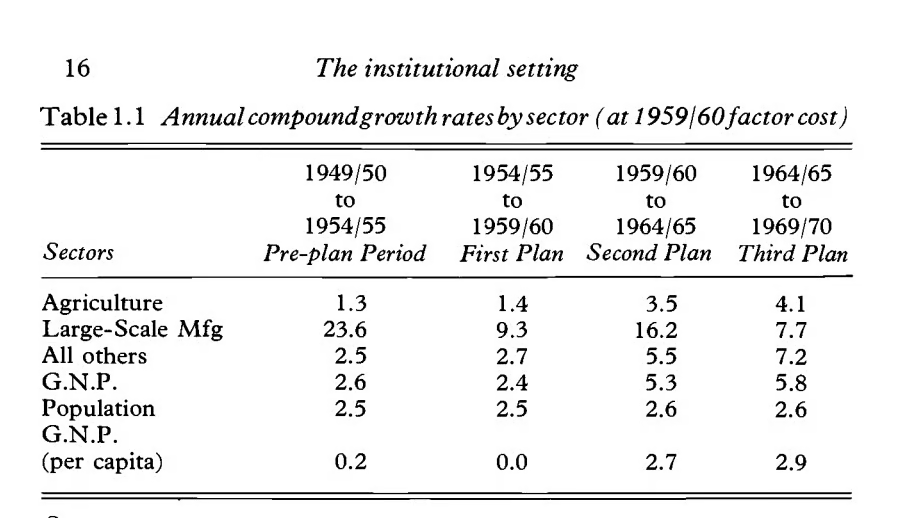

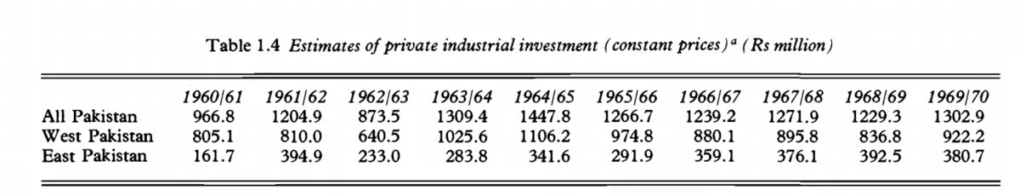

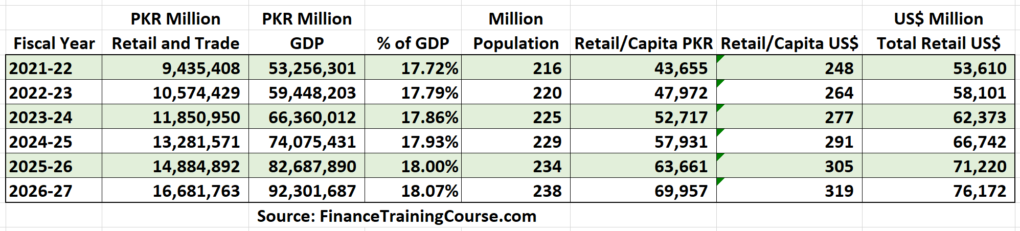

In the burgeoning telecom sector of Pakistan, Veon’s subsidiary Jazz faces a pivotal juncture. Veon’s third-quarter financial disclosures and strategic plans, outlined during their latest earnings call and a comprehensive trading update, convey a narrative of a company striving for digital metamorphosis amidst a fiercely competitive and economically challenging environment.

The latest figures from Veon present a mixed bag. While Jazz boasts a commendable year-over-year local revenue growth of 12% — an impressive feat in a tough economic climate — when converted to the reported currency, this figure faces a steep 17.1% year-on-year decline, according to Veon’s trading update. This stark contrast underscores the debilitating effect of the depreciating Pakistani rupee and the country’s macroeconomic volatility on Jazz’s financial performance.

The strategic decision to sell Jazz’s tower assets for $450 million is both a lifeline and a gamble. This divestiture, frees up substantial capital. However, with $150 million allocated for debt settlement going to the Parent Co, the remaining $300 million represents a strategic war chest that must be invested shrewdly. The question on investors’ minds is whether Jazz can channel these funds into successful digital ventures, or whether this will mark the beginning of a gradual decline in infrastructure quality and network reliability. We have seen plenty of bad bets from Jazz/Veon in trying to build and launch its own messaging app in 2017 to not really being able to capitalize JazzCash beyond low end money transfer use cases (don’t get me wrong, how it built out the service from no where to taken on easy paisa is great execution) what we don’t know is, if they can get past the basic use cases? They have burnt more advertising money on SME/MSME market in their QR code and other strategies with no real financial returns.

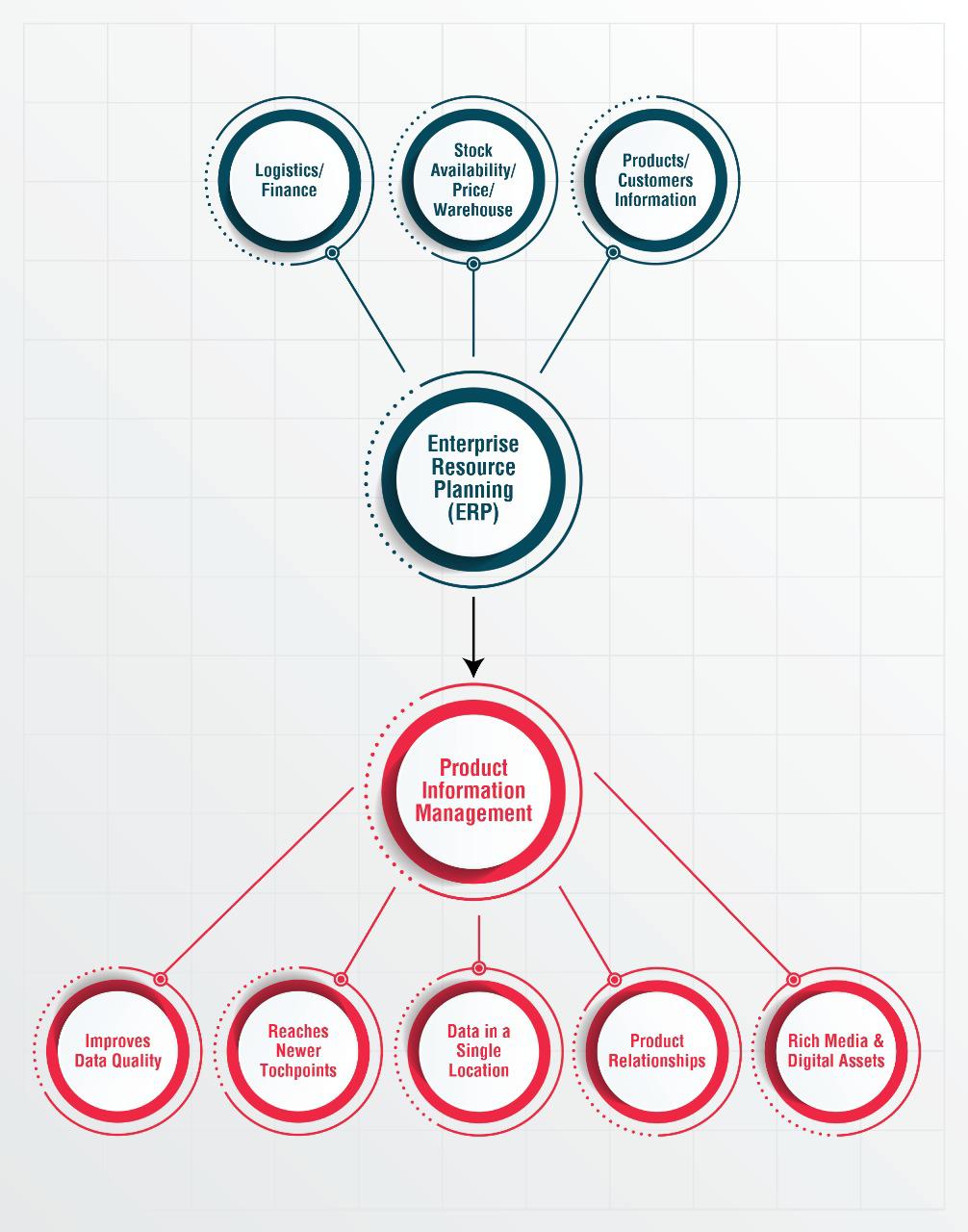

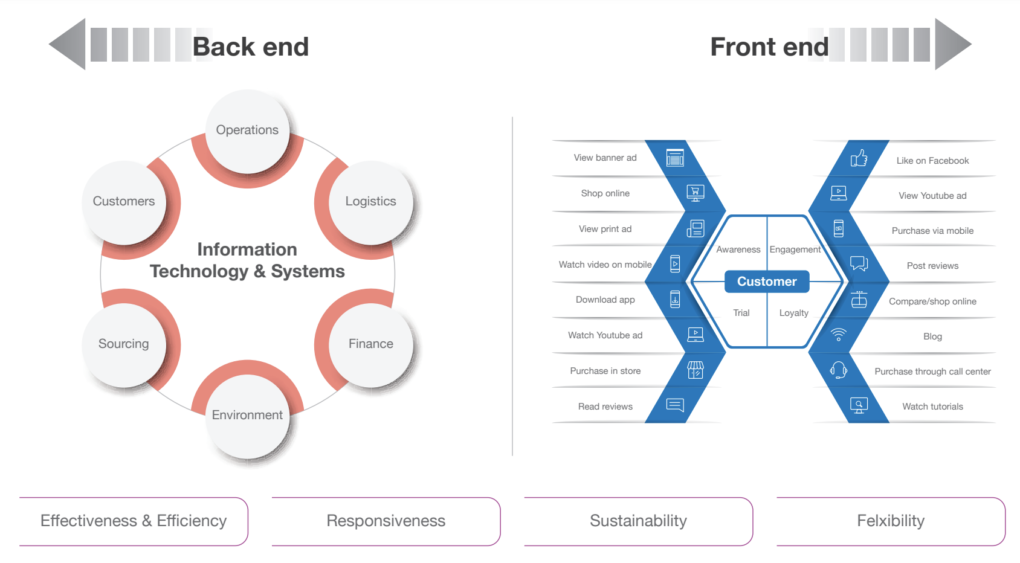

Generally, it is seen that the value created by the digital adoption of services at the consumer end cannot directly be captured by B2C product creation alone. A much better model is B2B2C and the B2B portfolio of PTCL (beyond corporate SIM connectivity) is seemingly much larger and faster growing than Jazz.

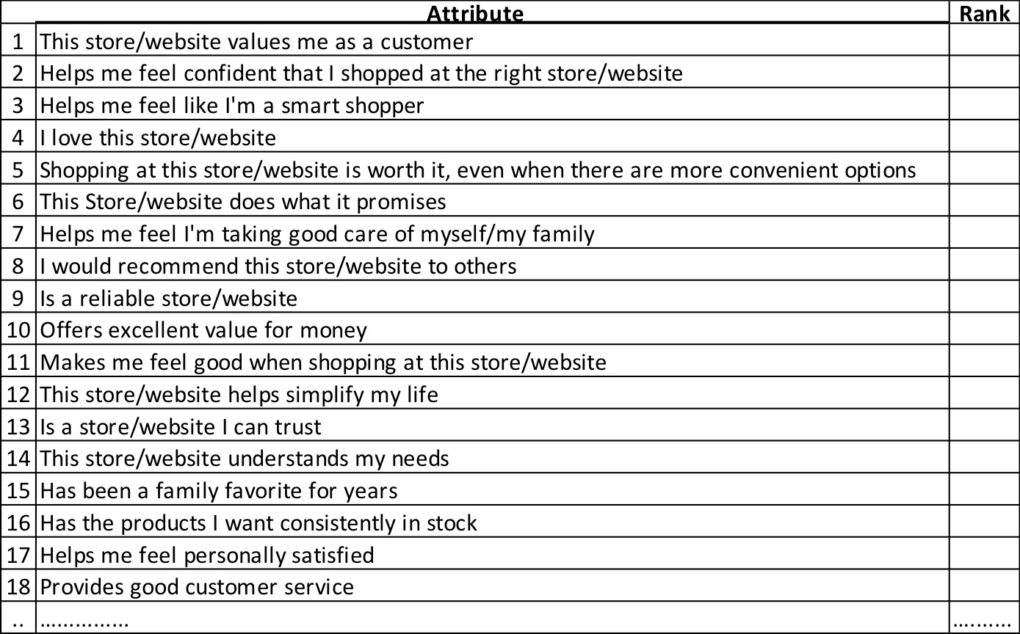

On the digital front, Jazz has made commendable strides. Veon’s earnings call, as recounted by Insider Monkey, highlighted JazzCash and Tamasha as shining examples of its successful digital operator strategy. JazzCash continues to dominate the fintech space with 15.4 million monthly active users, and Tamasha has emerged as the country’s leading video streaming app. Yet, as Pakistan’s digital economy burgeons, these platforms face the colossal task of converting digital traffic into sustainable revenue streams. A contender in the form of TAPMAD with 1M subs and a revenue model is a real competitor in the space.

This land grab is without sustainable revenue and Jazz has not really leveraged its network dominance to grow this, it has relied on the same advertising muscle without reliance on innovation muscle. The question, we are compelled to ask, are they even playing the innovation game or are they just carrying out corporate instructions from VEON?

The skepticism surrounding Jazz’s future is compounded by the recent acquisition of Telenor Pakistan by PTCL, a move that could potentially dethrone Jazz as the market leader for the first time in three decades. The sentiments expressed by the Jazz CEO on Twitter reflect a complex blend of industry insight and personal reflection.

He acknowledges the potential efficiency gains from market consolidation but also voices concerns about foreign investment implications and the need for policy reforms.

PTCL’s acquisition, backed by Etisalat’s prowess, could bring about a new telecom era in Pakistan. With a government stake, PTCL may leverage this merger to push for infrastructure expansion and digital services, potentially reaping the benefits of scale and state support. Jazz, in contrast, must navigate these waters with a private-sector agility and a focus on innovation to retain its market share.

Drawing parallels from other markets, the consolidation of telecom operators often leads to a surge in investment and improvements in service quality. However, it can also result in reduced competition, potentially stifling innovation. Jazz’s challenge will be to maintain its innovative edge while managing the inherent risks of reduced CapEx and infrastructure investment.(As per VEON alluding in its Q3-Call). Based on what I read.

The telecom sector’s history in Pakistan, marred by high taxation and regulatory challenges, offers a cautionary tale. Jazz’s predecessors, Warid and Telenor, once robust market players, ultimately consolidated or exited, leaving behind a legacy of what could have been. Jazz must learn from these lessons to avoid a similar fate.

As Jazz charts its course, the potential pitfalls are numerous. The Pakistani telecom market, with over 167 million mobile subscribers as per the Pakistan Telecommunication Authority’s 2022 report, is ripe for digital services growth, yet equally fraught with economic and regulatory minefields. A failure to capitalize on the digital wave could see Jazz’s customer base erode, particularly as PTCL and Etisalat fortify their position as they are global players in tough markets having launched and built more sustainable products.

In conclusion, Jazz’s future hinges on strategic agility and the effective deployment of its $300 million windfall if the sale goes through and numbers hold, I am not aware of the latest developments on that front. Veon’s historical data and market precedents suggest that the next few years will be critical. Jazz could either emerge as a digital phoenix, rising amidst Pakistan’s telecom revolution, or find itself outpaced by a newly consolidated PTCL-Etisalat entity. The strategies adopted today will resonate through the next decade, potentially redefining Pakistan’s telecom narrative.

In the PTCL-Telenor mergedCo, there is an element of fixed line subscription and the very fast deployment of FTTH that PTCL has undertaken. By Jan 2024, PTCL will become the largest FTTH player overtaking Cybernet (source: PTA FTTH Market Data). The fixed mobile convergence advantage that PTCL-TP has cannot be replicated by Jazz, unless they use their $300 million war chest to acquire an FTTH Operator.

War-Gaming the Digital Frontier:

Jazz’s Top 5 Strategic Moves

- Diversify Digital Offerings: Jazz must broaden its digital service portfolio beyond JazzCash and Tamasha, potentially tapping into e-SME, e-education, and smart home technologies along with a huge focus on customer service.

- Strategic Partnerships: Collaborating with tech giants and local startups could infuse innovation and expand service offerings without heavy CapEx investments. Partnerships of equals.

- Data Analytics Investment: Enhancing data analytics capabilities can lead to personalized services, improving customer retention and attracting new segments.

- Monetizing User Base: Leveraging its substantial user base to offer premium digital content and exclusive services can generate additional revenue streams.

- Community-Focused Initiatives: Investing in community-driven platforms can build brand loyalty and drive user engagement, essential for organic growth in digital spaces. Make money when people make money with you concept.

PTCL-Etisalat’s Tactical Advantages:

5 Growth Catalysts

- Infrastructure Expansion: Leveraging the merger to expand and upgrade network infrastructure can attract customers prioritizing connectivity and service quality.

- Government and Enterprise Services: With a government stake in PTCL, there’s scope to secure large-scale enterprise contracts, particularly in smart city projects.

- Foreign Investment Influx: Etisalat’s global presence could attract foreign direct investment, facilitating advanced technology deployments in Pakistan as a bolt on to SIFC Led initiatives.

- Market Consolidation: Rationalizing the merged entity’s operations to eliminate redundancies can result in cost efficiencies and streamlined services.

- Brand Positioning: Rebranding efforts post-merger can position PTCL-Etisalat as an innovator, capitalizing on Telenor’s goodwill and Etisalat’s international reputation.

Jazz’s Potential Strategic Missteps could be: Five Faux Pas in Pakistan’s Telecom Play

- Overlooking Infrastructure: In the bid to transform digitally, if Jazz neglects its core network infrastructure, it could suffer from quality issues, leading to customer attrition.

- Misjudging Market Needs: A misalignment between Jazz’s digital offerings and consumer demands can result in low adoption rates, rendering new services unprofitable.

- Failing to Innovate: A lack of continuous innovation might render Jazz’s services obsolete in the face of rapidly evolving technology and consumer expectations.

- Inadequate Policy Lobbying: Without engaging proactively with policymakers, Jazz could find itself disadvantaged by regulatory constraints that hamper growth.

- Erratic Financial Management: If the $300 million/Xxx Million from the tower sale is not allocated strategically, Jazz could miss critical investment opportunities, impeding its digital transformation.

PTCL-Etisalat’s Strategic Stumbles: Five Potential Pitfalls Post-Merger

- Integration Woes: The failure to seamlessly integrate Telenor’s operations could lead to service disruptions, customer dissatisfaction, and a tarnished brand reputation.

- Overestimation of Synergies: Overestimating the cost savings and synergies from the merger could lead to aggressive cost-cutting, compromising service quality.

- Neglecting Customer Loyalty: If PTCL-Etisalat underestimates the value of Telenor’s customer loyalty, it could face unexpected churn post-acquisition.

- Misaligned Brand Strategy: An incoherent brand strategy post-merger could confuse customers, weaken brand equity, and dilute the market message.

- Complacency in Competition: With the merger’s completion, there’s a risk of complacency, assuming market dominance is assured, which could lead to a lack of competitive drive and innovation.

The moves outlined for Jazz and PTCL-Etisalat are not mere conjecture but are based on an analysis of market trends, consumer behavior studies, and the strategic patterns observed in global telecom markets albeit at a basic level of review by non industry insider. As the Pakistani telecom market braces for this tectonic shift, the strategies adopted by both entities will have far-reaching implications, potentially redefining their trajectories for the coming decade and beyond.

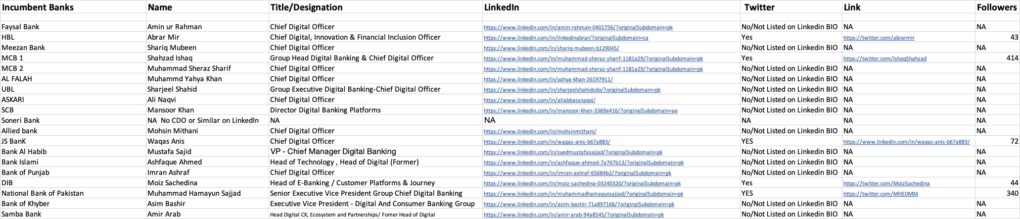

Leadership Dynamics: The Silent Catalyst in Pakistan’s Telecom Tussle

In the high-stakes game of telecommunications, where market data and financial muscle often dominate the discourse, a subtle yet powerful force is at play — leadership. As PTCL and Jazz vie for dominance in Pakistan’s evolving telecom market, the leadership style and organizational culture of each entity could well dictate their paths to success or failure.

PTCL’s rise in the B2B space can be attributed to more than strategic positioning; it is a story of effective leadership and a robust support system. With a leadership team at the helm who has not only expanded the business but fostered a culture of experimentation and openness to ideas, PTCL stands out as an exemplar of progressive corporate stewardship. But PTCL has legacy issues, talent and infrastructure led growth, lack of early innovation in some ways resulted in an acquisition vs incubated growth.

In contrast, Jazz appears to be navigating through a personality-centric leadership approach. The company’s struggle to maintain a stable CEO for its Jazz Cash venture, with approximately four or five attempts falling short, potentially points to deeper issues within its corporate hierarchy. Organizations that operate on a ‘cult of personality’ or through an atmosphere of looking to the parent co and thus compliance are often at a disadvantage. Such environments can stifle innovation and deter talented individuals who may not align with the overarching leadership ideology. But some may argue, in a developing market you need strong leaders, and Jazz has certainly by way of its decade long position proven that they are doing it right. There is a method to the madness for sure. I for one think that effective leadership is what got them here, they have just been unlucky in the Jazz Cash business. The question is, do they take those lessons and evolve fast enough? Especially since there is no EasyPaisa in the PTCL-Telenor deal. Or does this now create two battlefronts for Jazz, one in the telco space and one in the financial services one? What if there there was a possibility that PTCL will also acquire Telenor Bank/easyPaisa in which case the JazzCash advantage will be muted.

The importance of leadership in shaping corporate destiny cannot be overstated. Companies that embrace a collaborative and inclusive leadership style tend to exhibit greater adaptability and innovation. PTCL’s ability to grow and retain its B2B Leadership that has not only delivered results but also cultivated a team-oriented culture could give it an edge over Jazz. This leadership model is conducive to nurturing a fertile ground for new ideas and initiatives, which are critical in the rapidly shifting telecom landscape. But its too early to make a call who wins.

Jazz, with the leadership tier seemingly ensconced in longstanding roles, may lack the agility that comes from a more fluid exchange of ideas and leadership styles. The top-down approach, may hinder the company’s ability to effectively respond to market changes and internal challenges.

The case of Jazz Cash is illustrative of the pitfalls of a non-inclusive leadership approach. A revolving door of CEOs (at Jazz Cash) suggests an inability to align with the vision of the parent company(Jazz), hinting at a discord between individual initiative and corporate direction. Such instability at the leadership level can cascade through the organization, eroding morale and hampering the company’s ability to execute a coherent strategic vision especially when you cant win the battle by deeper CapEx spend. The current market dynamics around regulatory policies don’t help either.

As PTCL quietly strengthens its position, backed by a leadership that is open to experimentation and ideation, Jazz’s leadership challenges could prove to be a significant Achilles’ heel. While the telecom giant is not without its strengths, its ability to evolve and adapt leadership structures will be critical in keeping pace with a competitor that is quietly outmaneuvering it not just in market share, but in corporate culture and innovation. (Some thing Id be hard pressed to admit a few years back about PTCL)

This juxtaposition of leadership models underscores a broader narrative in business: companies that cultivate a dynamic and inclusive leadership ethos are better positioned to thrive amidst market upheavals. For Jazz and PTCL, the battle for telecom supremacy in Pakistan may well be won or lost not just in boardrooms and balance sheets but in the less tangible, yet equally critical, realm of leadership philosophy and practice. I would not discount Jazz’s ability to use it as a strength and surprise every one.

Heres to the better company & leadership dominating the space and for consumers to win in the end.

#PakistanStrong