As a consumer who is marred by sub-par digital banking services, let alone delightful experiences. I always wonder(ed) who are the anonymous faces that gather on our behalf and come up with experiences in the digital realm? Also why are most, if not all of these experiences so shitty? And why has not one single bank/fin tech etc really done any thing significant in the space. I have tried very hard to like the apps, services, user experiences, digital journeys, but they are generally illogical, badly thought out, detached from good user experience design and then some.

Look every one has a right to build their APPs/Online services the way they want to but given that these ones specifically impact the way individuals and arguably SMEs do business, they are helping no one. I would argue that the reason SMEs really don’t scale in this country is because of the horrendous lack of focus by the Incumbent banks and really consumer-intellect heavy products, that are neither intuitive nor shelf-stable.

Why did I add SMEs to the bucket, because that is the real value unlock of any of these players and their organizations understood stuff besides receiving trophies and accolades from circle jerk clubs of peers and attending paid conferences to evangelize the 1996 level websites & services they continue to crank out. No hard feelings, if any one took an objective look they would tend to agree.

Let’s start by identifying who the players are first. It took Some time, but it had to be done. *If you’d like an interactive copy of the file, subscribe to my newsletter or engage with the post here/retweet the original post

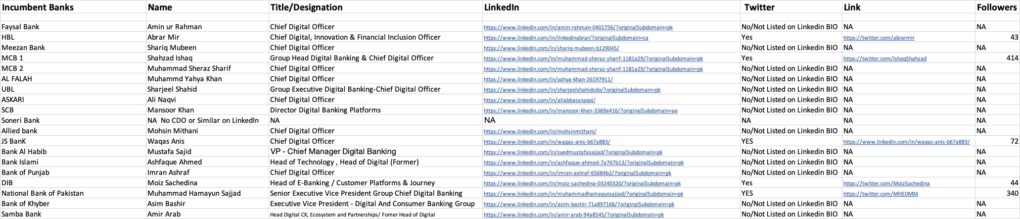

Incumbent CDOs/Leaders

So looking at the incumbent banks and their Digital Chiefs/Custodians, I decided to look at their digital footprint and their digital engagement.

The exam question being:

“Can some one who is not really digitally first/native, them selves, (based on cursory information online) lead/develop/build/guide/manage, the best digital experiences for their banks audiences?”

You can be the judge of the answer to that question & if you agree or disagree that their designed experiences come up to par with your basic expectations. Some of it has to do with the culture of the banks, some of it has to do with the background and experiences of the people leading the charge.

This data cant be used as statistically accurate; as its part, fact, part opinion part conjecture, part wishful thinking part frustration with the shoddy services as an end user that I have to endure daily.

In the spirit of generalizations, barring a few of these folks at incumbents, most have been moving around between banks locally, some, arguably have foreign experience, some in relevant fields, whilst others not. The issue is, when banks locally continue to hire people who have been learning only from “vendors” & their so called “conferences” in Dubai, the collective sum of the output is in front of us.

Please recognize that person with the latest IPhone or the tightest jeans or turtle neck , pinstripe blazers or socksless shoes is not the only or ideal CDO candidate. Nor the ones who talk the loudest or make the most noise are those who are the most ruthless politically at the bank(s) either. Its these traditions that have continued to F**k the consumers and continued to challenge the central bank who really wants to support digital first services and products, but they get disappointed by their babus of digital at commercial banks. Interestingly the regulator has more gravitas with digital vs the incumbents. So really need to highlight their efforts and digital stewardship. Good on you SBP…You know who you are.

Show me one key player in this list and show me some thing of value, significance, they built in this role or their former roles working domestically or abroad that can be attributed to being a local, regional or a global success in the digital space? Most if not all follow the same mentality, how many people report to me? How many days will I take to respond back to vendor/client emails? How busy am I pretending to be this week?

These digital leaders cant be faulted alone for the way things are, they are just victims of their own roles and self perceived success. Some humble pie would go a long way.

The issue is, what new “doodad, thingamajigy” is the flavor of the month that some one forwarded the CEO of the Bank.. The way that journey works is; the Banks CEO or Sponsors rely on some thing called the “down ward shit-sandwich” which is essentially to reign in the stooges, they find some thing from an other market, send a Whatsapp forward to the person in charge, and then ask “do we have this” (DWHT). This is how most strategies come about at Banks. Pleasing upwards..

Fu** the customer essentially, what the F**k does the customer know they want… Let’s build what the CEO or the Saith is asking for. So can you really fault the employees?

Job security, brown nosing, one-upmanship , big titles with no execution gravitas, zero technical and infrastructure understanding, is what brings us to this. This is not an attack on the employees of the incumbents, but more of an empathetic stance, “I understand your plight bro(s)” Also missing in no small part, is the fact that not one BANK in PK has a Female CDO or Tech Leader. Please do point me in their direction if I missed some one.

Looking further down stream on why some ones digital foot print beyond LinkedIn namely on Twitter/X is a good representation of their digital credentials, I couldn’t possibly point you to a scientific reason.

No less if you aren’t even some one whose end users/product participants cant even tag online, are you really proud of what you are building or leading? Or are you hiding from the work behind layers of obfuscated handles, company accounts, call centers etc. Basically if the buck doesn’t stop with you on digital journeys, where does it really stop? So you want the title, recognition, awards, salaries but not the responsibility? Again more a systemic issue than a role/person based one.

There are serious exceptions to the rule, none that I’ve seen at the incumbents but many at the upcoming fintechs/new banking product leaders etc. We will get into that list shortly.

So coming back to Twitter or even LinkedIn perhaps, the only thing most of these executives are experts in doing, from a community engagement perspective is taking stylized images of their business class flights, expensive wrist watches and the occasional “How do we fix IT exports” type debates. Clearly focusing on the wrong KPIs.

There is zero building in public, zero public apologies, zero feedback, just hyperbole and bullshit posts/copied from other places and most recently completely mindless ChatGPT output. Yes I’ve spent some time reading their posts last weekend. The most interesting ones are those where they write posts on GenZ and Millennial POVs, and you have 50-60yr old bankers & internal employees commenting on their posts, “great boss”. Talk about the Irony…

If you were a large share holder of these banks, a board member, a saith, a sponsor, or even the CEO, you should be asking: “How qualified are these people really to lead the single most important factor in your future growth as the challenger banks and fintechs come to town?”

You are about to be toast if either your banks goals aren’t aligned with your digital leaders skill set or you do not empower them, all the faults don’t lie with them, they are the output of a highly politically astute chess match that typically got them to where they are. But human instinct is survivalist at best and these guys have perfected it.

Digging further down, since we are being honest, some of these guys have re-branded their failed mis-adventures in to juicer titles/roles in their new companies and roles. My favorite example from some years ago is that every one in every bank who ever worked at EasyPaisa was “founder team member” of easy paisa or head of payments or “chief some thing”, I identified 7 of them at various banks using LinkedIn. Not my data or analysis just what their titles state. Gross inflation of designations leading to sub-par journeys for customers and no real traction in the digital realm. Forget financial inclusion, these folks cant even have a cohesive online conversation on the functions they are allegedly leading.

So far we have identified 5 Core issues

- Lack of Digital Channel Engagement on part of the CDOs/Leaders

- Title Inflation & Celebrating Fake Former Milestones

- Pleasing Upwards

- Being first for all the wrong reasons & products

- Limited Exposure (domestic market job cycling) or horizontal movement from the region

We move along to the challengers next and their CDOs/Leadership.

New-co Banks/Fintech Digital Leaders

There is some traction in this space(Thankfully). Whilst these were the only folks who showed up on minimalistic LinkedIn searches, before you come at me, that there are many more fintechs and many more new licensees. Trust me I am not getting paid to dig out the folks here but genuinely interested in comparisons. With Sadapay and Zindigi we have seen the leaders engage heavily with the community online tackling questions answers, complaints. both Omer + Noman take to public engagement and hence I am aware of their community first approaches because it’s online. With Hugo, Atyab is seen as trying to build in public so thats a +1 for some one entering the market and clearly a lost opportunity for incumbent digital leaders who have insane brand recognition and distribution. So Kudos to these folks for trying as new-cos and new brands. But time will determine how successful they end up being, from the looks of it, they are trying a different approach and being mindful of their audiences.

The Easy Fix:

- Bring in teams with digital transformation, expertise hire from adjacent industries

- Build real talent on your boards with folks who have multi vertical digital experiences

- Shed the sahabs/babus/relatives of the sponsors or their touts in positions that can change the fate of the banks Vis-à-Vis the real potential of real digital rails

- Stop hiring McKinsey

- CEO of banks need to really really really hire digital advisors or board members not just internal committee members. CEOs understanding of digital is really superficial barring 2-3 banks. Sorry guys, you may not agree but it’s the truth.

- CEOs of Banks Need to Focus on SME/SME solutions think growth $s

- Be very careful, that your brightest talent is going to be, and is already being hired by regional players. If you do not promote the right talent from within they will leave because they are sick and tired of working for your non-digital, digital leadership

- For the CEO/Boards/CDOs, please start using your own apps vs relying on your CDOs for feedback

- Take action vs making claims(CEO/Digital Leaders)

- KPIs are your friends, not fake awards

What is really missing?

I continue to feel that the intent to build truly digital solutions is missing. Apps, websites, hardware, etc do not replace intent. Since 2007, I believe, when branchless banking regime came about, has any one really put out a comprehensive digital banking product, experience? Bi-weekly the industry continues to do MOUs, drive FOMO at their leadership cadres and the most successful digital pundits continue to get outsized internal funding allocations. Till there is intent nothing will change. With this, I wish the new-comers to really make a difference and lead with intent & for the incumbents to try one last time.

Net, net stop talking about digital and start innovating and putting in the right talent, leadership and KPIs with a view that most of your future customers are going be in their 20s & 30s and they are brand agnostic, only service will determine the success across your digital platforms and dreams so lead with intent or these new audience will move along.

This is a consumer driven view, I feel every time I write an opinion piece some one comes out of the woodworks and threatens legal action. Consider this a free audit instead. Focus on using litigation dollars for bringing about change instead. Consider this a public service for our collective growth. No CDOS were harmed during field research.