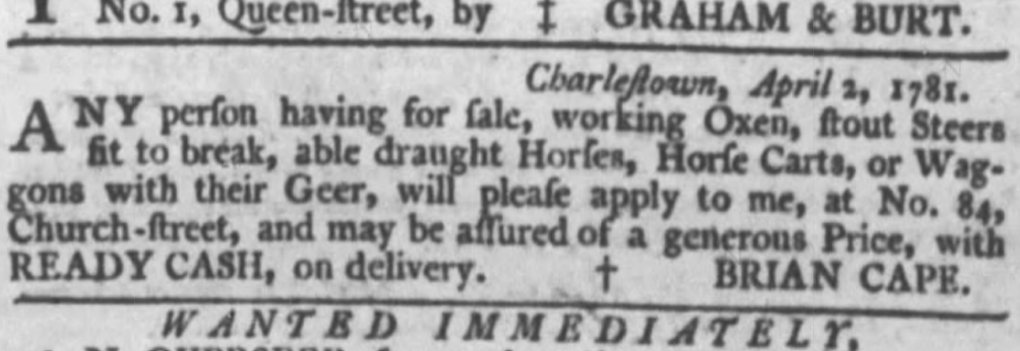

COD “cash on delivery” and “collect on delivery” mean effectively the same thing and have been used interchangeably since 240 yrs or so. At least based on the oldest published newspaper clipping available(1781) on newspapers.com as evident below.

Myths busted by the above

- Asians invented COD

- Brown people popularised it

- Credit cards came before COD

- Its a developing world innovation

- Its time has come to be replaced

Before postal systems came into place, delivering goods basically required a cash-on-delivery approach. This even pre dated credit. So COD has been here for ages, all other systems methods, even the postal services system came after it. Historically speaking it was in 1864, The year that Congress passed a bill establishing a system for money orders. This law, championed by then-Postmaster General Montgomery Blair, allowed the U.S. to replicate a popular British system for sending the equivalent through the mail.

Whilst across the pond the money order system was established by a private firm in Great Britain in 1792 and was expensive and not very successful. Around 1836 it was sold to another private firm which lowered the fees, significantly increasing the popularity and usage of the system. The Post Office noted the success and profitability, and it took over the system in 1838. Imagine our public postal infra taking over any thing even today.

Fees were further reduced and usage increased further, making the money order system reasonably profitable. The only draw-back was the need to send an advance to the paying post office before payment could be tendered to the recipient of the order. This drawback was likely the primary incentive for establishment of the Postal Order System on 1 January 1881—but helping to prevent theft in the process by not sending actual money through the mail. Money orders enabled cash-on-delivery systems to thrive in the days before credit cards.

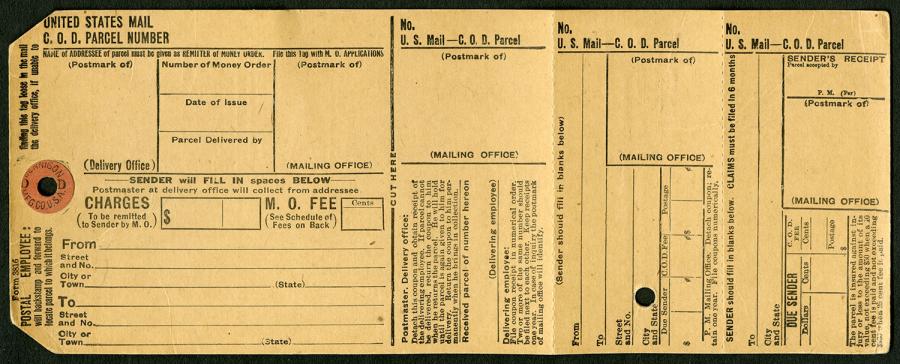

USPS’ collect-on-delivery system

A Harry H. Charles, of Quincy, Illinois, deserves most if not all the praise for doing something very important whose impact can be felt on the modern use of e-commerce even today: In 1899, he successfully pitched the United States Postal Service on the idea of collect-on-delivery. You don’t hear about Charles, but maybe you should know, every time you get a COD delivery that some one some where many moons ago had an original idea in relation to a problem; yet he didn’t go on Twitter creating content or talk about how hard it was he instead solved for it. Granted there was no twitter then..But you get my drift.

Charles had 900 reasons to celebrate. He didn’t give up, as outlined in the document of the Proceedings of the National Board of Trade from 1901

A little more than a year ago Mr. Charles decided to send a few of these parcels through the mails, collect on delivery, in exact accordance with the plan heretofore outlined. In every case the parcel was promptly delivered and the collection made and returned by the postmaster. Then Mr. Charles presented his plan to the attention of the Department officials at Washington, and was advised by them to give it still further trial. This he has done. In the past year he has sent over 900 “C.O.D.” parcels through the mails, to post-offices in every State and Territory, and in every single case, save one, has received prompt returns, the remittances being made in all cases by money order, registered letter or postage stamps. On investigating the single failure for the year, it was found that the postal car containing the “C.O.D.” package was ground to pieces in a wreck, and not even the wrapper of the parcel could be located.

Judging from the extended and satisfactory experience of this manufacturing concern, this feature seems in a fair way to work out its own salvation.

We got here in the present, in the today because, USPS was willing to experiment which led to innovations such as registered mail and the use of the money order, two features that Charles’ test took advantage of.

Perhaps a lesson for our postal service as well. So before we credit the Asian economies or the Indian e-commerce segment for revolutionising payments and bringing services for the masses, it has/had all been done before, for decades, this was a primary use of money orders, only to be changed in 1987, when checks were allowed into the system.

Please note, whilst you can still send things collect-on-delivery even today, the convenience of credit cards had killed the segment in the time of amazon prime. Id go so far as saying that Visa and Mastercard should thank Charles because had it not for been a problem he faced credit cards would have likely not come about in their present iteration.

The Western world may have given up on C.O.D., but many parts of the world have not, they are just getting started..

To be able to disrupt some thing, we must first try to understand its origins. A key missing component with folks/disrupters/wannapreneurs around us where 80-90% of our domestic ecom delivered are done via COD. Most folks have no idea about the origins, versatility, need or the shift that it brought when it came about.

Unless you have an acute understanding of the domestic market; & understand the challenge of low credit card usage in Pakistan and realise that customers prefer to pay cash only if they were satisfied with the delivery you cant really disrupt the model.

We have a credit card problem/credit problem. We also have a larger fundamental problem in understanding who we are transaction with. Lets try to understand this further.

Person A, Sees some thing forwarded to them via a friendly whatsapp. With a picture + price. Person A decides this is a good deal. Person A places an order with “friendly whatsapp/fb/insta, unknown seller”. Friendly XYZ seller uses a reliable delivery service, to send shipment. (they want to get their money in time hence they use a reliable service) The shipment is sight un seen by the messenger. Messenger delivers to Person A. Person A pay for it, takes it inside the house, doesn’t like it.

They go berserk on social media in blaming /shooting the messenger. Because their last interaction was with the only known entity in the transaction, the delivery co. The seller then blocks them on Whatsapp and goes on to sell more Italian dreams made in China at affordable prices sans quality.

Whilst its easy to go online and hurl colourful language at the messenger, this is single most common outcome of buying from un-trusted sources , who in turn rely on known brand delivery agents and thus creating a trust deficit for e-commerce, not for the delivery partner.

The underlying issue is of trust, till the public at large becomes savvy to not be conned by folks or check credentials or give in on their urge to buy PKR 600 Gucci slippers and then be shocked that they didn’t come from Italy is less a function of COD or E-commerce failure but more a function of a market whose time has not yet come(fully). You get what you pay for, if folks screened better they would do better over all, but element of greed on the side of the sellers, fake representations and instant gratification on part of an aspirational/millennial crowd with disposable income is adding jet-fuel to this issue. Its literally a communal problem but we fail to recognise it.

What are we really trying to disrupt then?

The first thing to understand is that e-commerce/sales/online startups/insta sellers/fb sellers/whatsapp sellers/wfh producers are all a microcosm of the country. People forget before they transact what the environment around them looks like.

Its like for a short while people really do step in to a magical place and consider their shopping journey online will be different from a real life experiences. Therein lies the “trust deficit” but it only kicks in post transaction.

Most people also lack the basic background check hygiene, or their guard is lower for e-commerce. Cant really say. But for all the payment companies, digital channels, marketing mavens, startups, etc solving for “e-money” there are other pieces to this puzzle that need to be solved equally hard. I see a dozen payment players come in to existence thanks to our regulators kind/timely approvals, but the question I struggle with, what are they all going to disrupt? If they are all solving for COD. I also don’t understand what they think, having the ability to pay electronically will do to move or create seismic shifts in a system and process thats been around for over 240 years. I am rooting for all yet cautiously optimistic only.

Questions every disruptor must ask them selves? What is the problem?

Looked an other way, away from payments alone, What are the things that must align for COD to work:

- The consumer needs to be physically available to receive the goods in order to provide payment. (That could very well be “credit/digital payment on delivery if you choose a card”

- Often times the consumer is not available, which means that multiple delivery attempts are made for one order

- The average number of delivery attempts per order is 1.24, (say an educated industry approximation normalised across similar markets).

- This translates into an extra 8-32% of labor costs in last-mile delivery for the seller depending on the size of the shipper/the delivery co the network/urban density

Furthermore, e-commerce retailers with high/exclusively COD orders potentially also face higher cancellation rates due to the consumer refusing the order. For example, the consumer may not be satisfied with their purchase & upon seeing it and refuse payment. They have nothing to loose…In such a case, the seller is responsible for all costs associated with the return of the item, increasing logistics costs.

Do I still have you with me?

So COD is not just a payment vector problem. Faster check outs will help the existing install base already familiar with the e-com world, more product range or established retailers can not also solve for buyers remorse leading to refusing parcel on arrival. So COD in isolation may seem like a large cash problem but in reality it has many complex layers.

D2C Brands starting off now, don’t believe what you hear. Payment gateways alone wont make this go away. Trust will. Build audiences, tell stories, content marketing is king as is a community. The future of COD will be increasingly in favour of those who take these steps.

There are lots of reasons C.O.D. goes on and on and on and on in e-commerce in the modern day, one of the largest being digital security weaknesses in developing countries. Also in an all cash economy, consumer preference are equally hard hard to shake, especially in Pakistan and especially in tier 3-4-5 cities.

Tier III,IV, V and beyond.

COD has a mapping problem as well. As recently demonstrated by our dear friends at Google nothing remains free for ever and with the lack of google being able to map beyond the major cities and the utter lack of any local mapping solution being up to scratch, what we need and I shudder as I verbalise this, A Nadra for Maps. COD, ecom, payments, KYC are all part of the same hypocrisy. That in my mind gets closer to being solved with an indigenous mapping solution, system & service. Cloud based systems are bigger larger than machines running in foreign lands, they are platforms and services that allow businesses to scale. We really need to understand that there is 0 indigenous stuff commercially available today that helps any startup play in the beyond KLI market at scale for years to come. We can’t be hustling backwards(saying use local when they are not up to scratch) because of faux patriotism.(line credit my dear friend https://twitter.com/asemota)

Focus on one big thing and solve for it.

Startups in the d2c, last mile, payments, fin tech, insurance tech space, mapping etc are all solving for different pieces of the equation. Yet the equation has been broken down into small parts above. In your area(s)/realm of experience you can only help solve the larger COD item or innovate if you focus on ONE BIG THING at a time. Every one seems to want to solve for the other “channels” core issues without first solving for their own. Mapping companies want to build payment gates ways. Bro first build a better map. Payment companies want do QR implementations, Bro first fix the mdr issue. D2C Companies want to solve for “locally made, better than imported” Bro first focus on quality and scale…I can go on, but I will not win a popularity contest. Banking regulator wants to use “Western successes stories” Bro focus on regulation and let the free market come up with the solutions instead. Buyers want to go online and shame the “delivery cos” Bro focus on ordering hygiene….

COD is not going any where….

This is the good news, it shows the ecosystem is thriving and self regulating, there will be progress and many will contribute to it. The next revolution is being shaped and fuelled by aspiration buying, smaller niche ticket items and staples. The biggest seismic shift will come from TikTok. There I said the T word. As the creator economy grows, so will the consumer economy, there will be more and more focus on locally sourced, locally available instant gratification, a merger of Home Shopping Network and Live Stream fuelled by Local Commerce. If you are not a stake holder in either of these, you are likely going to loose hard. COD will evolve, the transaction structure will evolve, the creator economy will give rise to lower end, but trusted community based commerce. Be ready to evolve to CDCOD*(Community Driven COD). Just like micro finance banks give loans to people who can bring in 2 references, shopping and consumption based on TikTok community based activities will give rise to trust models we don’t know today but are bound to come and will only favour those who are ready to play in the new evolving world of COD.

From 1781 to 2021, we are only just getting started.

“Yesterday I was clever, so I wanted to change the world. Today I am wise, so I am changing myself.”

― Rumi