Pakistan stands at a critical juncture in its economic development. With one of the largest youth populations in the world, the country possesses a significant demographic advantage. However, entrenched in outdated business practices, Pakistan’s industry and business leadership has largely failed to innovate and adapt. As the world rapidly embraces Artificial Intelligence (AI) and Artificial General Intelligence (AGI), Pakistan’s reliance on inexpensive labor is under threat. This article delves into the urgency of modernizing Pakistan’s business landscape, to avert a looming economic disaster.

The Current Business Landscape in Pakistan

Youth Population

Pakistan’s youth population, accounting for 64% of its total population, is a double-edged sword. The United Nations Development Programme (UNDP) reports that Pakistan has one of the youngest populations globally, with a median age of around 23 years. This youth bulge represents a massive potential workforce that, if harnessed correctly, could drive economic growth. However, without adequate job opportunities, this demographic dividend could become a demographic disaster. If you are young and reading this, heres some advice for you and some words of cation. TL;DR No One Is Coming to Save You.

Economic Crisis

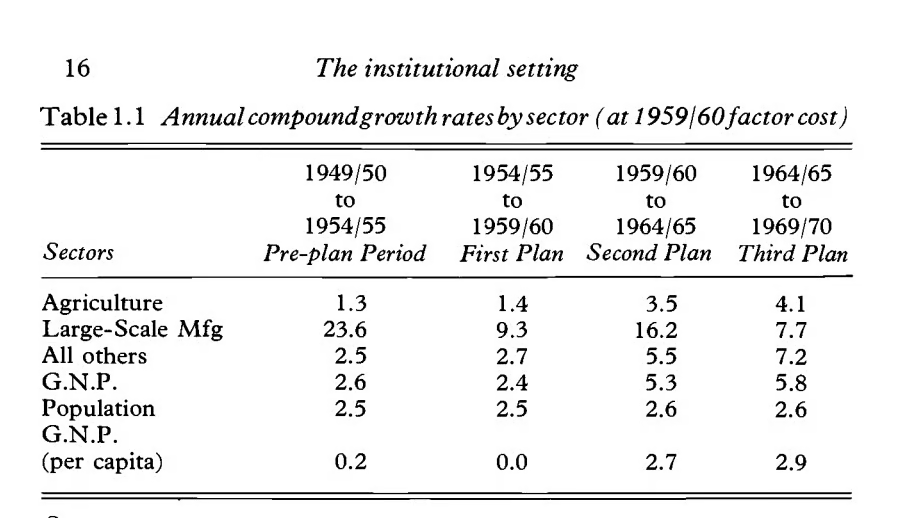

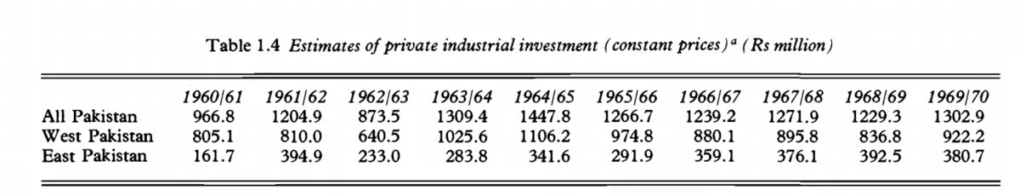

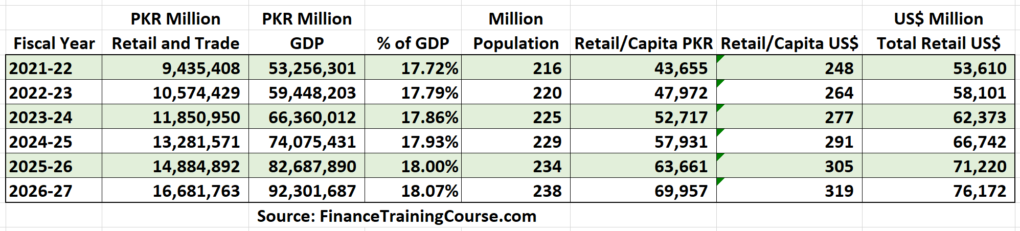

Pakistan’s economy is grappling with multiple crises. The GDP growth rate has stagnated, hovering around 2.4% in 2022, down from 5.8% in 2018. The inflation rate surged to 27% in April 2023, exacerbating the cost of living crisis for millions of Pakistanis who continue to loose hope in the situation and worse yet in life at large. The fiscal deficit has ballooned, and public debt has reached unsustainable levels, making economic stability precarious. We are battling massive losses on state owned enterprises with only talk of privatization, every passing day causes tax payer losses and no positive momentum. If you want to understand the underlying breakdown of data of how the SOEs(State Owned Enterprises) continue to malfunction and those at the helm who have no idea about what to do, read the following thread.

IMF Loans and Debt

Pakistan’s reliance on external borrowing has placed it in a precarious position. The country’s external debt stood at approximately $131 billion as of 2023, with portions owed to the IMF. The IMF loans come with stringent conditions, often leading to austerity measures that can stifle economic growth and increase social unrest.

Unemployment and Job Market

The unemployment rate in Pakistan is a critical issue, particularly among the youth. According to the Pakistan Bureau of Statistics, the overall unemployment rate is 6.9%, with youth unemployment estimated to be significantly higher. This translates to millions of young people unable to find meaningful employment, leading to a potential rise in social instability. The highest overall unemployment rate (11.56pc) is prevalent among the age group of 20-24 years. (Data and Stats below)

Lack of Modernization and Corruption Across the board

Pakistan’s industrial and business sectors lag in modernization. The World Economic Forum’s Global Competitiveness Report 2022 ranked Pakistan 110th out of 141 countries, highlighting severe deficiencies in innovation capability and technological readiness. Corruption exacerbates these issues, with Pakistan ranked 140th out of 180 countries in Transparency International’s Corruption Perceptions Index 2023. Bureaucratic inefficiencies and political corruption hinder economic progress and deter foreign investment.

Social Justice and Education

Social justice remains an elusive goal in Pakistan. The literacy rate is around 59%, with significant disparities between urban and rural areas. The quality of education is inconsistent, often failing to equip students with the skills needed in the modern economy. The Human Development Index (HDI) places Pakistan at 154th out of 189 countries, reflecting the country’s struggles with providing adequate health, education, and living standards.

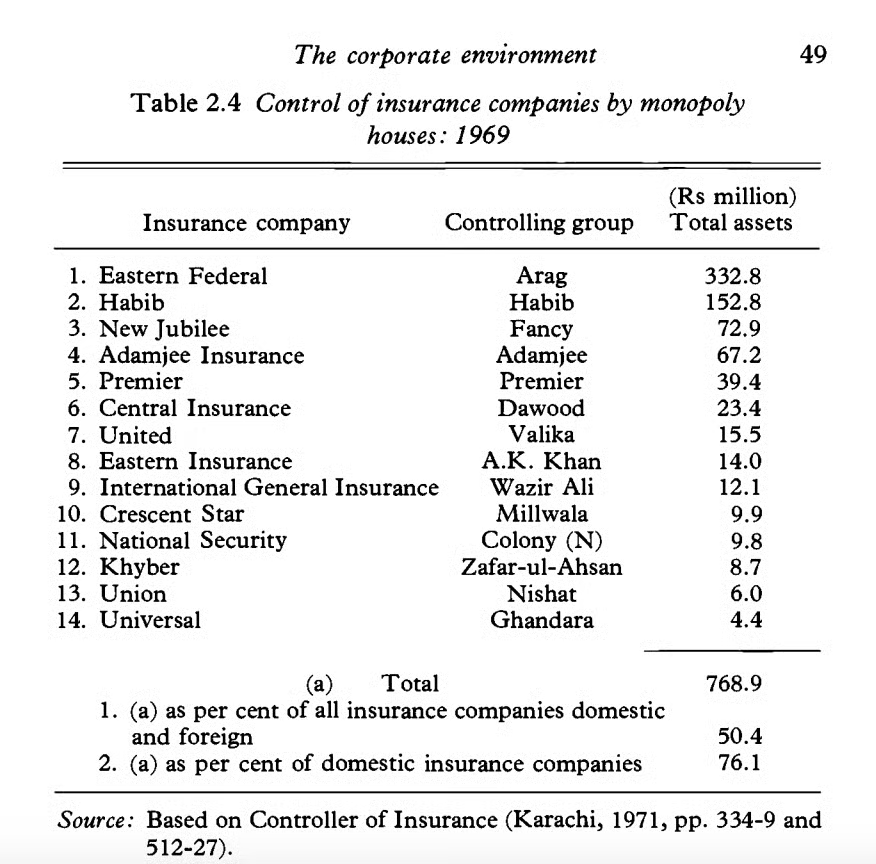

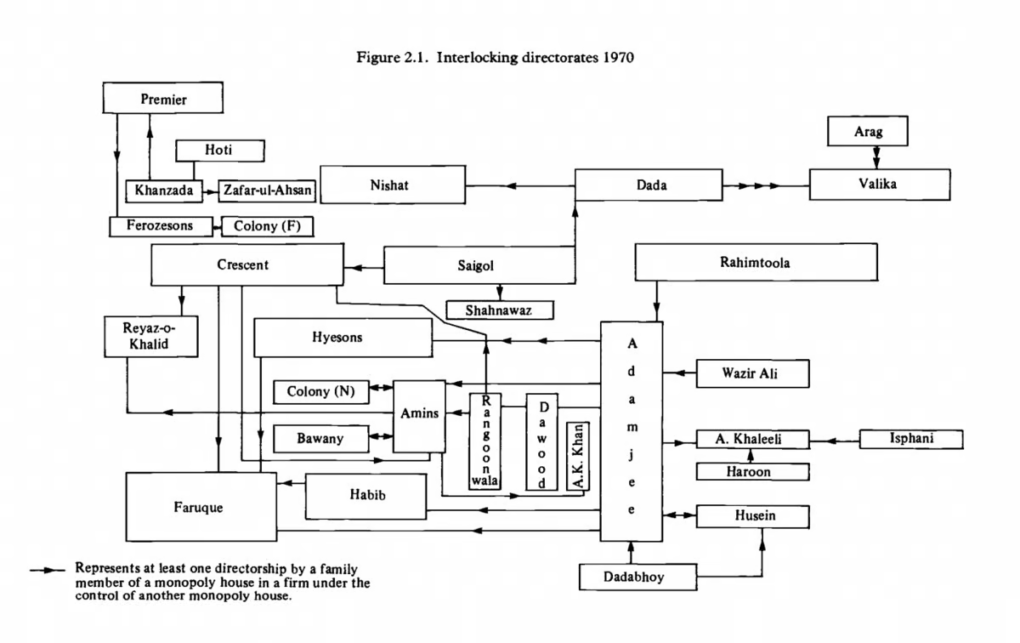

Elite Capture

Elite capture refers to the phenomenon where a small, wealthy elite controls a disproportionate share of economic resources and political power. In Pakistan, this manifests through the dominance of family-owned conglomerates that stifle competition and innovation. These elites often engage in rent-seeking behaviors, using their influence to secure favorable policies and contracts, further entrenching economic inequality. We have been hit in the face every day for the last 7 decades with this phenomenon. You must understand this before you try to solve for it.

Now lets Talk about AI and AGI + Where we are headed..

Artificial Intelligence (AI): AI refers to the simulation of human intelligence in machines that are programmed to think and learn like humans. These systems can perform tasks such as recognizing speech, making decisions, and translating languages, often with a level of efficiency and accuracy that surpasses human capabilities.

Artificial General Intelligence (AGI): AGI is a more advanced form of AI that possesses the ability to understand, learn, and apply knowledge across a wide range of tasks, mimicking human cognitive abilities. Unlike narrow AI, which is designed for specific tasks, AGI aims to perform any intellectual task that a human can, with the capacity for reasoning, problem-solving, and abstract thinking.

Last week, I had the opportunity to visit Singapore, and the experience was eye-opening. The progress I witnessed there starkly highlighted how far behind we are in comparison. Don’t get me wrong, I celebrate humanity’s advancements, but it painted a somber picture of our own future.

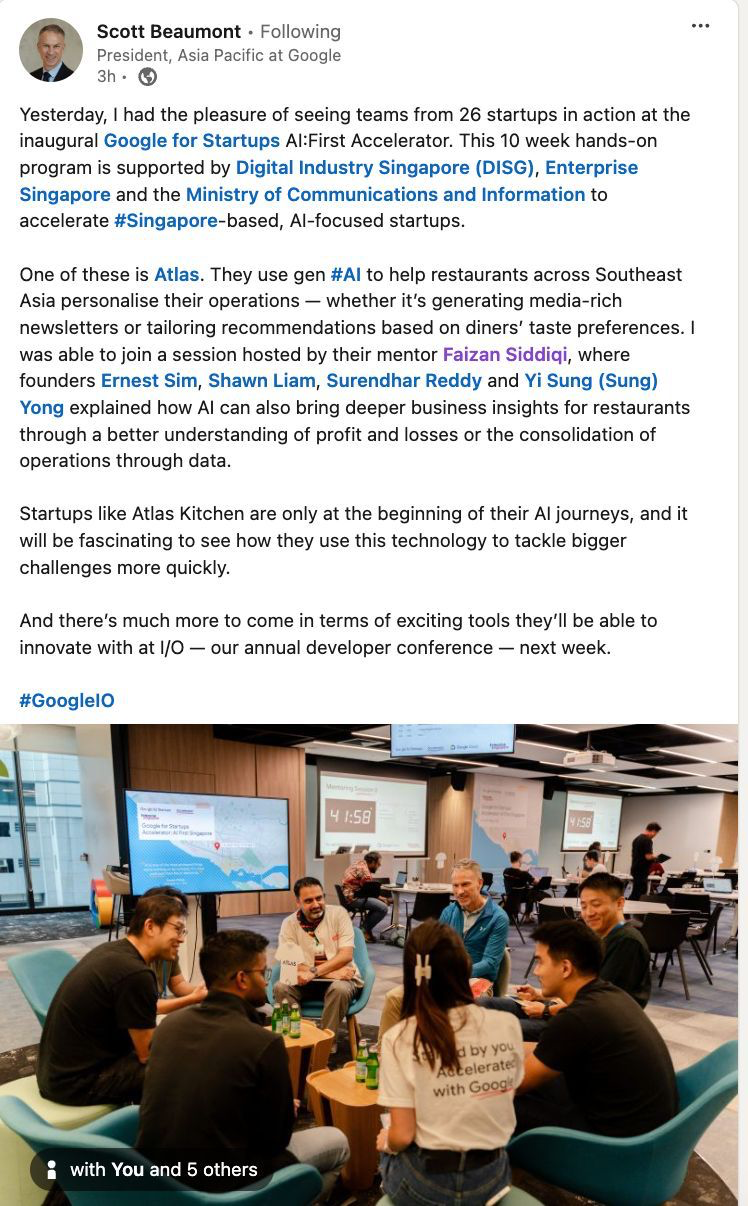

To provide some context, Google operates a global accelerator program, and I have been fortunate enough to serve as a mentor for several years. At its core, this program aims to support startups by providing access to Google’s cutting-edge technology without requiring equity. Startups are paired with top global talent in the form of mentors, helping them to innovate and grow.

During my visit, I was involved in Google’s AI:First Singapore Accelerator. This initiative, in partnership with the Singaporean government, was exclusively for Singapore-based companies. The level of support and resources available to these startups was impressive and highlighted the significant gap between Singapore’s proactive approach and our own.

Singapore’s government and business leadership have wholeheartedly embraced technology, driving a wave of innovation that positions them at the forefront of global progress. Their commitment to fostering a tech-savvy environment is evident in the robust support infrastructure for startups, the strategic partnerships with tech giants like Google, and the relentless pursuit of technological advancement.

In contrast, our own leadership and business sectors seem mired in outdated practices, resistant to change, and slow to adopt new technologies. This reluctance not only stifles innovation but also hinders our ability to compete on the global stage. Singapore’s forward-thinking approach serves as a stark reminder of the potential we are failing to unlock due to a lack of visionary leadership and a commitment to modernization.

The Reality of Pakistan’s Youth Population

Despite the government’s frequent proclamations about the benefits of having a young population, the harsh reality is that this youth is under-educated, under-skilled, and under-exposed. As AI continues to advance, these young minds are at risk of being dominated by intelligent systems that can perform their jobs more efficiently and at a lower cost.

Education and Skills Gap

The literacy rate in Pakistan is 59%, with substantial disparities between different regions and socioeconomic groups. Furthermore, the education system is not adequately preparing students for the demands of the modern workforce. According to the World Economic Forum, Pakistan ranks 125th out of 130 countries in the Global Human Capital Report, highlighting the severe skills gap.

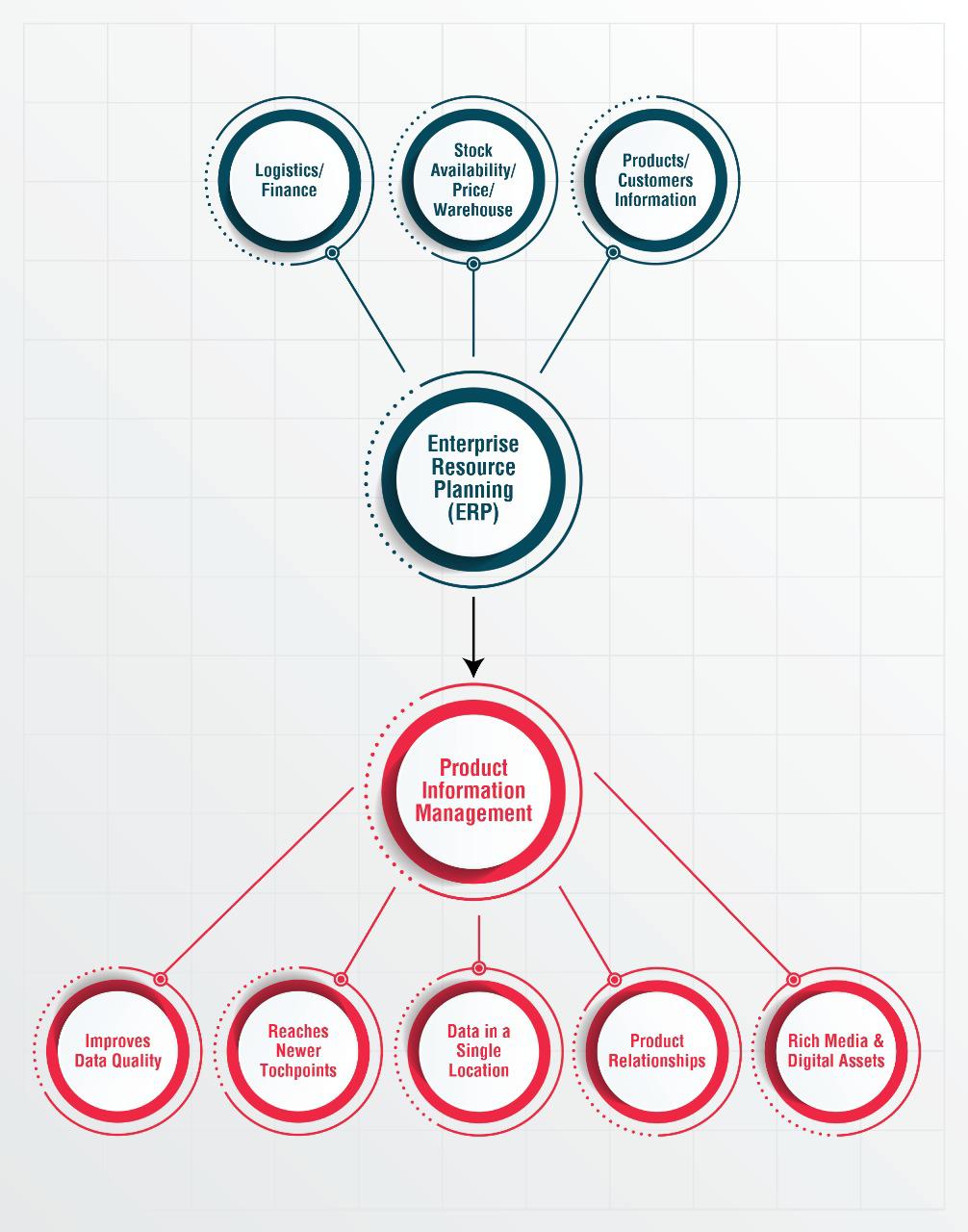

Technological Advancements by OpenAI and Google

Recent advancements by companies like OpenAI and Google demonstrate the disruptive potential of AI. OpenAI’s latest autonomous agents are capable of performing complex tasks such as content creation, translation, and customer service. Google’s AI tools are transforming industries by providing advanced capabilities in data analysis, virtual assistance, and design.

These AI tools are set to clean the slate for low-cost destinations. For example, AI-driven virtual assistants can handle customer service interactions more efficiently than human workers. AI-powered design tools can create high-quality graphics and content without the need for a human designer. AI translators can provide instant, accurate translations across multiple languages. Call centers, traditionally a stronghold of low-cost labor, are increasingly being automated with AI systems that can handle inquiries and provide support around the clock. But first, to really understand what is going on, you must understand the Myth of the IT Sector that has been created by the powers be, for us to act on next steps and not build IT Towers and Buildings we must understand where the issues lie.

Some Sobering thoughts on whats to come..

AI systems excel in data processing and analysis. In industries like finance, healthcare, and logistics, AI can perform tasks such as data entry, pattern recognition, and predictive analysis more efficiently than human workers. A PwC report estimates that AI could contribute up to $15.7 trillion to the global economy by 2030, but only for countries that effectively integrate these technologies.

The Urgency & Will to Change & Knowing What to Change….

Investing in Education and Training

To harness the potential of our young population, Pakistan must invest in education and vocational training. Emphasizing STEM (Science, Technology, Engineering, and Mathematics) education is crucial to prepare the workforce for AI-driven industries. According to the World Bank, improving educational outcomes could boost Pakistan’s GDP by up to 30% over the long term. But we might already be too late, we need to start of by having less ministers and more doers. We cant fix a problem we don’t understand. Start with vocational training and re training of unemployed and underemployed youth in the field of AI enabled tools, services etc. The Irony being that the former Federal Minister of Technology who could likely not even use a computer is now the Federal Minister of Education. You can not change your outcomes with these Mickey mouse tactics. Our current minister of Technology has not really been in office long enough but early indicators clearly point in the direction that they are not much different from the previous one or the many former ones who have had no idea what they were doing(based on progress or the lack lack thereof). Working to either build PR, enjoy foreign trips, or do photo ops. Net net the outcomes and promises seldom fulfilled. From trainings to budgets being squandered across the decades we have had these ministries.

Encouraging Entrepreneurship

Creating an environment that supports startups and small businesses can drive innovation and economic diversification. Government policies should provide incentives for young entrepreneurs, fostering a culture of creativity and risk-taking. The Global Entrepreneurship Monitor (GEM) reports that countries with high levels of entrepreneurial activity tend to have more robust economic growth. For all my opposition on doing away with ministers and ministries, what we do need and continue to optimize is to promote SMEs, we have near retarded and regionally focused organizations who allegedly work for SMEs, all they do is show up to kitty parties paid for by Karandaaz and Bill & Melinda Gates and many others (not trying to single out these guys) in Islamabad, have some tier three food at Serena and do PR events and go home. Oh lets not forget, tag each other across social media and talk about their hard life. The real dis incentive this nonsense causes is stop those who are really working hard when they see baseline and crappy ideas getting support and funding but no outcomes. We have to try harder.

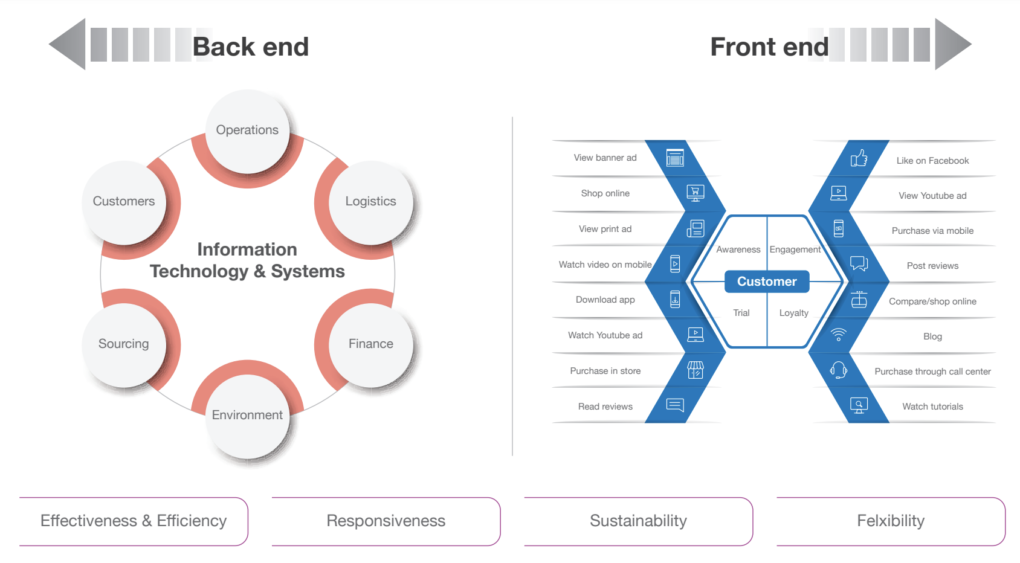

Modernizing Business Practices

Family-owned conglomerates must modernize their business practices. This includes investing in research and development, embracing digital transformation, and fostering a culture of continuous improvement. According to a Harvard Business Review study, companies that invest in digital transformation are 26% more profitable than their peers. Here is the kicker, when you got in reality and stasticaly speaking old men running the country, its businesses and enterprises, who insist on in person meetings and wasting your whole day about “things in their time” you know this is a one way ticket to no where, we have to bring change where change deserves a chance, a the very top. Folks who became rich by holding on to dad’s money, dad’s friends, concessions, contracts and subsidies, will not want to do any transformation, digital or moral. But we need to move in that direction for the growth and sustainability of our youth. This country can not afford to keep its youth at home and un employed with only TikTok as their best friend. The net effect of that is that the AI Algo on that social media will actually bring more dis content to the youth when they see the have and have nots across geographical divides, no level of social media monitoring and management will fix that discontent. You must realize that you cant compete with AI and Algos by filling forms and stopping accounts. You must know your adversary (*inquire within). The saiths must be mandated to attend some level of basic AI awareness bootcamp or chai, what ever gets them in the door to listen to the voice of reason.

Public-Private Partnerships

Collaboration between the government and private sector is essential to accelerate the adoption of AI technologies. Public-private partnerships can fund research, develop infrastructure, and create a supportive regulatory environment. Successful examples from other countries, like Singapore’s Smart Nation initiative, demonstrate the benefits of such collaborations.

What should the Government & Business be doing?

The rise of AI and AGI represents both a challenge and an opportunity for Pakistan. But if only managed in real time. The current business leadership must act decisively to modernize and embrace technological advancements. The political folks at the helm must do away with building IT Parks and inviting has beens to advise on building educational ecosystem and modern growth led industries. We have this backwards. We continue to invite people who have access to local political and business franchises vs bring the host of Pakistanis who live and work globally who are experts in the space. We do not need committees. We need to Kum the Teas if you get my drift and do more work. We need less announcements, more action. But at the very core we need working and reliable internet, or none of this talk of the youth, goes any where besides to shit. You can not have a thriving digital ecosystem offline. So who ever is responsible for advising the powers be, my 2 cents to you, is being pragmatic and defining the exam question you want to solve vs solving for your own success as advisors and torch bearers of equality. We can see past this, the youth understand this BS they have seen enough, help them help us all get out of our economic mess.

Failure to do so will not only erode the country’s competitive advantage but also leave a generation of young workers facing unemployment and economic uncertainty. By investing in education, fostering innovation, and modernizing business practices, Pakistan can navigate this technological revolution and emerge stronger and more resilient. But the expiry date on this is fast approaching. To understand why, you must understand the competition, does not eat, sleep, or take bio breaks. Don’t believe me, see below.