Once upon a time…

Pakistan stood at a fork in the road where its growing youth, restless digital entrepreneurs, and globally dispersed talent saw glimpses of a future more connected, more efficient, and more fair. But the systems around them were still drowning in paper trails, power outages, and policies built for another century.

Every day…

Citizens navigated endless bureaucracy for land titles. Freelancers fought global payment blockades. Schools’ taught yesterday’s tools while tomorrow’s jobs demanded quantum leaps. Ministries, despite goodwill, operated in silos each with its own digitization agenda but no unifying compass. Until now.

Then one day…

The Digital Nation Pakistan Act, 2025 passed. It wasn’t a whitepaper it was a legal startup charter. It created three things Pakistan never had before:

A Pakistan Digital Authority (PDA) with real teeth, not token budgets.

A National Digital Commission, chaired by the Prime Minister, making it everyone’s mandate.

A legally binding Digital Masterplan, forcing every ministry, province, and regulator to sync with one mission: make Pakistan digital-first.

Because of that…

We now have a law that goes beyond tech. It rewires the entire operating system of governance. It mandates:

A Data Exchange Layer (Sec 2(e)) so ministries stop hoarding data and start interoperating.

Federated identity systems, open APIs, and citizen-centric digital journeys (Sec 2(g)).

A Digital Nation Fund (Sec 13) that can generate revenue not just from grants, but from taxes on API calls, digital assets, and service layers.

The legal right for the Authority to override conflicting legacy laws (Sec 28) and the power to demand real-time collaboration from ministries and provinces (Sec 12).

But even great architecture doesn’t build the cathedral.

Pakistan’s Digital Nation Act, 2025 might just be its defining moment.

It’s not a whitepaper. It’s a legal product spec. A blueprint to rebuild the country’s governance stack with digital-first logic and not just with APIs and dashboards, but with something more powerful: You ask what? Read below…..

Model-Context Protocols (MCPs): AI-native infrastructure that allows systems to interact, understand, and learn in real time.

This is Pakistan’s chance to build a government that not only works but thinks.

THE BLUEPRINT IS HERE. SO WHO BUILDS IT?

The Digital Nation Act establishes:

A Pakistan Digital Authority (PDA) with real execution powers (Sec 6–8).

A National Digital Commission, chaired by the Prime Minister (Sec 3–5), enforcing alignment from provinces to regulators.

A binding, annually updated Digital Masterplan (Sec 11), defining the nation’s digital priorities across all sectors.

But policy is only the scaffolding. Now comes the build.

DPI: THE FOUNDATION FOR AN AI-NATIVE STATE

Digital Public Infrastructure (Sec 2(m)) is the backbone of a digital nation. It includes:

Digital identity

Data exchange systems

Secure digital payments

Open, interoperable cloud services

But DPI today must be more than wires and ledgers. It must be cognitively extensible, able to support intelligent agents, autonomous workflows, and citizen-facing LLMs.

This is where MCPs are essential. Planning digital infrastructure isn’t about building roads it’s about securing the corridor. Imagine you need to connect Karachi to Peshawar. A short-sighted approach builds a 2-lane highway on the cheapest available land. It works today, but when traffic triples, you’re trapped: factories and homes now flank both sides. Widening it means bulldozing communities at 100x the cost.

The builder’s way? Secure the 8-lane corridor now pour asphalt for only 2 lanes today. You pay marginally more upfront for land acquisition, but preserve shoulders for future expansion. When growth comes, you add lanes overnight no demolition, no delays. That corridor reservation is your plan against obsolescence.

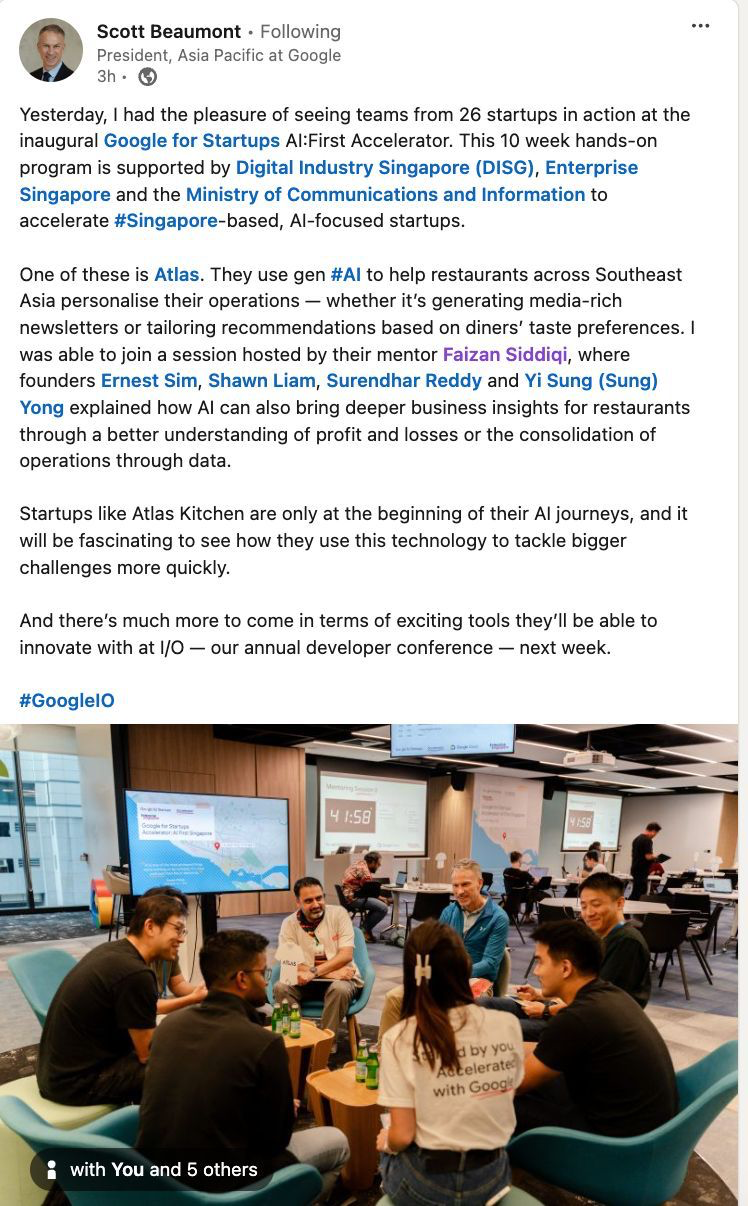

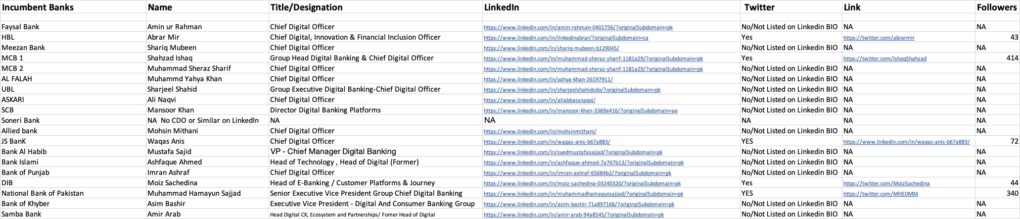

Pakistan’s digital highway’s identity systems, data exchanges, payment rails demand this discipline. Build MVP (2 lanes) but engineer MCP (8-lane rights-of-way). Don’t let short-term savings create long-term traps. We have done this many times over with financial inclusion mandates and other short sighted initiatives, led by the very people who know nothing about it, bankers, or ex bankers whose own banks could not do it, but in retirement we hire them to do this for the nation. The irony should not be lost on us as we build PDA leadership.

WHY MCPs CHANGE THE GAME

For years, governments relied on APIs to connect databases and services. But Pakistan can leapfrog to MCPs frameworks that don’t just connect systems, but allow them to exchange structured context. Think of how we moved from land lines to cell phones and the dividends it continues to pay. Do it right, vs doing it twice.

That means:

Land registries that speak to identity systems intelligently.

Financial aid systems that adapt to user history.

Health services that tailor responses based on citizen interaction, not form fields.

MCPs are how AI-ready governments will operate. The Digital Nation Act enables this through its emphasis on secure, interoperable data layers (Sec 2(e)), national infrastructure, and governance standards.

WHO SHOULD LEAD THIS?

You don’t need a multilateral consultant. You need a wartime CEO. Not someone to prance in Islamabad and tell people what they are doing, ideally never be seen talking about the work but instead executing.

A founder-operator fluent in building digital products and public trust equally adept at managing complex systems and shaping narratives in real time. Someone who understands that national sovereignty today means owning not just infrastructure, but the story. This is a leader who has built in the age of digital distribution, where platforms move goods, capital, ideas, and sentiment at scale. Whether it’s logistics networks routing in milliseconds, SaaS systems standardizing workflows across borders, or media platforms reaching millions with a single push the pattern is the same: velocity, trust, and control. Pakistan’s digital future will require nothing less. These needs understanding the country and its assets to be the foundational layer in building a National Information Infrastructure. Understanding context is key, that doesn’t happen by being a conference attendee or a twitter panelist in a nation’s transformation journeys or those who have relied on consultants at scale.

Built under scarcity, not excess. Anyone with b$ funds can build, but can you build in scarcity and lead to abundance?

Understands how to make a university like NUST compete with IIT not on brand, but on output. Also not believe the rhetoric that. We have 10k CS grads a year, we have under a 100 that can compete regionally and 10 globally. Come with solutions to change this.

Fluent in crypto, governance, and education as national assets but humble enough to partner with and draw the counsel of the new crypto SAPM. Embed your Crypto Czar in the Oversight Committee (Sec 9). Their role? Negotiate as equals not supplicants

Code-literate, scar-hardened, and fast enough to deliver v1.0 not ask Mckinsey to build performative decks.

Can prompt LLMs like Tiger Woods used to play golf on his day off.

Operational stamina to execute 18-hour days, credibility to command respect from generals and Gen-Z coders. No more uncles with ill fitting jeans with white shoes and turtleneck tents, who cant walk 2 flights of stairs without crowds cheering them on. Have your fill of Nihari but to represent Pakistan we need some one who is committed to their health and the nations. We don’t need an ozempic level shortcut to our challenges, we need real commitment to build fit for use purpose outcomes.

This isn’t an advisory role. This is a Builder General job. Also, if you want to hire favorite’s and has been’s you are doing the act a dis service. Don’t hire for what you see but hire for someone who can do. Also note, if you pay peanuts, you will hire monkeys.

THE MASTERPLAN: 5 PILLARS FOR HYBRID REALITY- The Real Non Kinetic Force

- National Information Infrastructure (NII):

- What: Federated data exchange layer (Sec 2(e)) + edge-computing nodes on military-secured critical sites (power grids, highways).

- Why: Avoids “cloud colonialism.” Data sovereignty meets low-latency rural access.

- Military synergy: Leverage strategic assets (fiber networks, secure facilities) as NII anchors positioned as “guardians of national digital sovereignty.”

- Talent Factories:

- Transform NUST into Pakistan’s IIT 3.0: Not just curricula but mandate 50% faculty from industry (ex-FAANG, ex-Silicon Valley founders). Embed crypto/Web3 labs funded by blockchain taxes.

- Military linkage: Veterans with cyber ops experience → retrained as DPI architects.

- 30-60-90 Day War Plan

- Day 0–30: Build the Digital Spine

- Connect energy + data layers using military-grade fiber networks (Sec 17).

- Establish secure data exchange protocols via MCPs.

- Identify five high-impact citizen interactions to convert into digital workflows.

- Recruit technical leads from Pakistan’s tech diaspora and FAANG Alumni.

- Day 31–60: Deploy Foundational Digital Journeys

- Launch 3 end-to-end, citizen-facing journeys (Sec 2(g)) using MCP logic:

- Land ownership verification (identity + property context)

- Telehealth scheduling + triage

- SME e-loan approvals (FBR + bank integration +situationally aware)

- Each of these should be context-aware, multilingual, and mobile-native.

- Day 61–90: Talent Infrastructure Mobilization

- Redesign NUST as a National Digital Product Studio.

- 50% of faculty from industry.

- Build labs focused on AI, cryptography, public systems.

- Retrain veterans in cybersecurity and signals into DPI engineers.

- Begin bilateral co-builds with Stripe, OpenAI, and others only with shared IP and local hiring mandates.

- Day 0–30: Build the Digital Spine

- DIPLOMACY BEYOND SALES OFFICES

- Pakistan must resist the temptation to become a passive consumer of foreign tech.Instead, it must become:

- A co-trainer of models: e.g., OpenAI fine-tuning Urdu LLMs inside NUST with shared weights + sovereign data access. Any one hoarding public domain information digitally must make it public for national interest for Sovereign LLM Models. A lab for AI governance: embedding policy layers directly into MCPs, creating templates others can adopt.A developer of its own MCP stack: that other countries can adopt or license, transforming Pakistan into a DPI exporter.

- Pakistan must resist the temptation to become a passive consumer of foreign tech.Instead, it must become:

- Abundance Engine:

- From “consultant dependency” to founder-led execution: Hire Authority leaders (Sec 7) from Pakistan’s own mix from any where on the planet.

- Why founders > policymakers: A digital native who scaled startups knows how to digitize FBR faster than a 30-year IMF veteran.

Designing for Sovereign Governance without having to explain ourselves

The Act allows for:

Assignment of secure infrastructure (Sec 17)

Inter-agency expertise transfers (Sec 18)

Requests for coordination from strategic actors (Sec 19)

Translation: Military-run infrastructure can power secure cloud. Signals veterans can code mission-critical systems. This doesn’t need a press release. Just results.

WHY PAKISTAN NEEDS A “BUILDER-GENERAL” TO LEAD THIS

This isn’t a job for a Geneva-trained policy expert or a Davos-panelist. It’s a mission that demands:

Someone who’s scaled products in high-constraint environments: B2C at scale, B2B SaaS, and enterprise integrations.

A person who understands education as infrastructure: not just transforming NUST, but turning it into an AI production stack.

A crypto-literate pragmatist: who knows how to tokenize, govern, and integrate digital assets into public systems securely and seek help where they aren’t an expert, this is a role in humility with candor not a know-it-all role.

A founder-operator scarred by failure, sharpened by scarcity, obsessed with shipping.

This isn’t about ‘relating to youth.’ It’s about harnessing two asymmetric assets: military’s strategic rigor + tech talent’s disruptive velocity. Fail to fuse them? Pakistan gets digitized by foreign platforms, not sovereign code.

This is not “reform.” It’s a rebuild

PAPER DOESN’T WRITE CODE

The Digital Nation Act is world-class.

But like all great product frameworks, it will only succeed if someone builds version 1.0 fast on real infrastructure, for real citizens, with measurable gains.

This isn’t about Estonia envy. It’s about Pakistan setting the global standard for what a digitally sovereign, AI-native nation can be.

THE 90-DAY PROVING GROUND: SOVEREIGNTY VS. SUBVERSION

The next 90 days will reveal whether Pakistan’s digital rebirth is led by its people or auctioned to outsiders. We’ve waited decades for this moment; about a week has passed since news surfaced about the government setting up a committee to hire PDA leadership. If the government cannot install a proven builder within 30 days, brace for a familiar tragedy: a ‘global search’ orchestrated by foreign consultants. They’ll draft RFPs with impossibly narrow criteria, run ‘competitive’ bids for 12 months, and ultimately embed their pre-chosen candidate a loyal agent of donor interests, not Pakistani ambition. They may have already done some of the work.

We’ve seen this script in resource-rich African states and fractured democracies.

This isn’t incompetence. It’s institutional capture. The delay itself is the weapon starving momentum until desperate governments outsource sovereignty. Pakistan’s Act is too visionary to be suffocated in committee rooms by those who’ve never shipped a product in load-shedding.

The Non-Negotiables:

- Appoint the PDA Chairperson in 30 days (Sec 7) from Pakistan’s own global builder cohort not Geneva’s consultant aristocracy.

- Reject ‘global talent searches’ that mask pre-baked appointments. Scarcity breeds ingenuity; abundance breeds dependency.

- Let the Oversight Committee (Sec 9) audit appointments not donor-funded ‘advisors’ with conflicts of interest.

If we miss this window, we don’t get a second chance. We get a digital colony. Let us no longer negotiate our future with those who have no interest in its success.

Let’s not waste the last, best stand.

Pakistan Zindabad!