TL;DR: All the items below are based on publicly available info that you are too lazy to Google, so if your understanding is different than mine, leave a comment.

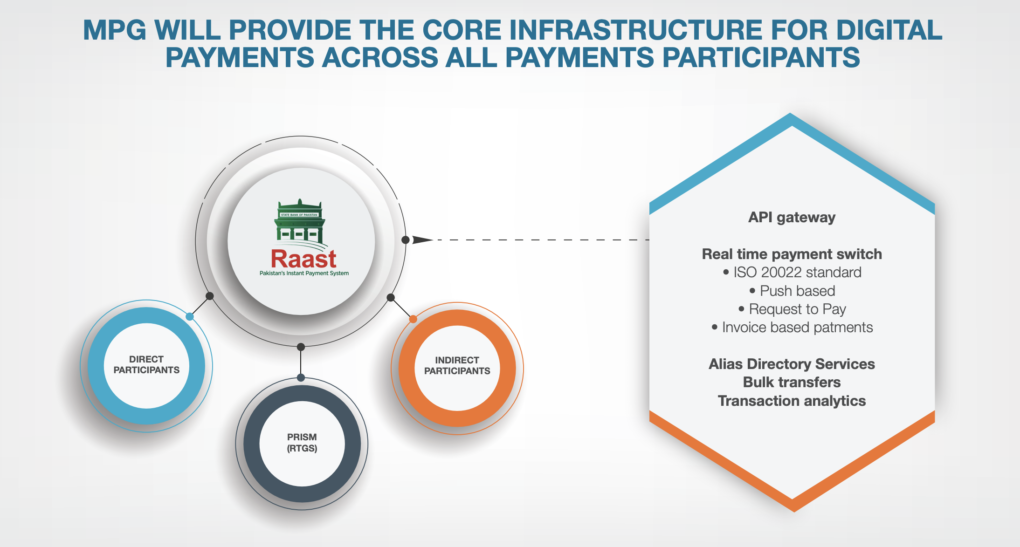

On Jan 11th I saw like many others a news paper announcement for the long awaited MPG(Micro Payment Gateway) project, launched as Raast + The standard govt fare of online PR etc.

It had all the right things in this advert, but not a whole lot of context for the otherwise curious. The rest of the PR also had somewhat vague timelines, a hurried launch perhaps or a final push (also read as IMF/FATF Pressure)

But the need, context, impact and bottom line were fully evident along with the hard work of the partners and the regulator. These things aren’t easy to stand up especially in markets like ours where almost every one is disincentivized to not get any thing into the documented economy or where you are able to add traceability. There will always be some one who challenges the thinking the process the execution, we aren’t here to do any of that. But rather make sense of it all as a consumers, merchants + think through the future role of banks/aggregators and existing payment systems.

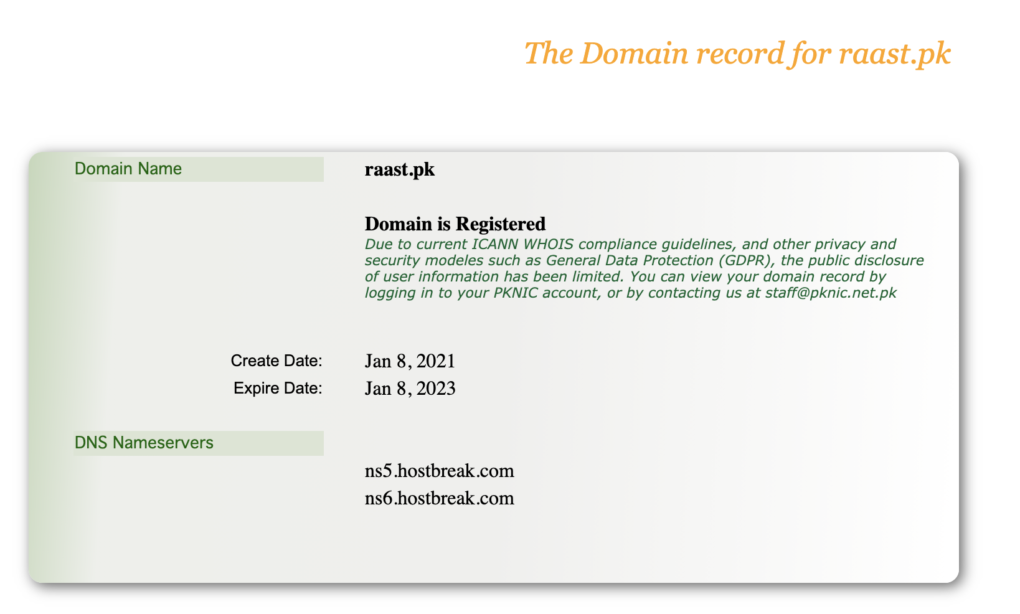

Interesting choice of name. Commonly interpreted as straight or in Urdu Seedha, Mustaqeem, Nishanay Par Baithnay Wala, Khara, Hamwar and Theek. Logical inclination to look at if the domains taken. Lo and behold it was registered on the 8th of Jan 2021 per PKNIC.

I sent an email to the link on Raast.com, apparently for $3300 you can buy it.

I also saw a fantastic explainer thread from Khurram Zafar who is on the Board of Karandaaz, the not for profit that is front and center on this initiative.

Up-until now, what I for one understood, is that a lot of clarification/insights being provided to tell every one that its not just an other digital payment switch or similar to existing transfer mechanisms. Fair point, it is not, then what is it really?

I can fully understand why the big guys, Telcos who have spent billions getting us to this point will not take lightly to the usage of their pipes for “free” in conjunction with Raast esp since they have been used to a “fee” based model, the mechanics of their predatory pricing notwithstanding, but then nothing is built for free. They are commercial enterprises so there must be continued opportunity to make money with consensus and on the basis of “fair value”.

Similarly for 1Link and all the Banks that own it, what a silly way to be marginalised. Goes to show that had they done some transformative thinking in 2017/18, when the tendering etc from MPG was being rolled out, they would have not been sitting ducks in this process, had they even attended the stake holder meetings the SBP ran up until 2019 they would have seen the fault in their ways or perhaps contributed to partake. In dec 2017 1Link was doing an RFP For an OPEN API Platform.

One would assume they would have figured out what was coming. I’m shocked the Banks didn’t gear up to put forth an indigenous solution vs being told what to do now. No less its a +1 for the common man when this rolls out. The elephant in the room will be fees and interconnect, whilst the feature set of Raast make it fully interoperable, the questions that come to mind are many as to how it will actually happen? We will get to those in a minute.

So Whats 1Link then & how does it work?

The following diagram shows the overall architecture of 1LINK with co-networks. There is no direct interaction with Alternate Delivery Channels (ADCs) of member banks. Transactions are received from the Acquiring bank ATM Switch / Middleware to 1LINK switching platform. 1LINK supports all type of cards transaction along with EMV transactions on VISA, MasterCard, UPI and JCB.

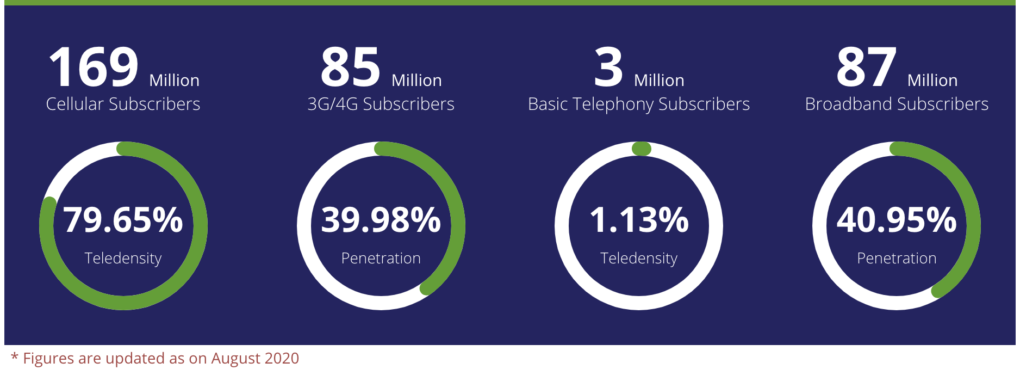

Pakistani Telco Numbers & The case for digital transaction adoption/or not.

With say around 169M 3G/4G folks how is it that we have under 50M bank accounts? Some thing clearly doesn’t add up. Are the services being pitched correctly, is there a knowledge gap, access gap?

So heres my simplistic take on Raast, these are finally the rails on which all else will be built(for the future) as opposed to 1Link type push only services. For now the assumption is that either by regulation, coercion, friendship or legislation all the existing players in the eco system, meaning banks, fin techs, payment companies will have to connect to this going forward, only then can ubiquity and interoperability become real. Till then it’s any ones guess really. Time lines and availability of the stack and guidelines + pricing will make the difference between mass adoption and success or a theoretical exercise.

What are Digital Financial Services? (A simplistic view)

Digital Financial Services (DFS) include a broad range of financial services accessed and delivered through digital channels, including payments, credit, savings, remittances and insurance.

– Digital channels refers to the internet, mobile phones, ATMs, POS terminals etc.

– DFS concept includes mobile financial services (MFS).

■ MFS is the use of a mobile phone to access financial services and execute financial transactions.

– Includes both transactional services and non-transactional services

– MFS include M-Banking, M-payments, M-money.

■ M-Money is a mobile based service facilitating electronic transfers and other transactional and non transactional services using mobile networks

■ M-Banking is the use of a mobile phone to access banking services and execute financial transactions.

– Often used to refer only to customers with bank accounts.

What Problems exist in the DFS space in Pakistan today?

- Inadequate digital ecosystem and processes to drive digital payments adoption(also read lack of incentives and in-expensive access to drive change)

- Difficulty to integrate with existing financial and non-financial systems (laggard and myopic view of the payment/scheme operators, local and international both)

- High cost of digital transactions (not suitable when you want bottom of pyramid inclusion)

- End user experience, limiting convenience vs cash (consumers, merchants, etc.)

- No full sector wide interoperability (e.g. USSD-branchless banking)

Why Digital Financial Services?

■ Reach larger audience of customers untapped by the existing banking

infrastructure

■ Increases financial inclusion

■ Increase efficiency of delivery

■ Improve quality of service

■ Revenue growth

– Reaching new market segments

– Offering new products and services enabled by technology

■ Cost reduction to companies and customers

– Operational cost by reducing branch costs and manpower costs

– Reducing transactional costs by being accurate and context aware

So How does Raast Really work & What does it do?

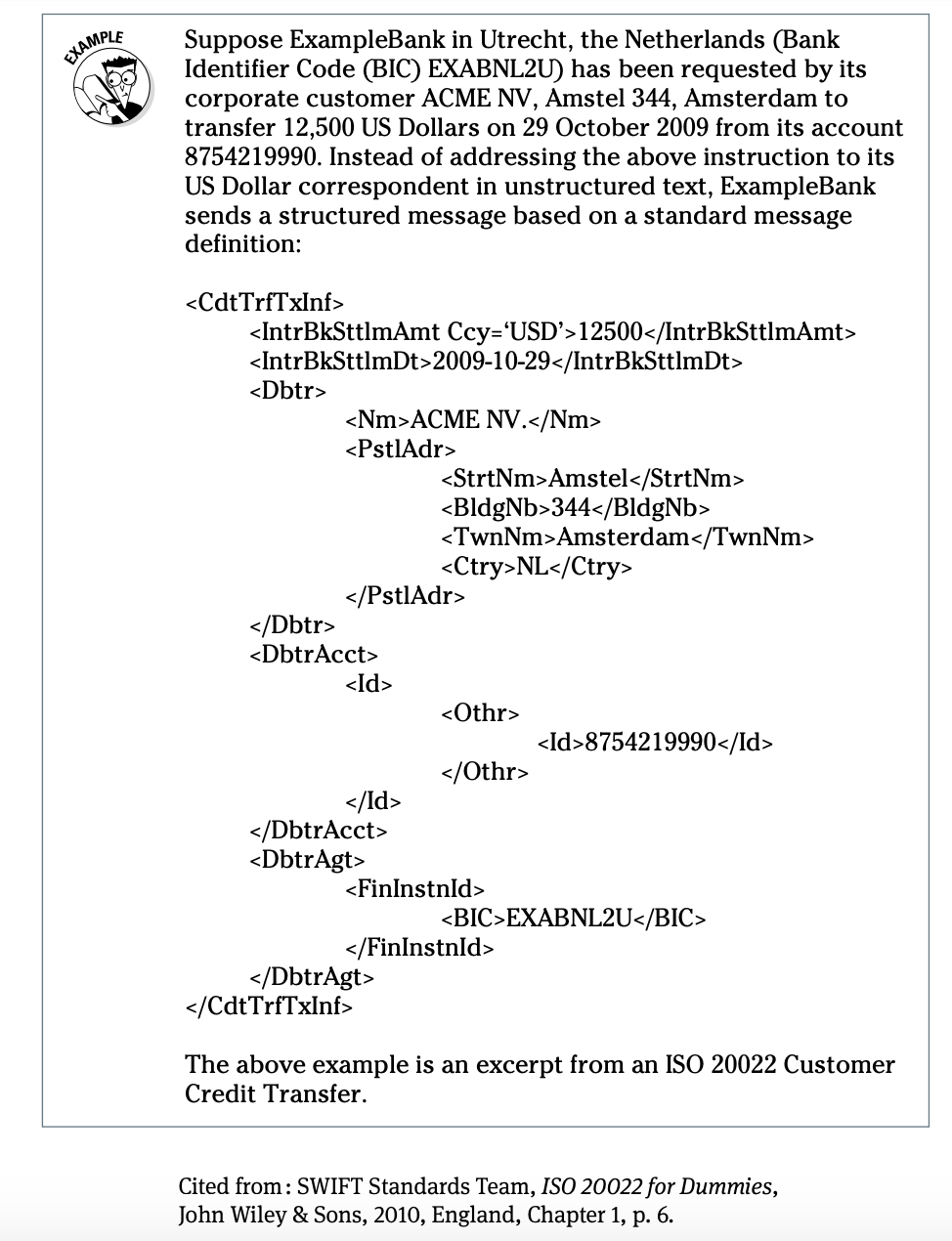

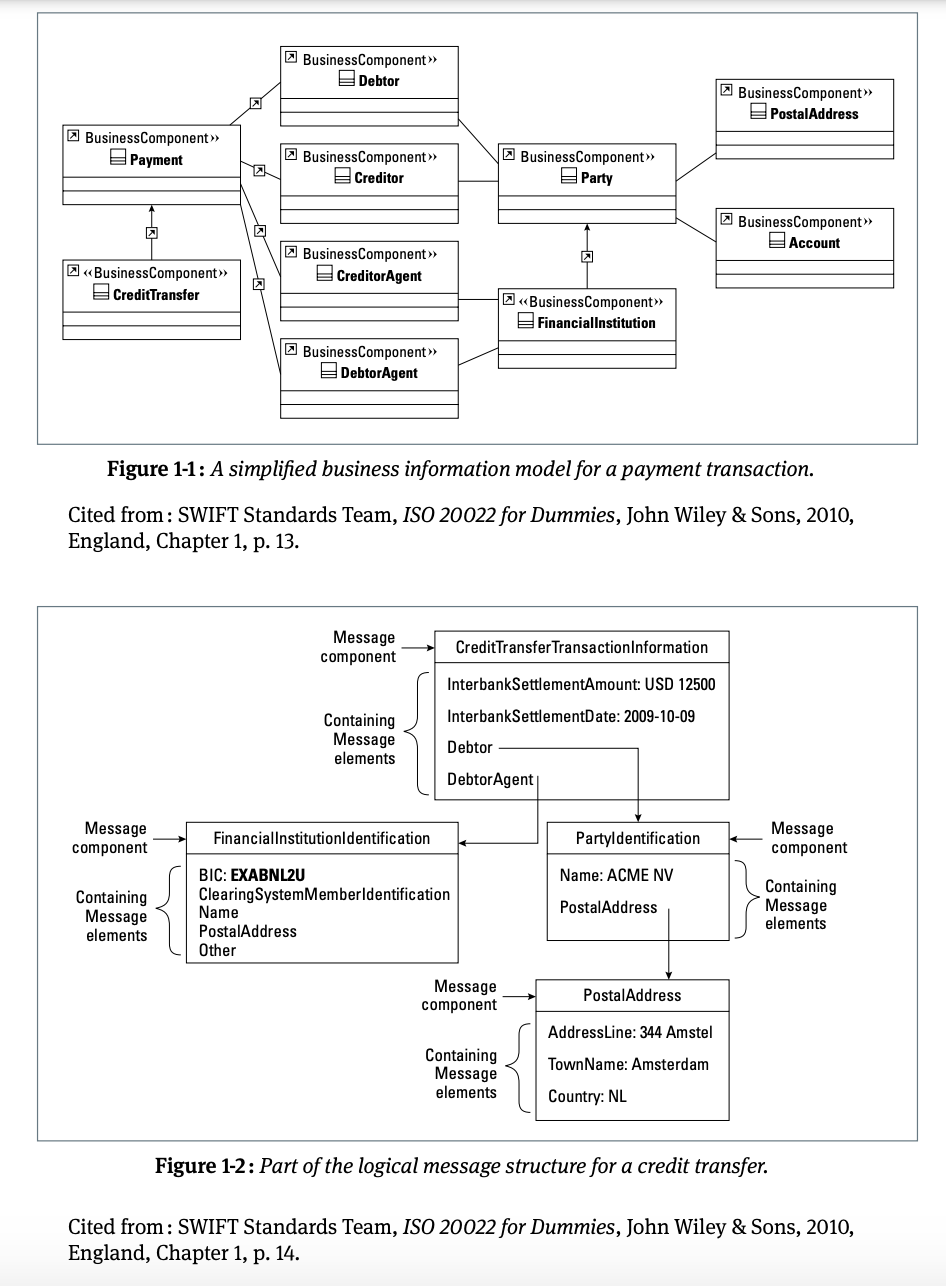

Thats a loaded question with a loaded response. The first thing to understand about Raast is that it is built on some thing called the ISO 20022 Standard. This is key. This will keep on coming up so pay attention.

In the financial services industry where trust, interoperability and resilience are

key requirements, the quality of data exchanged between parties, closer and closer to real time, and between increasingly diverse stakeholders in the value chain, is of paramount importance. So to keep this quality up and running there had to be a standard to make sure every ones on the same page.

This is why financial services industry experts have developed ISO 20022, a global and open standard for information exchange, that is being adopted by a growing number of users in various domains: securities, payments, foreign exchange, cards and related services . . . notably for end-to-end straight through processing, components management or regulatory reporting. We are neither alone nor the first to adopt this but clearly in the right for doing so.

The ISO 20022 standard provides a methodology to describe business processes and a common business language, which can be rendered in different syntaxes enabling implementations for messaging and application programming interfaces (APIs). It is

supported by a central repository, which includes a data dictionary and a catalog of messages – and is accessible to all.

This is ground breaking stuff because it removes the need for the user to be “payment context aware” or like edge computing takes the processing to the cloud from the device. The onus or burden of responsibility to decipher inter scheme or inter payment method operability moves from the users domain to the systems (Raast’s) domain using the addressability feature. In short, from what I am seeing, between a combination of your phone number and your NIC there is little to nothing else you as a user need, to transact with any one irrespective of their bank or wallet of choice.

From a business point of view, the usage of this universal messaging standard, improves efficiencies in delivering products and services. In my mind ISO 20022 is essentially:

● “A single standardisation approach (methodology, process, repository) to be

used by all financial standards initiatives”

● An international standard for communication between financial institutions

● An Introduction of a dictionary of business terms used in financial communications, (catalogue of messages ) so that everyone uses the same vocabulary

● ISO 20022 is a standard to develop standards

● A Super structure that has Three layers:

1) key business processes and concepts,

2) logical messages or message models,

3) syntax (XML)

Syntax and semantics, Why they are important?

To be able to eliminate the need for human intervention to interpret data, the financial industry needs message definitions – that is, agreements on how to organise the data they want to exchange in structured formats (syntax) and meaning (semantics). Based on such message definitions, Raast will exchange messages thus being completely different from existing payments system in the country.

If you are really inclined here is a snap shot I found of an example that helped me better understand the transaction/msg flow and what really is happening.

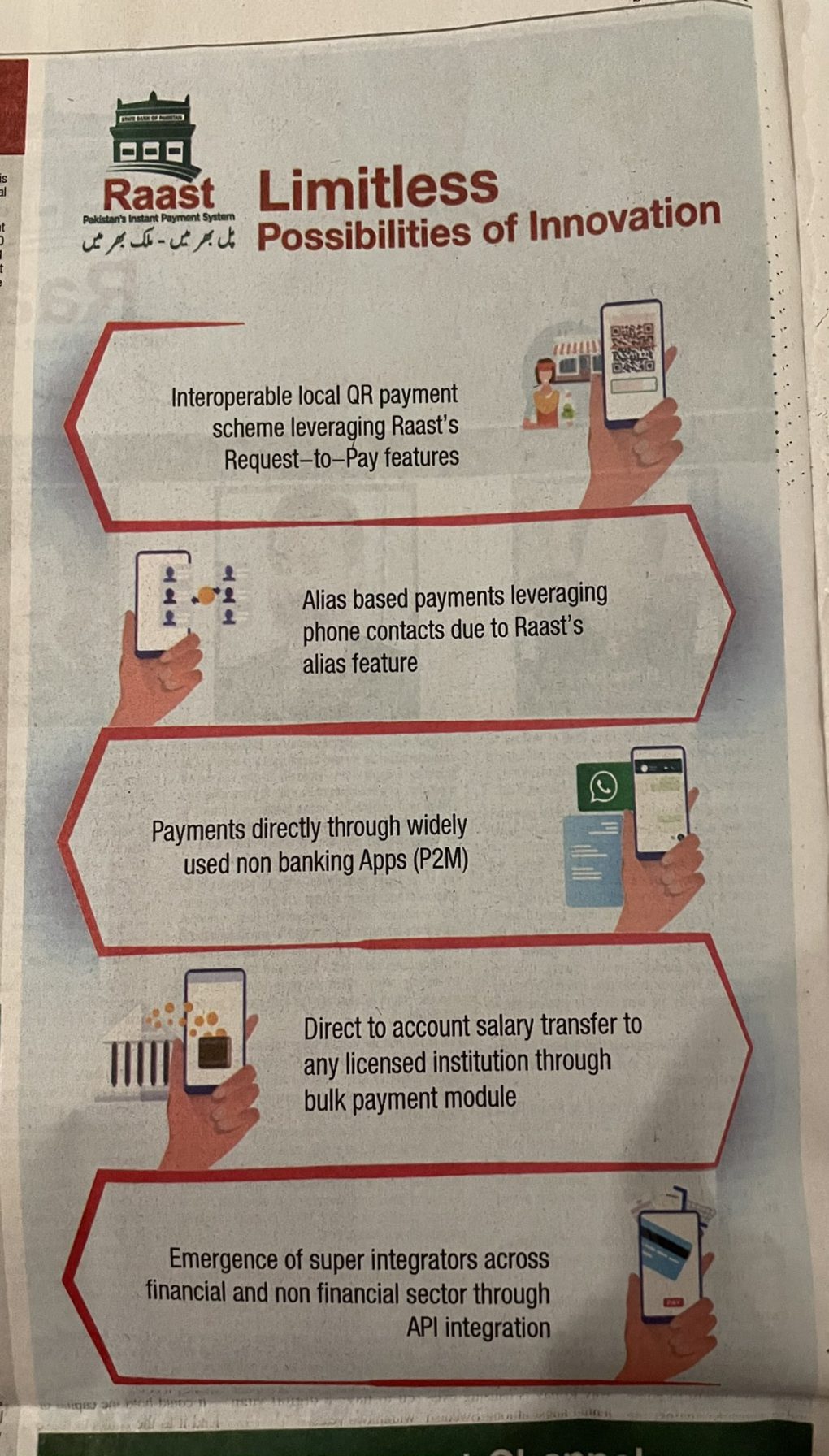

What can we hope to see when the above is executed?(SBP/Karandaaz view)

- Real time transfers: Instant availability of funds and near real time settlement of low value payments

- Sector wide interoperability and open governance: Connectivity across all licensed & other entities (Banks,MFBs, PSPs, relevant government entities) removing need for bi-lateral tie ups|NO MORE FFING MOUS & Mutual Admiration Clubs|

- Simple, account-agnostic payment forms: Alias-based (e.g. phone number) simple payments, standardised across the industry

- Drive new product introductions and innovation: New message standard, request to pay, sector wide bulk payments) supported by a dedicated testing environment

- Easy and cost effective participant on-boarding: API architecture allowing quick and efficient on-boarding mechanisms and integration requirements

- Low to no transaction cost for end-users: Cost recovery model, maximising benefit to end-users and participants

- Built in security and authentication: Robust end-user data verification and security

What does this translate to, for the ecosystem of players?

How does Raast/MPG solve for the above?

If all goes to Plan then what happens?

What could be some Initial Challenges particularly for Incumbent Banks?

- Ensure 24×7 real time processing in core banking (some can barely get their core banking to work internally)

- Ability to credit and debit within 5-15 seconds (Again, for banks used to doing day end processes, this will be akin to landing on the moon)

- Adjustment in reconciliation procedures (See above)

- Adjustments to business process (More mind set than process, but both will need a re-set)

- Figuring out pricing.

What could be some Initial Challenges particularly for Incumbent Wallets?

- Pricing

- Pricing

- Pricing

- Re configuration of settlement basis

- Re think on internet payment gateway and mobile top ups

- Re think on inward payment /settlement systems like items with Payoneer etc.

Where to next & by when?

Step 1:

Every one must connect to Raast for Raast to be useful (Think regulation)

Step 2:

Raast Usage will be priced nominally, so what happens to the existing Players and use cases? (Think lots of resistance to change/to connect/to forgo fees/or let others use pre built wiring for new use-cases for free)

Step 3:

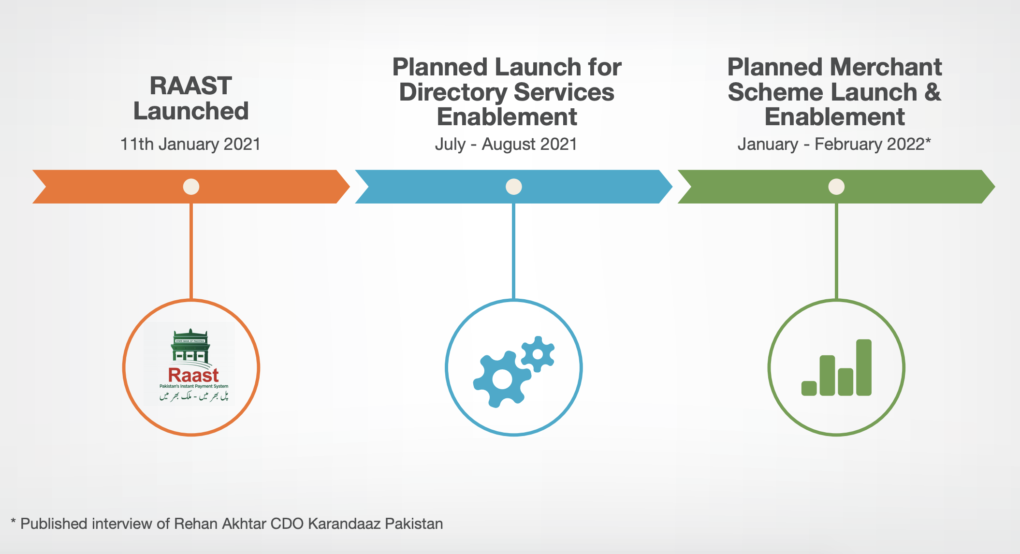

Will Raast deliver technically and on time?(The time lines are vague see image above)

Step 4:

Will the industry wait 1-2 years for all the underlying use cases and tech to opened up or will some one come in and do this better faster cheaper?

Step 5:

Will the regulator successfully be able to build an internal organic payment scheme on top of Raast for ecom-merchant-internet enablement use cases to work? What will the likes of Sadapay, Safepay, Nayapay, Foree do to pivot when Raast is up and running? And Visa + Mastercard. This is a sure fire way to stop FX settlement offshore for onshore services.

Net net, this is development in the right direction. I feel this has to be done in a consultative fashion and with all parties working towards solving for the citizenry whilst keeping healthy economic outcomes for self & others. Onwards and forwards, Karandaaz + The Gates Foundation + SBP + Policy makers all seem to have gotten the premise right, let’s just hope the economics makes sense and leads to adoption vs infighting.

Wow! What a brilliantly detailed breakdown. Thank you.

Some youtubers are calling it an app or even a “PayPal for Pakistan”!!

I had the pleasure of interviewing Rehan Akhtar, CDO at Karandaaz, where he broke it down as to what Raast does…

https://youtu.be/opraug9FdFI

Thanks again

There is very rare information available on Raast and your article filled few gaps. What is current status of this project. Which banks and what use cases are implemented so far?

Great breakdown! Raast feels like a game-changer if implemented right. Key will be adoption, fair pricing, and getting all players aligned not just technically but mentally too.