VC’s, Valuations, Real Market Numbers & the race to build sustainable e-commerce in Pakistan

Let us get all the data and stats out in the open that every one seems to be using as a basis for FOMO creation in the tech ecosystem. As an angel investor very early on, this is almost advice against my self,

but advice is a mandate that is sacred. So to do right by it, one must give it without any hangups and to the best of ones understanding and ability.

Every deck that every Startup has circulated to every VC and requested not to share, has ended up with every one. Thats the first truth, people have taken screen shots of those decks and circulated to everyone in their circles of relevance. In every whatsapp group where they were circulated, an image/story/narrative started appearing

- Pakistan has a young Population

- Pakistan has a connected young Population

- Pakistani’s crave instant gratification

- Pakistans Retail Segment is in the 100bn$ space, angling for 200bn$

- B2B + adjacent markets will allow us to get hockey stick growth

- By showing crazy trajectory on their MVPs(whilst failing to mention product discounting) in a country hit by mass inflation pressures, every ones on an insane GMV ride.

- There is great talent and a fraternity of ex Careem & Daraz & Easypaisa folks who will build great companies (read unicorns) with 2-3 years of experience under their belt. (I hope and pray this is true as it helps Pakistan)

Assumptions circulated from startups who have raised funding based on the above:

- “Our target market is the $152 billion retail market across Pakistan with more than 2,000,000+ retailers.“

- “Now Commerce Penetrating 130bn$ TAM”

- “Retail Market size is 150Bn$(TAM), Retail market size growing 9% YoY for 20 years. Retail market through mom- and-pop stores, or the Total serviceable market is 91% of that or 137$BN”

- “170bn$ Retail Market, 220M- Youth led population, 70bn$ Grocery Retail, 8.2% CAGR since 2016, over 3 million tradition retail stores across categories, 900k retail stores covering >90% of total grocery sale.

Building on the assumptions from above. We have seen the following Emerge.

- One Startup with 27m$ in GMV got a 275M$ Valuation

- An other startup with 42m$ in GMV got a 100M$ Valuation

- Yet an other one with 65m$ in GMV got a 200M$ Valuation

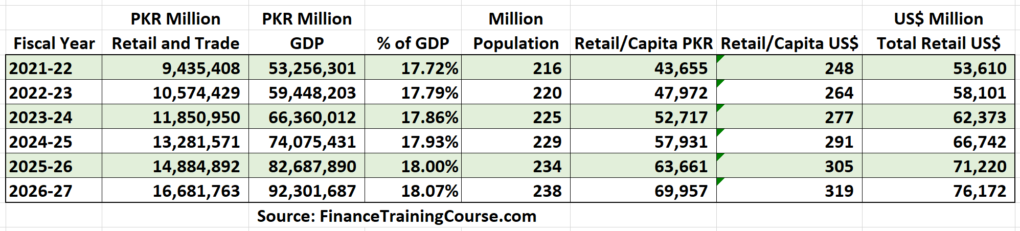

But then I came across Jawwad Farids market assumption note yesterday. In which his data suggests that the market is not remotely as rich and large as the assumptions that have led to these valuations it got me thinking. That there is real opportunity to help Pakistani retail grow, if we look at this problem from a value creation lens vs. a valuation lens.

Jawwads assumption/analysis is simple and points to the direction that “All this talk of informal economy, we can’t sell more than what we produce, what we import and what we store.”

He points us to some thing very interesting and I quote

“If the overall market size is $50 billion give or take a few, growing at 5% – 10% a year, year on year, how big is the market likely to be 5 years down the road? The answer is somewhere between $63 – $84 billion. If through an act of God retail in Pakistan goes completely digital, this becomes your GMV estimate with 100% market share.”

So whats really going on here?

- We lack data and transparency

- Seemingly there is a lack of due diligence on actual numbers vs perceived based on the 220m population size

- Even if Jawwad’s estimates are off, his hypothesis is accurate that documented or not, we cant be selling more than we produce or import etc, some where the numbers have to add up for retail, seemingly today they aren’t and no ones asking why not.

- Food for thought we co-authored a blog post on Pakistans online GMV some time back, for some color

Ok so enough talk about the gloom and doom. Let’s talk about the good stuff, the market is large, it will continue to grow, we are barely online and for better or for worse digital payment stickiness is not there yet(there in lies the opportunity). We need to build on it.

Let’s now look at things that help us get scale also look at the single biggest thing thats causing this transaction trust deficit.

Ask your self, what happens in corner store retail today?

A customer has an intent to buy some thing, they make the time to go to the seller, physically, they can touch, feel, evaluate the item then make up their mind, if they want to buy it, they do some price checking from the market by going to multiple folks. They have confidence that if they pay cash they will get the product that is in-front of them. The exchange of cash happens, they collect the product, bring it home. The deal is done.

In an online scenario, for the same product, the customer starts with a web search or goes to an existing online vendor or market place. They see the image of the product, the image varies across the sites, one of them has the label, the other doesn’t, yet an other one has a filter and the colors look off. They all feel similar but not the same because the end user cant determine if they are. The end user, either does COD from 2 stores and physically sees the goods arrive then pay the rider and close the transaction(They have nothing to loose by ordering from multiple stores- As some one who ran the largest COD service nationally, this was a common complaint from my end customers). Or they don’t bother and continue their purchase journey offline, because they are not confident of the products virtual representation and thus hesitant to buy online.

So here is where the Government comes in, from the honorable Finance Minister to the SAPM on E-commerce. Both have a vital role to play. Heres what the data tells us.

- Its not enough to document transactions

- You need context

- Take the line item detail and analyze it, to hold people accountable, you can only do this, if you have those details to begin with

- Enforce labelling standards, move toward packaged goods, that are more exportable

- Pakistans biggest problem is documentation and discovery of what we make to Int’l markets

- We suck at presentation, the government needs to help retail by having basic requirements/guidelines for product representation

- Require the Regulators to make Banks have APIs that work and run a local scheme of their choosing to enable digital transactions that do not take a year to apply and get access to

- Have Digital KYC enabled by NADRA Mandated by Law or an act

- Mandate Instant Merchant Settlement & full and final taxes to encourage movement away from the grey channels

- To Promote Startups in the commerce sector, allow Open Banking, Use the PSD standard or similar and apply to Pakistan. A minimum set of rules, apis, interconnections and published open standards by which everyone can connect and use banking services.

Seems like we(the community) have been talking for the better half of a decade to f*ing enable payments. Let me not even get started on logistics infrastructure and regulation. The lack of movement on these is the sum of our discontent when it comes to lack of digital enablement and having a clear path to e-commerce growth.

We need to ask our selves and the government:

- Do we only want large commerce to succeed in this country?

- Do we not want to remove our reliance on imports by creating a discovery mechanism by allowing for vendors to go online first?

- Do we want to continue to loose FX to AliExpress etc via credit cards by not having Made in Pakistan be listed in Pakistan?

- Will we continue to talk about digital payments and our large youth population or are we going to enable these folks to make money by taking part in commerce?

- Will we for a change spend govt/tax monies on enabling the right programs vs enabling for Airtime?

The answers are simple. Some one from government has got to be willing to participate with the stake holders and help enable these changes. We all know what they are.

If we don’t, we will move towards valuation games which are also need for a nascent ecosystem like ours, but the “awaam” will loose out on the value creation piece. There is a massive opportunity for the government to course correct and be on the right side of history. This leads to job creation, digital transactions, growth in logistics, enablement of time/value unlock, second careers etc. One leg of e-commerce are services, that we continue to discount from the narrative of online commerce.

If we do not give people the ability to go online, transact online, and deliver goods and services virtually and physically we are basically doing our selves a dis-service. At a national level, till there is a concentrated movement in tier 2, 3, 4 cities to on board, artisans, service providers, manufacturers, producers etc, we will not be collectively able to go grow domestic trade nor improve our manufacturing services.

The second leg of this enablement is to existing industry, industrial groups, help them come online, help them digitize, when they are able, capable and willing to play in the space, the over all pie will increase, there will be demands on the regulators, the politicians and the ecosystem providers to offer better, faster, more reliable services.

Net net, you can not be online if you are unwilling to accept the ground realities. The ground realities today all point to a transaction trust deficit, which has clear remedies spelled out above, all we need is a willing government to act-for once.

Today commerce is reliant on the Big players, FX losses & a cost of doing business in USD. You ask how? People opt in for international platforms, customizations and spend $s to sell products in rupees?

Where is the common sense in that???

The people we need to mobilize are the ones who have taken the first step. Meaning they are selling on Facebook, Instagram, or via WhatsApp etc. We need to transition them to Digital Store Fronts (DSFs). We need to account for them as players in the industry, we need to help vs talk about helping, we need to mobilize resources vs talking about said mobility, we need to train them to setup and sell, we need to help them get banked, or digitally financially included for real vs talking about it, we need to come up with taxation structures that help them and make the space inclusive for more first time sellers/entrepreneurs to get online vs press events. The time is now, the opportunity is real.

This country does not produce enough jobs for the youth to be employed, we need to create/enable entrepreneurs, other wise the same asset class we are banking on will be our biggest liability.

At the end of the day this TTD is only going to go away with the power of real action from the incumbent government organizations and the regulators at large. Less press conferences, less media coverage, more action.