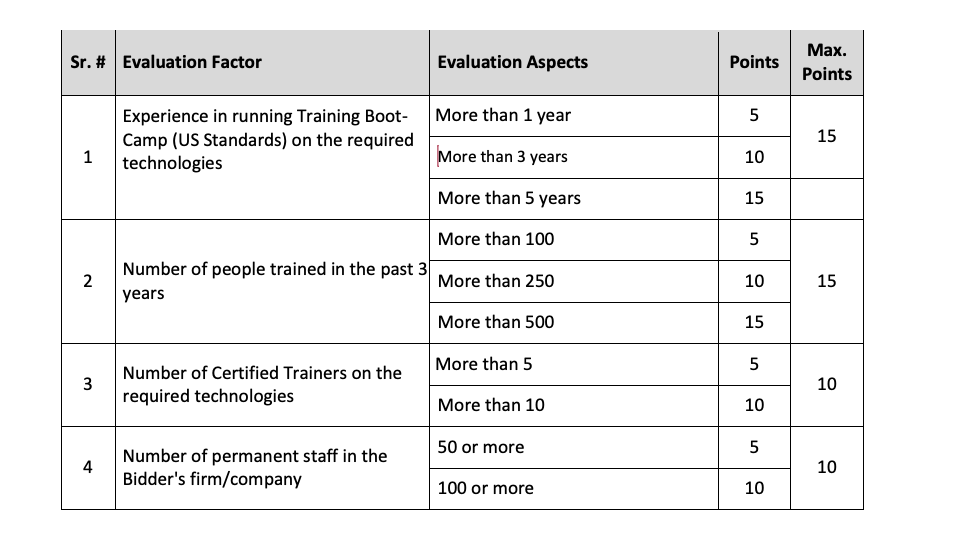

The minimum rank for admission into the Boot Camp is captain, or equivalent and the bootcamp lasts through three to eight-months with rotation to organisations that partner with the program or induction into startup(s), or helping find co-founders and incubating & launching new enterprises or pairing with international assignments and the internal consulting organisation to build our McKinsey–esque service. There will be three distinct tracks for ensuring the best talent gets paired with the best possibility for the highest success.

It sounds simple enough but this is Military to Civilian Transformation for Economic Development. MCTED. This also helps us in a host of different areas and removed taboos associated between civil and military interactions at large. If both parties build joint successes that too in new verticals, new services and create economic growth, every one wins long term. The harder we work the luckier we get, so lets work on this together and give |E|M a fighting chance.

Here’s my 2 cents for organisations who want to build just intake programs like OLP minus any incubation/acceleration, feel free to share this idea concept internally and reach out for any help you may need to kick start the effort. For incubators that want to work with retired officers to bring new co-founders to the front, feel free to pick up any thing from this note or to ping me directly.

For officers who have ideas who have retired or soon to retire and in search of the next phase in their life, it would be a privilege and an honour to connect and interact and see how we can work together even before a formal program is launched.

We owe it to our nation to our soldiers and to our selves to work together to build brave new companies with brave people and popularise the idea, so future generations know that post service there a new world waiting to be explored that can scale and monetize their skills. #PakistanStrong

“No soldier outlives a thousand chances. But every soldier believes in Chance and trusts his luck.”

― Erich Maria Remarque