The writing is on the wall. We just got bail out funds from Xi, its not a bad thing. Who else would underwrite the plundering of all our combined leadership or the lack thereof.

“China comes with a lot of money and says you can borrow this money,” Dr. Mahathir said in an interview before the vote in Malaysia. “But you must think, ‘How do I repay?’ Some countries see only the project and not the payment part of it. That’s how they lose chunks of their country. We don’t want that.”

There are 170 million surveillance cameras in China. By 2020, the country hopes to have 570 million — that’s nearly one camera for every two citizens. This should be an eye opener for the Pakistani government and the powers be. Do we think that some one investing this much money will not safeguard their interest? Actually they will get a first mover advantage by way of access to the new digital currency, data on you and me.

At the same time, China is a building a national database that will recognize any citizen within three seconds. Though that system probably won’t be unveiled for a number of years, facial recognition is widespread in China as a single google search will demonstrate.

Thanks to a large sample population and lax privacy laws, police and private companies have led the way in developing surveillance technology that is now being used to track travel, shopping, crime, and even toilet paper usage. While the West is engrossed in GDPR and debates on the ethics of AI, China already has production grade citizen surveillance deployed.

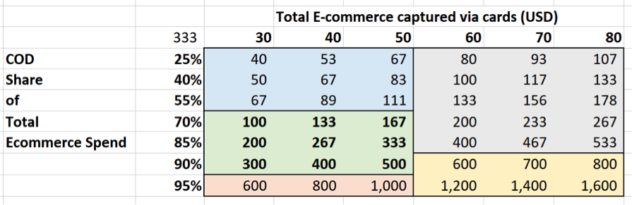

So we already have Ali Baba in town, we have Ant Financial and we have TenCent on the heels of both these companies making a market entry. So what does this really mean? Given we do not have any capacity locally to capture, house, store, manipulate, process, analyze and transmit any size-able capacity of Data, with the arrival of all the Chinese centric companies all our data is bound to be kept in the cloud, offshore in the safe custody of China.

I haven’t seen any privacy stipulations yet around data security, management and storage for Pakistani Citizen data as these companies get access to oodles of citizen data, transactions, internet usage, shopping habits, financial habits and abilities. In short, we are sitting ducks, the currency of the future is not going to be Bitcoin for the Pakistani ecosystem but it will be the access to last mile citizen data from every corner of the country. (Eat your heart out Google and FB)

We need to have a data privacy guideline that are enforced unilaterally else, as the dream of financial inclusion becomes a reality and as the Chinese companies come to shop in Pakistan for under valued deals, they will laugh all the way to the bank.

They would have done what Google and Facebook only dream of doing, getting last mile data or online to offline attribution. That is valuable stuff and we must protect both the rights of the citizens and the economic interests of domestic players by not co-opting all our future digital currency without any thought-out legislation in place.

Key Privacy Facts

1. Constitutional privacy protections: Article 14(1) of the Constitution of the Islamic Republic of Pakistan states that “[t]he dignity of man and, subject to law, the privacy of home, shall be inviolable.”

2. Data protection laws: Pakistan does not at present have direct data protection legislation.

3. Data protection agency: Pakistan does not at present have a data protection authority.

4. Recent scandals: Interception across Pakistani networks is pervasive; some of it is also unlawful, according to investigative and media reports.

5. ID regime: Pakistan has one of the world’s most extensive citizen registration regimes. This is run by the National Database & Registration Authority (NADRA)

The above is a Molotov cocktail waiting to combust on contact.

To share perspective that this is not some Pipe dream, Alibaba has developed its own systems that will soon be used in Shanghai’s metro to identify commuters via their face and voice.( Paranoid much?)

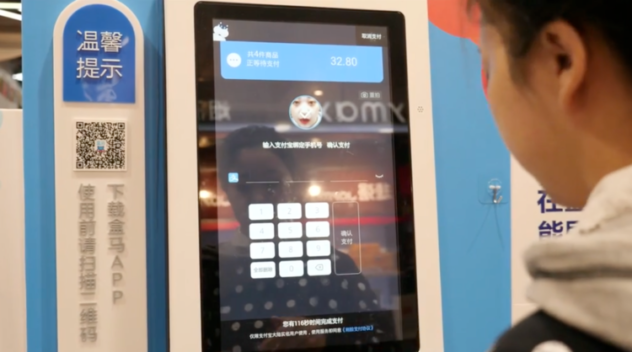

Alibaba also has a chain of cashless stores called Hema.(See Image Below)

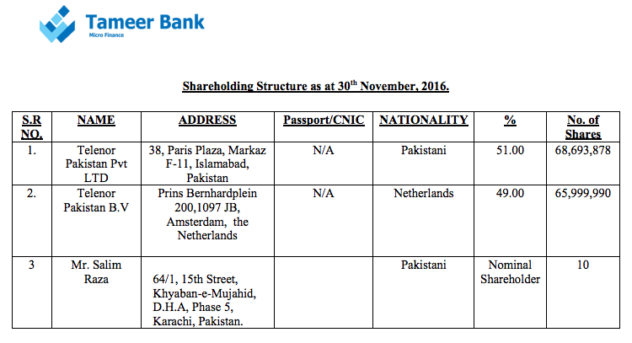

Shoppers use their face and phone number to approve payments from their Alipay account. (Ant didnt buy a bank to streamline their core-baking or to retrofit the bank in a top ten micro finance bank, they were acquired to get entry in to the space, then build scoring models to flush the market with inexpensive credit(which btw typically is very positive for financial inclusion).

The other side of this equation is pattern development and score attribution based off existing usage patters of patrons, their sms or phone usage data, without any opt-ins or without any domestically built technology or housed data.

What happens in the future, would be pure speculation, but to ensure transparency and protection of citizen data we must ensure data management and privacy laws are enacted, beyond the central banks guidance on storing data locally and to encompass future integration with NADRA data and to set out clear privacy guidelines before hand.

The above two are already at play. It only grows more interesting as other Chinese and global players show up at our doorstep with little to no regulation in place. This is opening hunting season for any one with a little bit of structured capital to get in to this space and get generational advantage of citizen information.

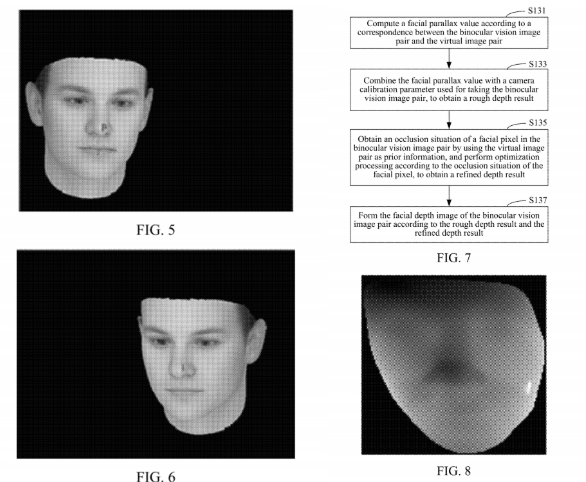

Tecent is one of the top applicants of facial recognition patents in China.

Below is a Tencent patent on a 3-dimensional human facial recognition method and system.

This is in line with the efforts of Tencent’s YouTu Lab, which provides image and facial recognition tech support to over 50 Tencent initiatives, like its social networking platform Qzone and image processing utility software Pitu.

Take a deep breath thats 50 things they are doing with image processing data alone, imagine the co-relation tables they are building and the amount of raw data being captured. If they implement a 1/3 of this when they come to town, the first and basic question to ask is Where will this data be housed? Will govt have access to its use? Will other domestic 3rd parties be allowed to build rails in to it? Will it be open for use? Whats the national policy on this? Does any one even understand the implication of what this means.

Tencent recently open sourced YouTu to other developers. YouTu technology is also accessible to users via WeChat apps, spurring concerns that this could kill smaller image recognition startups. Now we come to the other side of the equation, with all this tech, raw horse power coming in, will there be a national policy to get Pakistani citizens involved in the use/development and scaling of these platforms as a national security interest, just like we treat NADRA. Because the implications of this much data at scale will be much more profound . NADRA is just a building block enabler(that too the best kind) to come in and plug in all this AI/Facial Recognition etc on top of and build customized scores on citizens and their actions.

With all this computer vision, pattern recognition, machine learning, data mining, deep learning and audio analysis coming to our shores, who will police all this?

China already has social credit in place, where by citizens for various behaviors have been denied flights, or train rides etc, because now “the system” is tracking them and rewarding/punishing them based on their social behavior. We aren’t too far away from that reality domestically. Btw this has less to do with China and more to do with local policy and structuring items for our self interest. Great technology coming in; is good for all, managing it and ensuring there are laws to govern its use, is on us.

TenCent is already working with clients like China Unicom and WeBank for facial id authentication. (Note: Tencent is also a major shareholder in WeBank.) Yea so they own a bank too, no surprise there, The rumor mill puts them on the heels of Ant financial to acquire a license/micro finance bank , they typically go after the number 2 players in most operating geographies if they are late to the party.

So paishgey Eid Mubarak to “Laal Duppaty wala” carrier and their Maybe cash. Its a solid will be at the moment when DasPaisa (TenCent) pvt ltd comes to town.

In addition to the above applications, at least three provinces in China have announced they’re issuing electronic identification cards for their citizens using WeChat or Alipay’s facial recognition technology. So imagine the scenario where there is integration of all this tech into NADRA. It does wonders to bring social services and lending and identification and management of bad guys. But it opens up a pandoras box of sh*t we dont know and that we are not equipped to manage. We dont have enough data folks and policy folks and watchdogs bodies to administer the use of this tech.

The mobile IDs can be used for authentication instead of carrying physical ID cards – mandatory for citizens at all times in China – for travel booking, real name registration at internet cafés, and other security checks. Plus tracking?

Insofar as my research allows, theres no opt out from this, you cant tell the state to not track you. This tech will have other serious and crazy implications once it arrives on our shores, from tracking of all kinds of PMR(political, military, religious) activities and players.

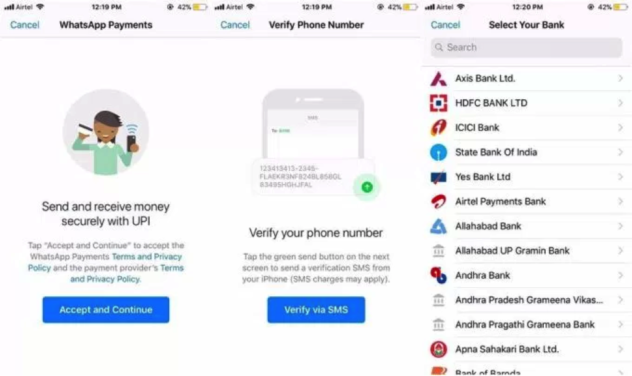

Google and Facebook are sitting pretty while all this is happening, their next billion dreams are likely to be managed by all this Chinese competition coming to town, because without a registered entity in Pakistan, unlike the Chinese they have Zero mind share in the local space when it comes to Online to Offline attribution.

Also without a Payments play (at-least for now) they are squarely going through FOMO at the moment and soon enough they will be blaming their policy teams for being too slow on their feet to understand the market opportunity in town. The only strategic advantage the FB/Google have is to take some pray and spray capital and start seeding investment in local fintechs and doing partnerships with banks and the logistics and ride hailing players who are trying to build their own rails. Local fintechs/banks also have a long way to go, so I wouldn’t blame Google and FB to be hesitant to partner up, also both lack a singular focus on Pakistan as a market because both in their own ways and rightfully so are looking at solving the India next billion items first. Who can blame them they have amazing government traction and they have been welcomed with open arms.

FB and Google continue to be caught up in small bullshit items of tax related matters in a country that has 200+M opportunities to offer. Some times the logic in that escapes me, worse off, the Pakistani origin folks at both and other silicon valley companies continue to be apologetic towards the issue of taxation. I say grow a pair and ask your bosses to read some of these articles or others & stop sugar coating this stuff as the governments fault. That boat has sailed, be ready for the now, if you have any serious Pakistani tech aspirational targets.

WTF? Both of these companies can surely settle the tax mans bill, its an easy one, they need to recognize that they had a good 10 year tax free run, as inconsequential as it may have been, it was free money at the cost of the exchequer, if they stand any chance against the Chinese they need to get past soliciting advice from their ” country sales teams” who they are setting up for failure.

I say that because if their day job is sales and the ask is to be involved in national level strategic plays or the identification of maters as diverse as tax, market scanning or M&A opportunities, surely with billions in the bank these companies can not be making such rookie mistakes. There is some serious strategic mis alignment. This has opened up the space for the Chinese companies to come in droves to Pakistan and will continue to do so, because they have a seat at the table given they are present physically and serious about doing business. If managed properly with data privacy regimes in place, dont get me wrong, this is the best thing since sliced bread. But if its let to spiral without any adult supervision, soon we are the ones that are going to be supervised.

I sincerely hope the incoming government and policy makers bring-in; change makers who can understand the dynamics at play and instead of still being stuck in the era of PSEB and PTA they move the fu*k on. Having folks who have never written a line of code trying to decide the future of our generations to come is going to be unfortunate at best and disastrous at worst.

This “Sahab” bullshit has gone on for too long and its time to unilaterally vote in public servants who serve at the pleasure of the tax payers and not serve at their own pleasure at cost of the tax payers. Some one needs to engage with all global players unilaterally and get the ball rolling, we are already late to the tech party in many ways so we need to get the data protection rails in place as we look East and West for partners.

Sometimes we stare so long at a door that is closing that we see too late the one that is open.

Alexander Graham Bell