These days its seems like not a day goes by and some one or the other publishes a picture, a leaked story, an input a whisper about Alibaba talking to some one in the country. That in it self is fantastic and super exciting. The choices for Ali Baba are literally unlimited in what they do and I have no magic ball to foretell the future. But the implications for Pakistan will either be really good or really bad.

Lets list the public rumors in place over the past week or so.

- Alibabas Ant Financial services to acquire stake in Telenor Bank in Pakistan.

- TCS putting out pictures of Alibabas visits to Pakistan

- Daraz not being far behind saying again some one is buying them, this has been on going since a few months after they came in to being

Lets evaluate the Telenor news first, minus the percentage stakes being discussed at this stage that’s immaterial to any one unless you are a shareholder, given you are not, lets focus away from the noise.

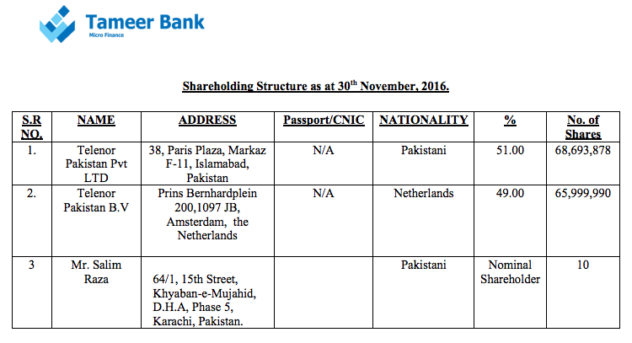

So if Alibaba does buy out the stake say at 40%, what happens? Look at the shareholding structure above. Whilst the news it self will be great for Pakistan(consumer confidence etc). Just my sense is, the monies wont land here post acquisition the B.V/Dutch Hold Co will probably partake in that transaction. The company is setup for tax optimization and there is nothing wrong with that either, all businesses are setup to maximize shareholder value, there should be no apology expected from Telenor for watching out for their shareholder interest.

So all this celebration of Ant Financial coming to town, could be misguided, as it may not really have any short term benefit unless the government mandates domestic injection, then it’s a different story, given our Chinese friendship that should be a baseline ask. I neither know any info nor do I want to speculate, I am analyzing the data and facts available in the public domain.

What no one is talking about what Alibaba’s entry to Pakistan will mean for digital marketing and advertising and the potential blow it will deal to OLX, Daraz, Classifieds online and offline and Ad-Networks like FB Audience Network and Google ADX.

You are probably wondering what the sale of shares in a Microfinance Bank has to do with advertising? You cant be blamed for wondering, its simple, some thing you have never heard of, but it is a rising tiger in the world of advertising to rival Google and FB, Its called Alimama .

Launched in November 2007, Alimama (www.alimama.com) is an online marketing technology platform that offers sellers on Alibaba Group’s marketplaces online marketing services. Now that is the real Crouching Tiger, Hidden Dragon that will come to town when/if Alibaba comes here.

Coming back to our friends at Google and FB, they don’t have an office here, they don’t have a presence, the bulk of their advertising revenue are generated through product advertising, FMCGS, CPGS, Brands, Product Pushers. The success of FB viz a vi the advertising agencies they work with, is lukewarm at best, both companies have struggled to keep the conversations ongoing with counterparts in the country. Google has been more serious with boots on the ground, FB is still enjoying the consumer play of people using credit cards to buy ads.

But where is the real commitment to operate in Pakistan a market of over 200M consumers? Perhaps we shouldn’t blame them, has any one from Government really gone to FB beyond data requests and to Google beyond resetting passwords for accounts and offered them a real stake on the ground in the country from location to access to talent to tax breaks to legal protection? If not then we will continue to wait for them to show up at our door step where as other markets that welcome them will prosper.

Look at this example from Amazon, shopping for a city to bid for amazon to come to it to build a second head quarter. That’s what government commitment is and should be if you want to attract the best.

Given what Google has done in healthcare alone, for a country like Pakistan where Chikungunya and others abound our government should be bending over backwards to invite Verily to de-bug our cities and towns if it is not interested in the digital play, the human life play should matter.

Lets look at what will happen, when Alibaba in any form comes to Pakistan, they aren’t going to just sit idle and away from the Marketplace business which is their core. When that comes, so will Alimama, that will wipe off the entire value from product listings and classifieds businesses and thus wipe major value of AD Exchanges but wait, there is more, none of this will happen tomorrow. Some specialized verticals may continue to operate but it will be only a matter of time till they also become irrelevant or be bought out in the process.

Google and FB have to take notice(More FB than Google). That is a fairly tough ask when Google is rightfully busy in the region with India, their interests aligned with launching payment tech (Tez) and their Next Billion obsession. FB on the other hand lacks even the commitment to operate out of market, they roll up from SG to UAE, where the hummus isn’t playing the unifier role it should between the German-Venezuelan + Pakistani mix . The UAE based leadership team responsible for PK has probably come here less than a dozen times. Credit where its due, Google guys are practically here every other week.

If FB , had they not put partnership folks and not just hired entry level talent from this country, would eat away at least 30% of other Ad Networks existing business and probably increase their pie by an other 80%, all they had to do was pay attention, there is still time if the interest level changes. Data is great, but context is the killer, it feels strange to be preaching context to Facebook.

Even beyond FB , WhatsApp related growth could potentially outpace all other business related growth in the months and years to come, no less for that you need to come to Pakistan beyond conferences and meet real businesses and hire customer advocates that have some real experience beyond trips to incubators, it has no real material output for Pakistanis beyond photo ops. Its time for the industry to grow up. Besides pretend to be grown up and promoting self recognition.

Google is in a far better position, but I fear all their market education that had the best of intent will be ridden out by Alibaba in weeks, months and years to come. Their(Google’s) teams have really done a stellar job to educate the market. Fb is trying hard, they had a better value proposition, its easier to market on FB. Every one uses FB no new account is needed to market, any kid can do it all you need is a credit card ( what happens when the central bank decides that it is no longer cool to loose out 45m$ in FX via card or third party transaction. Invoicing becomes key.) Hence the conversation is much easier from FBs perspective with marketers; the results on the other hand are debatable as are the conversions.

The market is missing a unified sales platform and payments, when both of those arrive, any guesses as to what will happen?

This brings me to TCS/YAYVO, from a Pakistani standpoint that deal makes the most sense for the exchequer, but from a value perspective Alibaba gets more out of buying TCS for logistics and fulfillment than it does to buy Yayvo for e-commerce. (Even if it paid 3/4x Revenues it would be a sweetheart deal)

Neither the TCS Ecommerce brand nor the way the operations are structured offer any thing that 2M$ cant replicate in 6 months. That is all it takes. TCS should be courting Alibaba to offload equity in the overall entity, e-commerce is some thing they should throw in for free. Make no mistake, Alibaba is already Pakistan’s largest e-commerce player by volume, you ask how? AliExpress.

Once FTA between China and Pakistan is sorted out, none of these brands will matter every one already knows Aliexpress, at least they get their products on time. The logistics game is a serious deal, check this out Amazon building an airline/Distro hub.

In the mean while if Alibaba wants to buy some thing to just try out and experiment, its not a bad deal to get Yayvo too. But by way of technology and talent, there is no real value to be driven from Alibaba’s perspective in buying Yayvo. Every other week, some Investment banker, market broker or some one is pitching the Yayvo deal, that is an indicator that they have run out of growth capital. Any plans of grandeur they may have had are actually on hold from the looks of things. Their SKU base is stagnant. Their systems are a mis mash, the sites performance are basic at best. So this is not going to be a tech buy for Alibaba an accu-hire for mid level talent yes for sure.

Which brings us to Daraz, perhaps Alibaba should do real due diligence there. Its simple, buy 5 products a day for a month and deliver to 5 cities a day, figure out the fulfillment ratios vs order placement and go from there. In developing markets that a better test than looking at a PowerPoint deck prepared by some one else.

Daraz will be a multi country Rocket Internet deal involving Alibaba so where-in other markets Rocket may have inherent business or operations value, in Pakistan : besides burning cash on brand building, iffy customer experiences, multiple management team exits and struggling market place/drop shipper experiments they have been consistently underwhelming consumers.

A cursory glance at FB posts or comments on paid adverts in local publications will tell part of the story. Its not easy being the first here. Just cant blame them alone, they have done more for market making than any one locally has. User sentiment abound. I am sure some one as sophisticated as Alibaba would try to get a discount on the offer given the customer toxicity. No one does “one day sales” better than Alibaba and its singles day, just apply that metric to compute GMV and if all holds true, perhaps Daraz really has value beyond what meets the eye.

Daraz is a foreign owned venture, if Alibaba does acquire Daraz / or its parent co, that money wont see the light of day in Pakistan. Again not a great deal for Pakistan or Pakistanis, the value of the transaction will unlock offshore most likely. Long term e-commerce will come, but short term No cigar.

All these factors to one side, a real funded player in any one of these 3 domains comes to town, it will be good news long term. So heres to hoping that we at least get a true payments play first, every thing else will find its way on its own once that happens.

Great article! How come you did not factor in Pakistan Post as a very juicy candidate for Alibaba to acquire. Could be a big “privatization” play – bringing immediate and significant liquidity into the country?

Already used by AliExpress for last mile delivery locally.

Interesting analysis.

– Noticed Salim Raza as the 3rd shareholder of Telenor holding 10 shares. Wonder what his role was.

– Alimama sounded like a parody of Alibaba! Though it doesn’t seem like they have international aspirations. Because they didn’t translate their website in english. Looks like its only meant to be for a chinese audience.

– Also will Alimama actually effect OLX? The rise of FB Audience network didnt effect eBay. Facebook he social network and Amazon killed ebay. So more like Aliexpress’s Pakistan version (or daraz if they buy it) will dampen OLX – which isnt doing great to begin with.

– Tez looks like the future of peer payments. Google is being late to the party these days. Payments, devices, AR, VR, etc. They always start early but never focus on making it big and are left behind.

– You talked about payment systems – but not sure why Alibaba’s Alipay wasnt mentioned. It could give a run to simsim (growing way too slow) and the banking industry in general.

A nominee shareholder is just that:) Plus ex-Central Bank credentials never hurt.

Also dont discount the lack of english support as lack of global ambitions:) Alimama is here to stay and grow.

Jury is out on what alimama and alibaba will do to market places, my read is, not good for business due to a host of reasons. Principally the lack of cash to compete with AB.

Google is google and they decide the things they want to play in:) With this much free cash float, they can decide to get in the business of freezing ice and being the best at it and probably make a global impact:)

Antfinancial is the new name for Ali pay. Those are the guys looking to buy Telenors banking ambitions:) per Telenor obviously.

So many people have had their eye on Pakistan Post, you are on the money Ali Baba is going to try and get in on that action, but its caught up in a lot of regulatory mess because it is also a deposit taking institution. They have from news on the street gone after that option also but given the turmoil in government really have not gotten a response.