Every one wants to be an omni channel retailer. Some will evolve but most cant, not because they don’t want to, but because there is a foundational basis missing in understanding the journey it self.

Let’s step back, if there is no “documented engagement process” in your organisation today, within the process(es) that lead to or generate sales; meaning if things are not codified & repeatable, the likelihood in digitising them is very slim. It may feel digital but you continue to loose all attribution data over time. Just collection of data does not equal $$$.

The SME/Startup Conundrum

Imagine your journey. You are an SME that runs targeted ad-campaigns with great ease and even better results. You attract people to your Landing Pages, or Check Out Pages. The Journey up-until then is digital as is your sales funnel. But when you take people off-page,into a WhatsApp chat or a twitter response or an Insta DM your omni channel dreams may seem to be fulfilled, but in reality you are creating noise in the channel by doing “hand overs” especially if they lack traceability.

You may argue that, all these are digital channels. You would be right in stating the obvious. These are all digital channels but any channel in the absence of traceability is just a Messaging Channel for Fulfilment (MCFF) vs a Pure Digital Channel for Fulfilment (PDCFF). Not some thing your Bachelors degree in marketing or your 2 internships at “insert leading Pakistani FMCG name here” have taught you, yet.

In our desire to push content and sales via any means possible we have veered away from mapping our internal and external journeys. Take the example of a founder who reached out recently, lets call her Ayesha in the interest of privacy. She has a 20% conversion on her FB Ads, but her order completion ratio is 8%, her online repeat customer ratios are even worse at 3.36%. She has an amazing product line up of pay-as-you-consume meal plans and her product reviews are phenomenal. Her Gross Sales are about 1.33M Pkr a month. But the potential, if she were to increase her order completion ratios + get repeat customers would be 4x without doing much. That was my working thesis. So I challenged her to critique her own process.

So what was happening? FB/Insta Ads were bringing people to her social media, where there was “no clear call to action or CTA”, there were prices mentioned but no unified menu of services. The interest in her meal plans was great, based on her views and engagement as far as I could tell. But where did it all break down?

The User flow was as follows:

- User discovered the product

- User came to Instagram

- User spent about 4 minutes narrowing down plans and mixing and matching what they needed (in their head and computing prices)

- User then messaged her on Instagram

- She then asked them for their Whatsapp number

- If they were interested further, they would provide it

- Then they would engage on Whatsapp

- She would then screenshot the Whatsapp conversation and send it to her order fulfilment team (aka one of her 2 employees)

- They would transcribe the order in excel and create an invoice

- They would then reach back the customer via a new Whatsapp Number (theirs)

- If the customer confirmed, they would send bank details for payment collection

- Customer would typically IBFT the funds between 2-3 days

- They would then fulfil the order

- Then an employee would reach back out 3 days later for a review post or feedback

- What I missed to tell you, was Ayesha has a retail location as well, thats how she started

- The process/workflow for that is when A customer walks in

- Has a person that greets them, there is a sampler menu to see the wares on offer

- The person signs up

- They pay in cash or via credit card (minimum signup is 2 weeks) online you can do it even for a day

- Her store sign-up customers typically stay with her for 7.2 Months

- Her online customers stay for under 48 days

- Interestingly most of the people that walk into the store discovered her services online

- She also has a gift card service

- Those gift cards are sold as vouchers and every time she’s run an ad-campaign for them her sales conversion is over 28%

Im sure it is getting evident, where the fault lines are.

Lets re-calibrate, in her mind she’s doing all the right things, FB Ads, Insta Ads, Whatsapp real time communication, multiple payment options, personalised services. Yet brick and mortar sales are higher as are the gift card sales. The first thing that was evident in the journey was, that a true customer experience is predicated on great faultless payment options, that have low to zero friction.(Cash/Visa/Mastercard). Hand over between multiple sales/company people from un-branded phone numbers adds delay and hesitation. The business seems like a mom and pop shop operation. Whilst the product reviews were fantastic, we did a poll on the users purchase-journey. The results were horrible. Most people said, “love the product, hate the hassle to order or cancel”

So we looked at the in store model. Fast payment, potential product test, curated menu + pricing and multiple options on the checkout counter. We replicated this by building a landing page, that had a big-ass CTA, Click here to sign up. Once you clicked, it displayed all the menus and provided in-store days if you wanted to test the samples + nutritional information (and real video testimonials). As you went through each menu item, it displayed FB/Insta reviews from real folks, You add your selection to cart, select the days of delivery then you go to integrated payment or IBFT etc, 10 seconds later you get a confirmation response email and a WhatsApp link + all other channel links to chat with the vendor if you so desired + a BIG BRANDED PHONE NUMBER. They combined all these channels, phone, WhatsApp, Insta to a single online managed help desk response agent service. With near real time FAQ and a bot to service the customer + Live help.

With the order process automated and a workflow digitised the most useful information they got was customer information, with every delivery at day end they instituted an SMS or WhatsApp bot, based on the customers preference. They got feedback from the customer digitally vs some one calling them at 2 am asking how their meal plan was.

In the 6 months since these changes were instituted gross sales are around 7.63M, 80% of them are via online channels now and they have moved to a store in store model to reduce brick and mortar expenses during Covid.

As they scaled they learnt a few new things:

- Category Management is a lost art (SMEs dont think about it a lot, we will get to this shortly)

- CRM data is king yet SMEs don’t capture it till its too late

- What the customers say they want vs what they like are 2 very different things

- SMEs are top candidates for Digital Transformation

- Process & Workflows are key, Whatsapp and FB are bad at this inherently

- Customer segmentation analysis allows for better AD-Targeting & Hockey stick growth

- Gift cards with fantastic checkout options bring in the highest margin if you have a video testimonial library

I took the above example as a starting point as its atypical but growing in relevance as online sellers are mushroom and not typically in the FMCG/CPG space and away from the current hoopla around B2B Retail and B2B2C Retail or even our favourite Kiryana store. But this is poised to grow and if the FMCG/CPG brands are smart they will keep an eye on this space and acquire the upcoming D2C brands. If you are a startup think about UX of Omni channel retail and keep adjusting for growth.

FMCG/CPG & Retails Moment in the Spotlight

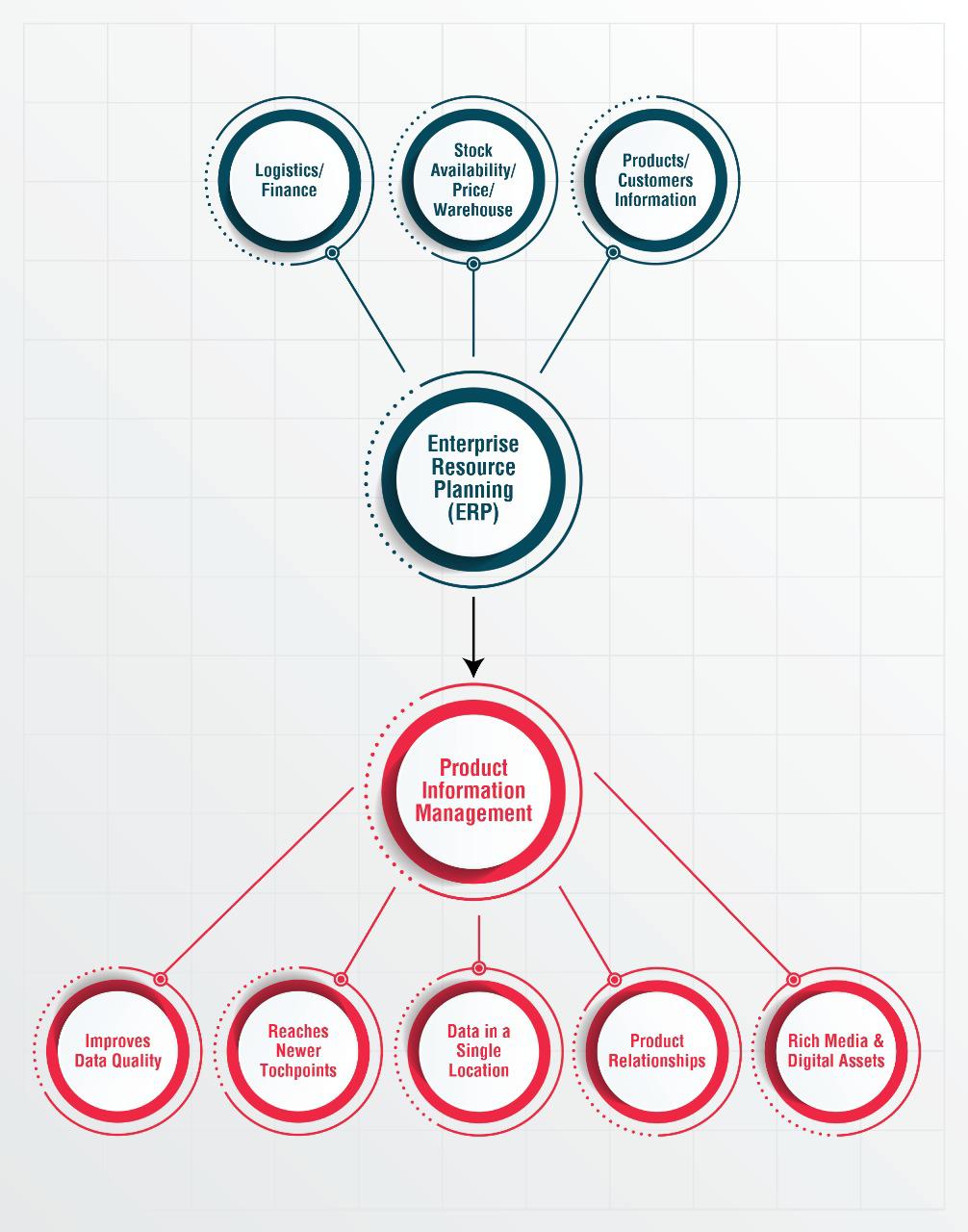

Shifting gears, let’s look at the FMCG, CPG vertical as its very relevant and increasingly unique. It only operates on the periphery of data, because of one key component that has been missing in our market up-until recently. Product Information Data (PIM). Along with that, what has been missing from on-line and off-line channels both is exacting data on category management and consumer trends in near-real time.

Whilst it would be totally unfair to the say that, Shan, National, Unilever, P&G, Reckitt, IFFCO, PTC, Coke, Pepsi, EBM, Engro, Vital, Nestle, Hamdard, Qarshi and the rest aren’t aware of this, I would venture to say that most if not all are relying on international best practices(for the global brands) and local derivates from transient employees(X Sahab, sr brand man as an example) when they shuttle between firms vs concrete defined, data-based strategies and nuances derived from on ground data and the ability to take “small data” and piece it into execution material. I could be wrong but so far in my experience, the talk around digital transformation and omni channel is much larger than the execution.

Why would I venture to make such a claim? Simple. I will list the questions that come to my mind that I would pose to brand teams locally.

- What if any category management framework do you use?

- How do you consolidate, curate, house & distribute your product information?

- Do you do universe planning?

- Do you have an-asset refresh policy?

- Do you have Marketplace SLAs for product information?

- What industry benchmarks do you codify your digital process against?

- What is your digital transformation journey and who owns it?

- Does your organisation have digital champions?

- Do you have a a 3PL or 5PL strategy? Are you as a brand custodian involved with it?

- Do you work on or execute retailer equity programs?

If you aren’t using a category management framework best to start off by looking at this webinar series on CatMan2.0 an industry standard for CPG/FMCG companies & beyond world wide.

We are an evolving market with X 100K Kiryana stores, they aren’t digital nor is their sales data, a great situation to be in. Why you ask? Because if you digitise a few 100k stores & their footprint across retail you will, for the first time get actionable and real time data compared to previous long standing guesstimates and market sizing power points handed down from generation to generation of brand managers.

Yes we have the likes of Salesflo and others who are operating in the distribution management, digital merchandising and in-store marketing and data analytics space, but that is still a mouthful and whilst great services no doubt they are working on a different part of the supply chain. As are the likes of retailo and tajir etc, raising millions is validation that this space is about to get interesting, making money will be validation that we are choosing to solve for the right sub-area. In the Kiyrana tech space this wont happen with non-feature rich East of the border copy cat products in Pakistan. At some level copying the model would be acceptable but when we cant evolve past the same name moniker from India along with colour scheme and UI, are we really innovating, granted some times a good copy does better than the original, time will tell.

Im generally not a fan of ME2 products, unless they are engineered to local specs with unique USPs and helping solve for real local issues. Valuation driven copycat apps, that lack ingenuity even in their look and feel wont likely solve for local problems because their prime motivation to build is not to solve for a unique local problem, but to follow the RocketInternet Model of cut-copy-paste and exit(CP&E). Granted it has worked in the past but I am more focused on sustainable local growth and companies and products that will make a true impact on the ecosystem, making the lives of Pakistanis better. The B2B players have it pretty tightly locked down in the value prop space and there are some formidable players in the b2c space as well sans copycats.

The jury is out, on when they become profitable ventures. In the intervening time of price wars and VC funded dreams, this should be cherry picking time for Brands/FMCGs/CPGs to really play their hand vs being locked in by technology players.

Just because most of these CPG/FMCG brands do not have the technical, operational and industrial supply chain bench-strength beyond what they have seen domestically they continue to have FOMO. Also this is not a swipe at them, its the reality of the items at hand. What this opens the space up for, is true digital transformation within the FMCG sector so they start to un-learn the Suzuki from warehouse to distributor model and go deeper in the value chain by understanding the step change in their own valuations that will come if they were to actively participate in owning “the digital last mile of supply chain data”. Whilst there is a massive push to be the “digital supplier” to all or most retailers, in the end FMCGs will win big if they get their act together as they have new buyers with likely better documented sales and order histories & reach. But as this grows the lack of proper 3PL & 5PL understanding on the distribution side and the harsh reality of unit economics on the instant fulfilment / retail side, will pose challenges at scale that are new, but solvable.

I feel:

Supply chains will be king, people who understand them will be king makers, people who use the most efficient ones with a keen understanding of real time data and traceability will be the prophets of retail.

But do we understand enough besides the press releases? Yes we do, to a fair degree, but can we operationalise it?

Not as much. So that a first time buyer of X brand sachet of shampoo in Parichanar shows up both as a first time consumer, has attribution data stored, is primed for re-marketing, aspirational spend, has language localisation elements built in, have native voice engagement available to them and for the first time be visible to the brand as User-X vs (Shipment 1 of 5000 sent to distributor in Kurram District in the province of Khyber Pakhtunkhwa) and based on census data have a likelyhood of being part of a 30% female cohort. This is the tough ask.

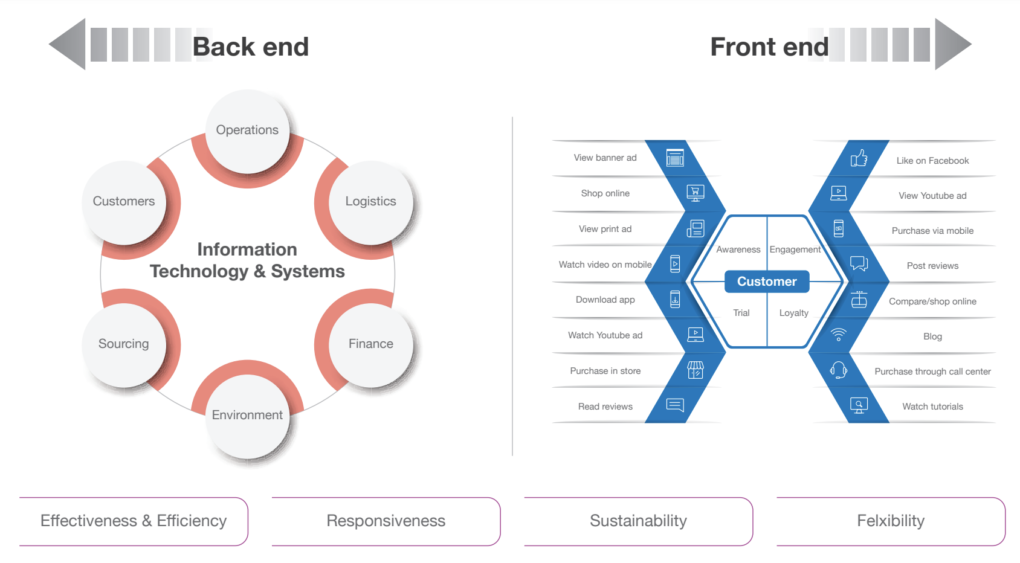

Every brand, FMCG, CPG, CEO wants and needs this data, but they do not have a clear cut strategy in place to make early bets to fund the growth in this space. My view is, most will be late, will try to make acquisitions in the space, will fail with integrations and then blame IT:). Best to note, IT ≠ Digital Transformation. Far from it, we continue to confuse the narrative at the top, thats why we have seriously dis-functional organisations. If digitization doesn’t have a clear owner and a mandate, you as the brand custodian should go some where, it does. If the CFO of an organisation has this mandate, short their stock if possible. Here is a model for you to keep in mind when thinking about the elements of digital transformation in any organisation.

Mindsets & Change Management, How to Transform Digitally?

It is a journey, that traditionally started with an ERP mind set that has to evolve.While a PIM system helps businesses consolidate, manage and enrich product information in a centralised repository and distribute consistent product information to every customer touchpoint, an ERP system carries out everyday business related processes like accounting, compliance, distribution, project management, supply chain operations, risk management, etc. We have to have an organisational shift from transactional to operational and understanding the building blocks around the digital infrastructure required will help organisations transform digitally. It has to have board room sponsors along with people who are willing to stay up nights in corridors holding doors open for the funnel of change to flow through in the right direction vs guarding their doors and not letting change management through.

Following the same thesis, its easier to measure things digitally but when your end product is being sold in an off-line first model for decades how to do you collect this info?

Well one traditional yet digital method is to work with the B2B startups who collect distribution data. But the better way is to own your “asset streams” across market places and digital channels, then use the same streams to enable the Kiryana stores to start selling via online channels. If any thing don’t think of becoming a shopify service provider. Think Instant stores backed by the brands them selves and deploying marketing and sales incentives to start “capturing” the offline footprint that goes online. Use local tech where possible vs jerry rigged foreign tech. Till you start the enablement of a digital first store, you cant do much around brand equity surveys in near real time. This journey is based on a thesis and you as the CPG/FMCG must build your view on the thesis vs the eyewash being sold in all segments of b2b/b2c/b2b2c enablers and tech. Tech only solves part of the problem at hand. It unlocks a channel, how you unlock it starts with an evolved digital mindset of having both a short term and long term strategy. This is not a race, but a cycle of growth, invest in the right tools, systems, thesis and products. Ensure your teams are trained. Getting outside help for training, consulting and advisory in

- 3PL/5PL

- Distribution

- Logistics

- Fulfilment

- BrandEquitySurveys

- Offline2OnlineAttribution

- Online Payments

Will be key tools in your future success. You cant do it alone, but you can go further faster with subject matter expertise.

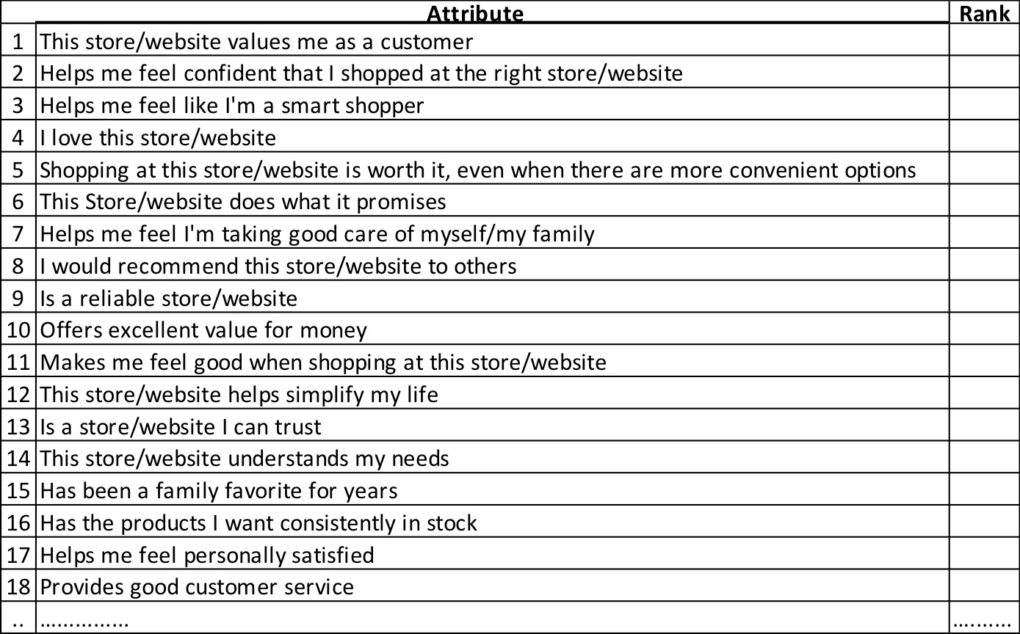

Let me leave you with what a Brand Equity Survey’s starting position should be. Similarly you could work with experts to carve out tool-kits in each area as you map your digital journey.

The Fast Fashion + Affiliate Opportunity

Oh I didn’t forget you Khaadi & Sana Safinaz, Elo, Limelight and Bonanzas of the world. You have an outsized opportunity. You are all fairly digitally inclined but with people copy-catting lower end version of your brands, I am caught thinking to my self why you haven’t co-opted the mass market yet? Beyond taking out copycats, why not enable your retail partners to sell further and wider?

Granted not all of you have retail partners since you moved in to the flagship store in every city model. But what about tier 3, 4, 5, & 6 cities? Why put out your infrastructure when you can work with others who already have the distribution channels. Why not enable them to go digital and become fulfilment agents or go drop ship? Why can I in 2021 not build a drop ship store for Limelight in Bannu?

Digital mindsets like all other mind-sets are transformative and happen over time, you cant do what you haven’t experienced even if you copy very hard. There is a massive opportunity to think about digital transformation beyond having a website and thinking about the cheapest delivery rates. Over time all those things are commodities, if you aren’t strengthening your supply chain by building resilience & reach, you your self will loose the opportunity to digitally enable new markets and thus new consumers.

If all your brand marketing is focused at, is one Target Segment are you even really digitally inclined? Agreed that not all products are mass market, but there is a market that you haven’t explored yet. Very likely, because you have not unlocked all your data.

Fast fashion has the most potential to grow, with the right world view and investment in digital transformation, beyond just lip service. Because most of these businesses are not run by boomers, there is a real appetite to scale the digital channels, which is great news for all. The roadblock is in human capital. Leaders within these organisations beyond the “saith” or “solo-preneur” are a line up of yes men and women who agree with the know it all brand masters(aka owner) and thus a sense of fresh thinking and experimentation is vastly missing. I could be biased, granted, but when was the last time an online or in-store experience in fast fashion, left you begging for more? That is because the rest of the industries standards are so shoddy, that when we get a package in time for the right price we are grateful and we as consumers haven’t evolved either to what can be, yet the same consumers have a very different mind-set when they order via Amazon.

Coming back to affiliate stores, both digital and offline, the data capture and inventory consolidation opportunities are plenty. Even before that, accurate product shots, the right handling of merchandise and a fast outsourced PIM could reduce 1000s of $s worth of photoshoots and product cataloguing every week. If I was the owner of these brands, I would do a multiyear planning and strategy session and build out the internal asset classes. AKA what to outsource and in turn allocate marketing spend on distribution channel experimentation. There is so much to do, if they were really smart they’d look at local shopify models and build affiliate on boarding for people that bring on & offline traffic and given them a digitally enabled sales tool kit.

Repeat after me, there is no shame in outsourcing, there is no shame in working with startups and even incumbents, there is no shame in accepting that you don’t know a lot around the digital value chain. If you accept the known unknowns and the unknown, unknowns your brand will evolve faster. Take comfort in knowing you built a power house of a brand-now rely on the experts to Scale it 10x.

So what is Digital Transformation in our Local Context?

The what!

First of all take stock of where you are in your digital maturity/e-commerce maturity. Especially before you embark on the how. You must define your what statement. Again no one size fits all but this should give you a better starting position than if you haven’t aggressively thought about it recently.

The How?

This is the tough part, knowing what needs to be done is listed above, since not all companies, organisations, brands, teams are made equal, the kick off process is extremely challenging. Ive spent the better half of the last decade working on framework and models that help companies and individuals more so, navigate the challenges of change management and transformation. The How to do it, whilst seemingly easy needs a lot of perseverance to execute. So I’m borrowing an excerpt from my (soon to be published book on digital transformation) to help guide you in how to even get started. I write extensively on the FAS-T Methodology in my weekly news letter here.

The When?

Not soon enough. You are already late if you are asking this question. Some Retailers/E-tailers, Brands, CPG, Managers, Product folks will read this and think they already have on-line presence, they are exploring partnerships with startups and have MOUs in place. You sir/ladies are the ones that will be left behind by a generation of execution mavens who truly understand the transformative power of actions. It is on the shoulders of such folks that new brands, D2C and otherwise will be built. If you rely on your “agency” for guidance on all things digital, I am already betting against you.

I don’t have any or most of the answers, but what I know for a fact, is that if you are the Owner, CEO, Partner, Change Maker, within any of these industries or verticals and you are struggling to frame “where to next“? Then let the hand written note above be the starting point, in having an honest conversation with your self before you embark on your digital transformation journey in the retail world – (or any world).

I wish you the very best of luck. If you want to operate beyond luck alone, I can be reached via Twitter and typically reply to all questions if you say please!

Loved the piece. Also love how you create your own mnemonic and hand written chart for your followers. Guru moments.