TL;DR; NBU(New Bankable Users) + E-commerce + Payments + Logistics. Did the big guys really miss this? Move over ad-tech, the ride hailing guys may just have a better handle on this one.

Here are the thick big published statistics.

An addressable population of 210M+. Roughly 125M people under 30 years of age. 60M smart phone users and 50M Internet subscribers. 140M bio-metrically verified Sim cards and telco subscribers. A projected middle class of 160M in ten years. We see these statistics flashed every alternate day. What is the big deal, you ask?

–Combine them with the following gems:

–Total domestic ad-spend of $650M.

–Total digital ad-spend of $100M.

–Existing M-wallets transactions at $2 billion.

–Branchless Banking transactions at over $6 billion.

–Two big players in the digital payments space (Jazz Cash & Easy pay) who are riding momentum of existing market share, ATL and BTL campaigns and a single decade old acquisition.

–One of them, a case study of how little it takes to move the needle in Pakistan if you have cash, infrastructure and timing on your side.

–Incumbent Banks with no net new innovation over the last decade that translates into a dramatically new, better or more profitable business model. They just can’t break out of the box or get anything with a real bite done.

–Ability to get an e-money license or tie up with a Payment systems Provider (PSP) to launch new services.

–A new universal connect in the works that will allow any telco network subscriber to connect to any other telco network subscriber breaking down the walls and the moats Telcos have hidden behind for two decades.

How do you monetize this army of young willing plugged in dis-satisfied users? Users who are ready for a better customer experience and for instant fulfillment. If you are still thinking ad-tech or ad-sales both your game and your mojo are out of date.

For a cash driven market like Pakistan there are only two words that you should be thinking of when you see the above stats. One of them is payments. The other is networks or systems. Take your pick.

60 million smart phones users doing a single m-wallet transaction every day for the next 40 years of their expected lives. What if its ten transactions per day? You do the math.

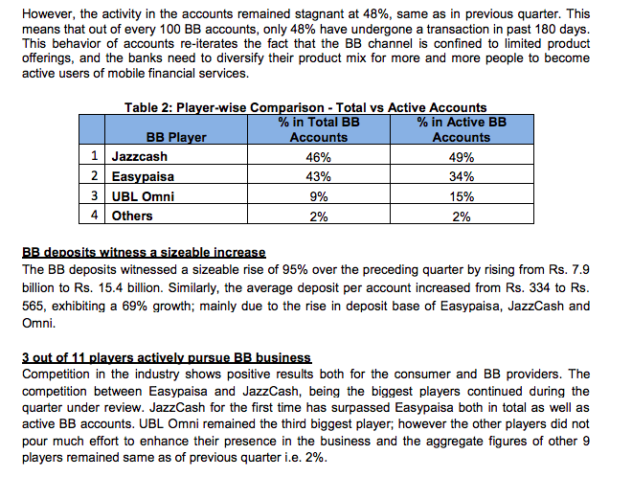

The incumbents, whether banks or Telcos have already blown the opportunity. Their best efforts over 5 years of product launches and onboarding initiatives translate into 2 m-wallet transactions a year on 50% of the accounts. The remaining 50% are in zombie mode.

Time for GO-Jek, Grab or Ant Financials to look at this ecosystem as there is a world beyond South East Asia where others are distracted or dis organized. Given the ride hailing guys have already made a play for POS/delivery/last mile/ad-on services and payment mechanisms all they need is a new market with a similar product market fit and go crazy with growth.

Essentially an ecosystem play.

The ride share boom has shown already that the Pakistani folk have an affinity for these services. If someone can build an ecosystem play it will only enhance that position. Careem to date has sadly missed out on payments, given the amount of “transactions” passing through its system (locally and regionally), it has either intentionally over looked or delayed getting in this space.

They won round one in raising half a billion dollars in funding and outsmarting Uber and the transport mafia in Pakistan but rather than building on that success, have gotten fat and happy. Round two, when it comes to scale, execution, consistent service quality and customer retention has been a disaster for them.

It may just be cheaper for their larger regional rivals to buy them out and do this right. They are already making all kinds of entries to build bolt on services on top of their respective platforms.

The Indian Story

For vanilla payments, the India example is a case study on the advantages we already have when it comes to building this out. The Indian market had to build out UPI (Unified Payments Interface), we are already ahead of the curve and by just a little tweaking could enable this using 1Link.

The key in India has been a PSP backend that maintains customer information, manages and issues virtual payment addresses (VPAs), resolves VPAs to user linked bank account for an incoming payment, maintains history of transactions, logs etc. Note that currently only banks and approved technology partners of banks are allowed to run their own PSP Backend in India.

The approved Technology partner is the golden nugget here. Same/similar holds true for Pakistan yet no one has capitalized on this in its true sense.

As of now, only banks and approved partners can operate PSP Backend. 40 Banks currently operate their own PSP Backend, which is connected to NPCINet. (National Payments Corporation of India (NPCI) the settlement agency).

In our case 1Link could arguably do this today. If only a mature, willing hungry partners builds an OTT service. The Asians seem hungrier for scale, so much so, Google made a bet on one of them just recently.

Three non-banking entities, PhonePe, BHIM, and Tez, operate as technical partners of the banks in India. In addition to building user facing apps, players operating PSP Backend can also provide business solutions to enterprises by means of exposing PSP APIs/SDK. A replicable model, with most if not all the components existing today in Pakistan.

Our banks and PSPs are not going to expose anything, besides their admission that they are late to the party.

There may still be time so that the industry reorganizes it self and get the Central Bank on their side or at the very least start building open API stacks where third parties could deploy services today.

You ask why?

Because if only the likes of GO-Jek or Grab look west from SE Asia or the Ad-tech companies look east from Mountain view or Menlo park they will realize that based on the demographic stats and the market access numbers above it is a no-brainer to enter this market.

Actually if they had been paying attention to actionable intelligence on Pakistan’s payment dynamics they would step back and first look at the money movement stats/volumes alone and then decide if they too may have missed the boat on this.

Sometimes, people don’t know what they don’t know. It is time to change that. It is great to look at Pakistan as a net 100% growing market for ad-sales by everyone, but the bigger opportunity lies in payment, commerce and the logistics space.

Think about it. If you grow commerce and logistics, it is just natural that ad-spend on line will grow. As an ad platform what more can we do to seed growth for the next two decades?

Moving from JUST payments to e-commerce

Jazz has shown, how little it takes to move the needle in this space. All it takes is one well funded player that has platform and tech experience, they had the funding part down atleast.

This is not even taking in to account the fact if some one would roll out a service and then enable in-ward remittances; potentially every android phone becomes a vessel to ship cash back instantly.

We take this one step further. Imagine if an Ali Express type service rolled out on the back of this. The ecommerce – ecosystem has already publicly proven how well e-commerce works; when executed correctly. Imagine if GOSF (Great Online Shopping Festival) or some type of Express market place was a permanent feature and the payment method always worked.

In one clean sweep, the entrant will displace most of the bad press around e-commerce, yet still use all the underlying e-commerce partners and help e-commerce grow leaps and bound but have a guaranteed payment system powering their own store and could work with banks and others to build loyalty as opposed to discounts to incentivize users further.

It should be a position that the folks at GO-Jek , Grab and maybe even Careem should be lining up to exploit. They already have a lot of experience with both stored value systems and services and large consumer facing apps.

Now look at this from the point of the average e-tailer not funded by corporate cash, they would get guaranteed electronic payment/settlement and less reliance on COD, thus potentially reducing returns and increasing reach. If Walmart and Target think it can work, I am sure a lot of thought has gone into this. It also gives rise to the notion of Market place of market places, allowing localized/hyper local shipping and rural access to products and people and cash and to the player who comes in an opportunity unrivaled any where else. If they happen to be in the ride hailing space it gives them last mile logistics too.

Realistically all it takes is to stitch the pieces together. Ant financial continues to be in the news, no one knows for sure what will happen, their approach is to buy a financial service provider and enter the market that way. Our South East Asian friends could take the easier route and tie up and do a technical partnership. No government with half a brain, during election year would say no to expedite some thing like this.

Sometimes I wonder with all the mental horsepower that the big boys have, what happens to the in country intel going back to Menlo Park or Mountain View? It probably gets rolled up as an ad-sales number somewhere and then rounded down due to being insignificant as a subset of the region.

We just need a fresh approach that Grab and GO-Jek have capitalized on in this region. Kudos to the Central Bank for putting out hard data all it takes is to take some intelligent views on this to be in line to capitalize from a multibillion dollar opportunity.

The next 100 million users are ready? Are you?

Annexures – Sources and Methods.

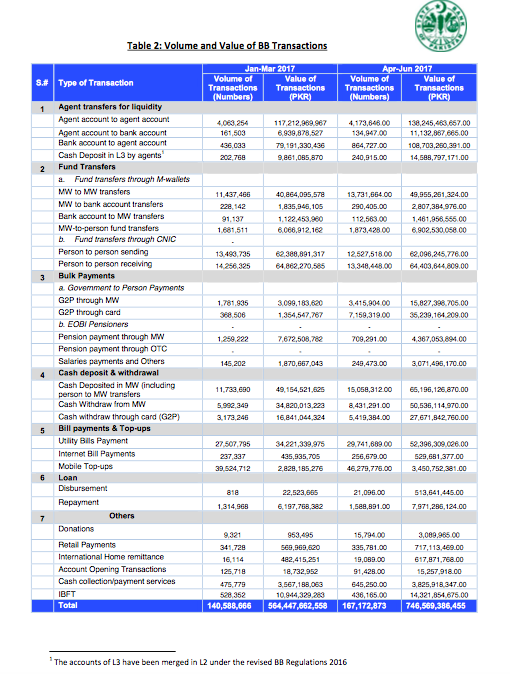

Branchless Banking Transaction Volume total was 746,569,386,455 PKR or 6,734,055,865 USD. (Six billion seven hundred thirty-four million fifty-five thousand eight hundred sixty-five USD)

http://www.sbp.org.pk/acd/branchless/Stats/BBSQtr-Apr-Jun-2017.pdf

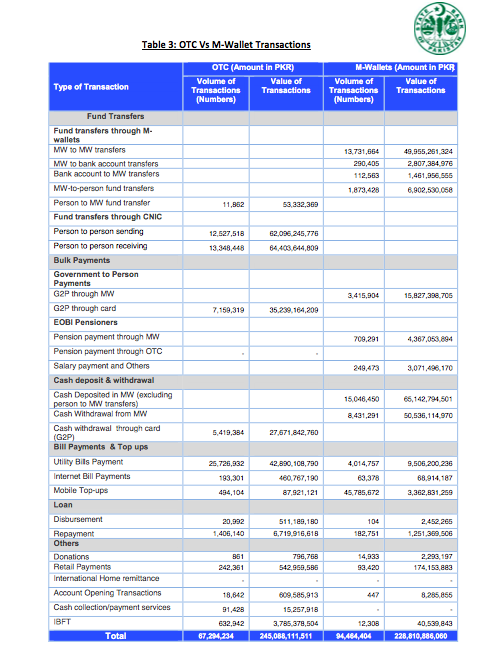

M-Wallet transaction stood at 228,810,886,060 PKR or 2,063,874,192 USD (Two billion sixty-three million eight hundred seventy-four thousand one hundred ninety-two USD).

http://www.sbp.org.pk/publications/acd/2017/BranchlessBanking-Apr-Jun-2017.pdf

Ad-Spend Data from an earlier post

Special thanks to Jawwad Farid for his input, additions and corrections plus all the other nice bits.