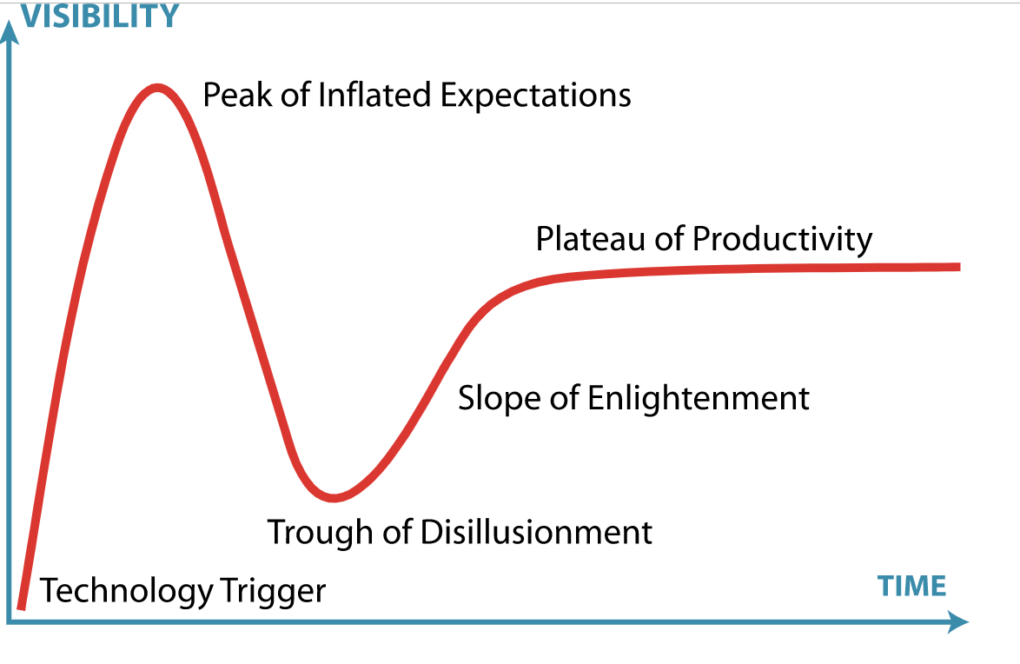

We are going through a major hype cycle. If you are not familiar with what the hype cycle is heres a representation to quickly come up to speed.

In the absence of a real technology trigger, but just people talking about technology things; we have built up expectations on the domestic front of being a near a technical revolution that will fix and or repair the state of the nation. Whilst technology can help and change the dynamics of a host of things, talking about technology really wont. There is a lot that must change but just talking about change wont do any thing positive in the short term, it may lead to select individuals doing select things to achieve select goals, but at a whole sale level not much will change.

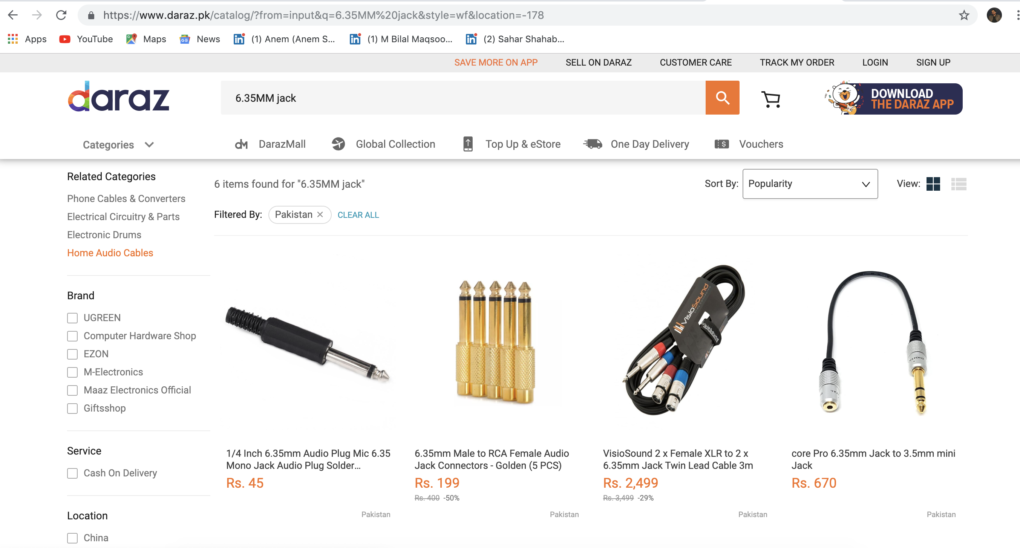

Lets start with e-commerce, the expectation was that as the Chinese come in, viz a vi their investment in Daraz, there will be in an overnight revolution. The revolution in my mind was the fact that there was a real exit of sorts and it did create buzz but since this was announced in May 2018, various pundits claimed the retail sector would be re-imagined, local industry would finally see the real potential given Ali Babas global scale and experience with all things tech, payments and e-commerce. As always we tend to celebrate early. In the time that has since passed the only visible item I see as a consumer is that service levels have not increased, product listings across the e-commerce sphere remain stagnant across the board and as any basic level of social media search shows the general dis-content of the online consumer on customer service. Cash is still king, no one has figured out a real use case for Wallets, if HBL/Meezan/Jazz/Telenor et all discounting were to end, some would argue there is no real benefit to the consumer either to shop online at least in KLI(Tier one markets). More alarming is the fact, that was perceived to be a win for Pakistani Businesses and Pakistani Consumers, seems like a net net win for every one else but Pakistanis. Simply if you look at the case of the Ali Baba acquisition, whilst part of the FDI may have come into PK on the transaction, what about the FDI that leaves the country daily on the same platform? that was touted to be a saviour for Pakistan and Pakistanis. The usual disclaimers apply, these exercises are not witch hunting exercises, especially in a global world and in a country that imports net net, this should not come as a surprise. But I searched for a 6.35mm Audio Jack. Total listings 362, Slight Catch though. See the Images below to see if you can spot it?

So Only 6 Items are being shipped or available from Pakistan, 356 from, you guessed it China. So is this e-commerce panacea and progress every one wants/wanted or is this merely an FX drain? Much like the many drains on AD Expense dollars etc that Ive written about in the Past. Whats the check and Balance on this cross border FX loss. The thing is, its not just one brand or entity doing this, there are dozens of Amazon drop ship operations happening in Pakistan and locally operated Chinese e-commerce players. Not to mention AliExpress it self ships to Pakistan using China Post and Pakistan Post. Who is regulating the FX component of these transactions and the many mushrooming local trading enterprises that are bringing in near commercial quantities avoiding most duties/taxes but depleting FX.

Who if any one is responsible for the customs duties on these items + the FX leakage on credit cards etc? Does any one see the irony in the so called e-commerce and digital revolution? Who is really benefiting from this? Before you jump in and say well these Ali Babas of the world create(d) employment in Pakistan , But does that employment off set the FX Losses we continue to get? Again no sense in blaming the channel, but rather the inefficient process of the institutions that have set out to regulate, they are actually stifling domestic e-commerce growth and growth at large without putting in pertinent clauses to manage around these advantageous tactics being used by the players in the market.

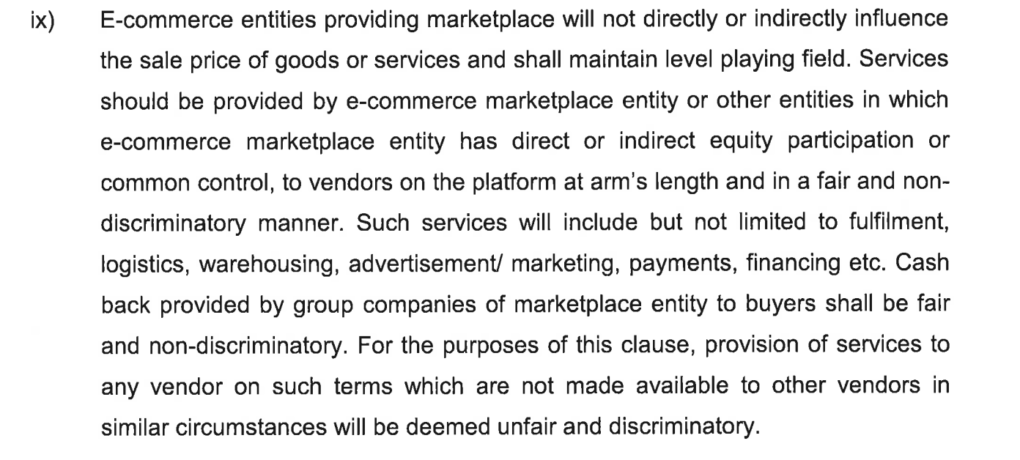

Dont have to look too far to evaluate what productive regulation looks like “On Feb. 01, the Indian government implemented several restrictive changes (pdf) to India’s FDI policy for e-commerce. The new rules state that online marketplaces can no longer enter into exclusive deals for selling products on their platforms nor can they have a single vendor supply more than a quarter of the inventory. The government also restricted marketplaces from influencing prices in a bid to curb deep discounting. It also forbade the marketplace for forcing vendors to use its own warehousing and logistics, payments financing etc.”

The smart move was to let the FDI come in via investments from Amazon (4b$) WallMart 15$Bn and then give the domestic brick and mortar retailers a chance to play fairly in the e-com space without discounts and venture money as the only value add.

In this new world, data is the new oil. And data is the new wealth. Anil Ambanis view has been that in India’s data must be controlled and owned by Indian people and not by corporates and most particularly not global corporates who have direct insights into online user behaviour. Clearly across the pond the regulators seem to agree. I had raised similar concerns earlier in an article around data being the new currency.

Sadly we continue to measure vanity metrics a reflection of which is evident in the current economic growth numbers. Its not e-com alone, lets look at Fintech, half the folks talking about or dispensing advice on the subject work at large scale Banks, most of which have been fined in the recent past for various KYC/AML issues globally, or have been hacked. Do we really want to, or are in any capacity to trust the same brands/institutions? I have written extensively about the fault lines and both the technical inability of the switch companies and their Incestual relationship with the Banks. Sprinkle in the regulatory teams at the Bank that are near retirement, who do not want to take any “un safe” actions 2-3 yrs before retirement, we are consistently at the mercy of self interest and the average consumer continues to get F**D. This has more to do with the political environment and the NAB related items, no public servant wants to serve time by doing shit that they know nothing about 3 yrs before retirement. Can we blame them? The relationship and attitude in the Halls of the regulator are extremely odd, I have worked with regulators globally, ours are way more special. Most have the right idea, but are not equipped to dispense justice to the cause. Thus there is a stalemate. There is virtually nothing been done to enhance SME growth. Yet the government continues to chime about helping just that sector.

Last-mile is an other flavour of the month of the Hype cycle crowd. There are many many contenders in the space and many more will come. The ones aligned with the hype cycle are the VC/Angel funded ventures that are not concerned with the bottom line but focused on customer acquisition ala Amazon style model, where over time your scale allows you to dominate. The other end of this spectrum are traditional players who will continue to thrive, because they grow organically and long after the VC money is gone. Purely because there is a growing population and increasing demand around logistics at large. But there is a hybrid model for the taking if you can effectively figure out mobile money and tie brick and mortal to last mile. Sky is the limit, in tier 2, 3 cities there is a much larger demand that can be opened up if the stars align on this. Tier one cities are still easier, the real enablement happens when you cover the smaller cities. But smaller city activation really doesn’t much to the valuation multiples, so typically overlooked.

If you have staying power today the real space to play in is a combination that will benefit from the economic value that the CPEC will create. Depends on who you ask and where you look. Domestic players have a once in a life time chance to scale businesses to meet existing demand in virtually all retail sectors by adapting technology minus the hype and by trying to create domestics multi party alliances to keep the competition in check. The only catalyst required is effective policymaking, when that happens the hype cycle will start to break and we may uncover real value.

Just like we only tax the salaried class in this country and refuse to grow the pie, we see similar items happening in relation to people movement. Last year we had about 7M domestic Air travellers and about 15m International travellers. Indonesia did roughly 34M international travellers. By the same measure look at the maturity of their online space, real fintech companies, real tech companies and real unicorns(ride hailing etc). Many similarities in population numbers and general make up, but they have completely outdone us because of having a progressive government and progressive IT Minister who understands the value of real growth vs hype. They have allocated tax $ to growing their eco system, our tax $ go into ill planned Incubation etc with out any directionality, that select on most occasions pre existing companies, white wash them, re launch them to essentially win the Incubator race that no one really cares about.What state money should be spent on is to make the ease of doing business and run road shows to invite VCs to town as opposed to taking tax payer money to attend “meetings” overseas. Had they been producing unicorns i’d have sent them easy load to continue down that path. But besides photo ops nothing of value having come from their ill thought out initiatives, I really don’t see a continued use to funding them from my tax money. All this eco system talk makes sick to the core, it’s essentially for people to hold on to a govt funded subsidy. There is definitely a better use for all this money to really support the ecosystem if some one thought this through.

“You can hype a questionable product for a little while, but you’ll never build an enduring business.” Victor Kiam

The industry to celebrate entrepreneurship is bigger than entrepreneurship itself!