In Pakistan’s noisy tech streets freelancers doing midnight sprints around power cuts, startups scrimping to keep servers alive, founders flying to meet clients because local procurement rarely buys from them. The Pakistan Software Export Board (PSEB) sits like an institutional fossil.

Founded in the dial up era to “promote Pakistan’s IT industry,” it still evaluates success by trade show booths, registration counts and export leads. Meanwhile the real engines of growth, freelancers, small product startups, accelerators and diasporic networks, have powered the country’s leap into the global digital economy.

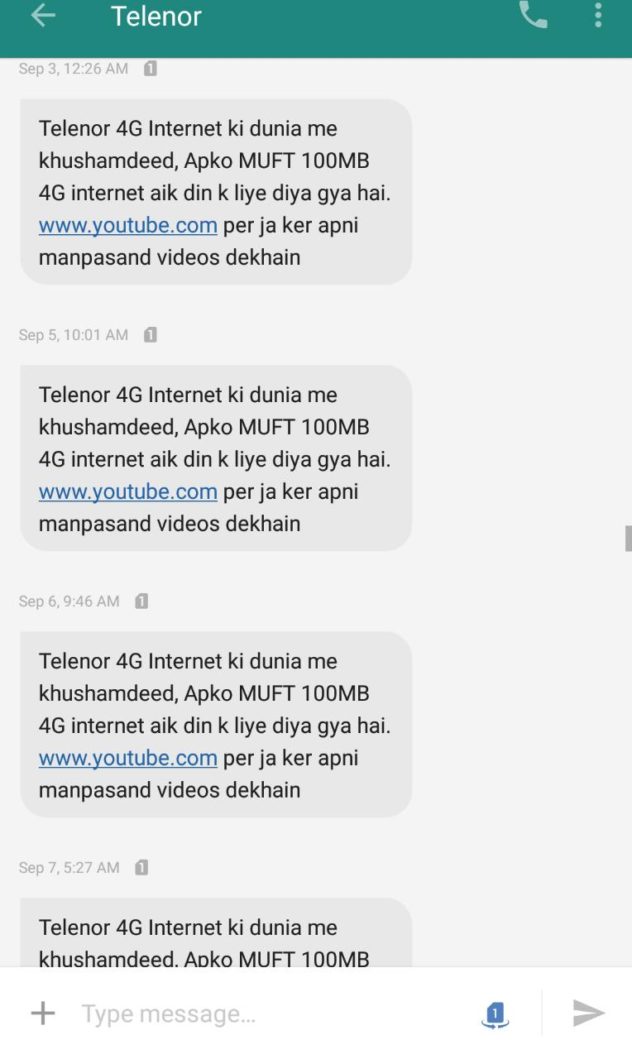

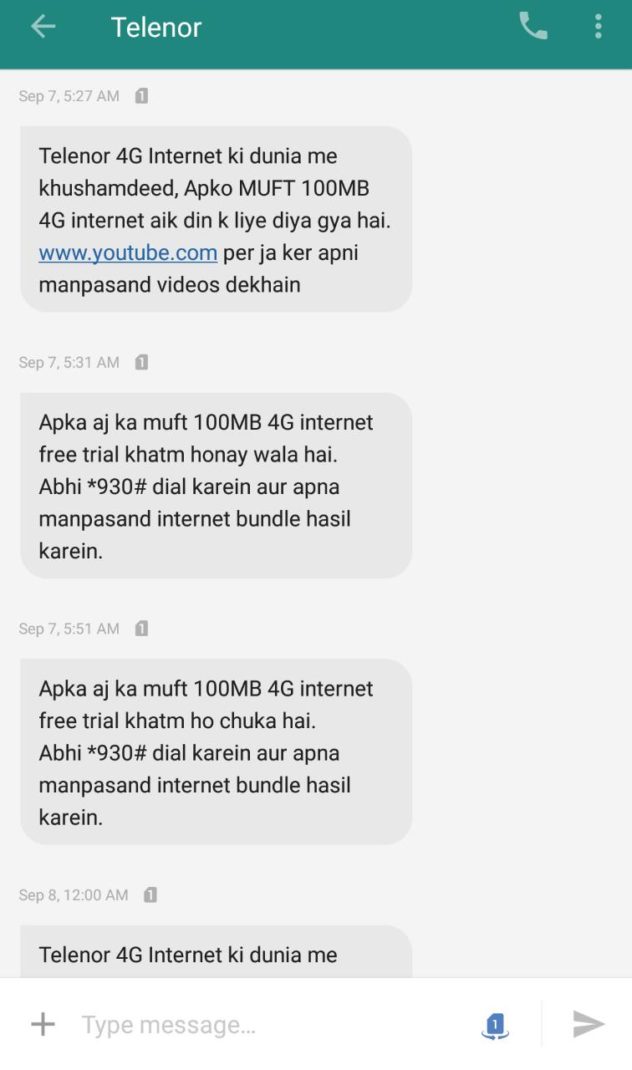

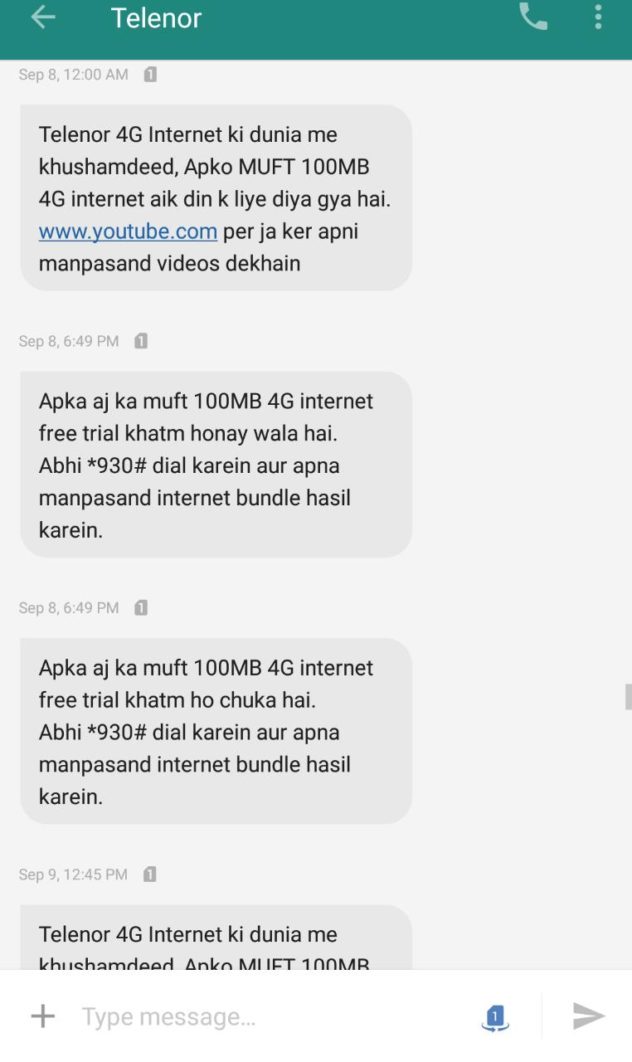

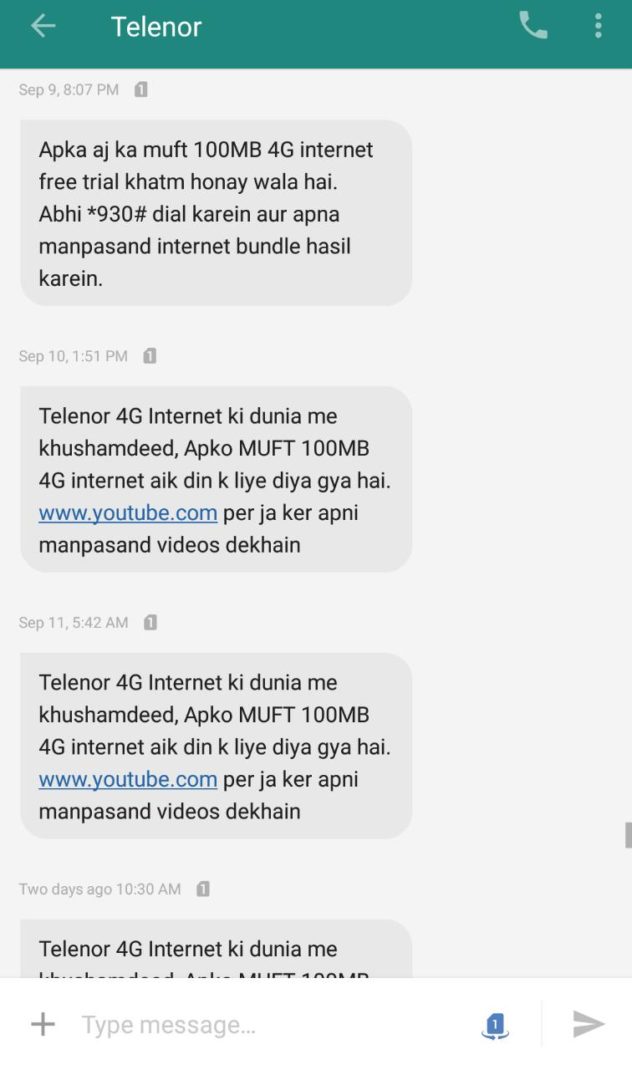

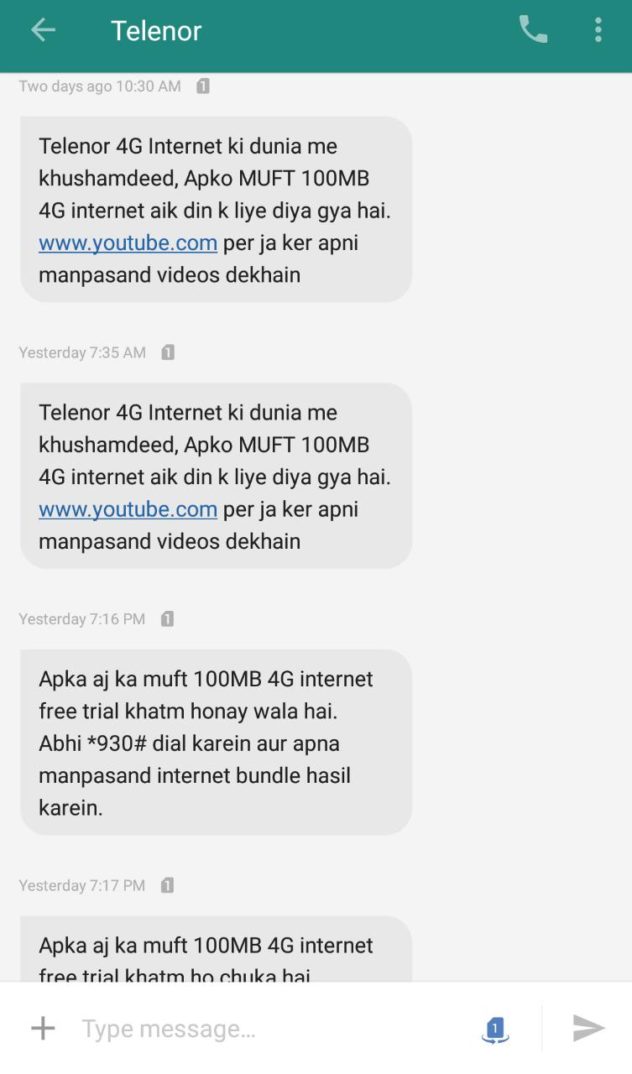

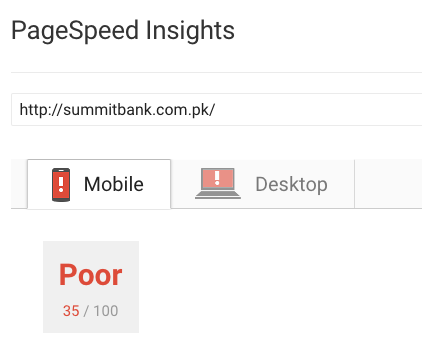

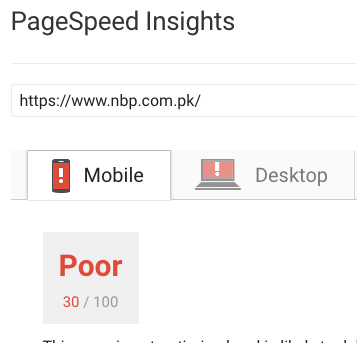

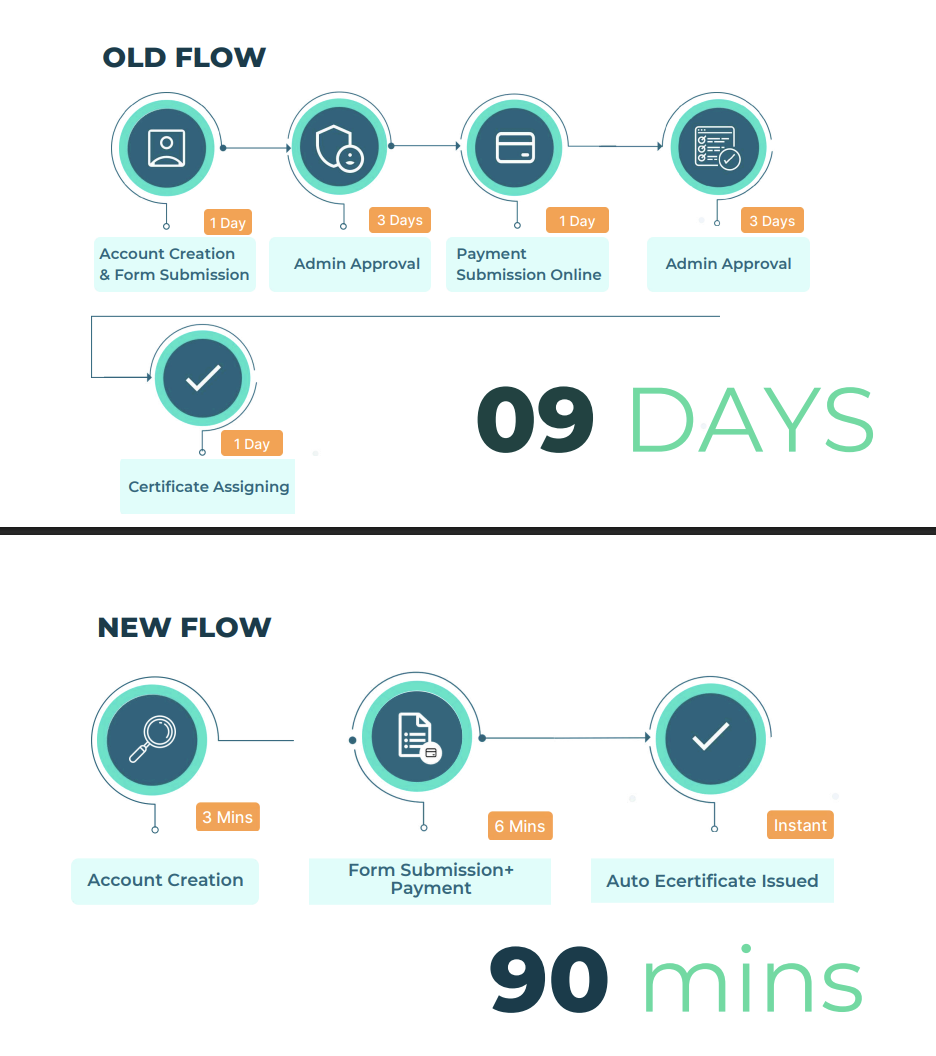

The PSEB in its current and recent past has had nothing to offer them besides being a circle jerk of ribbon cuttings and collaboration with local trade bodies and conference organizers to re hash the same “churan of key market indicators” a.k.a. how many young people we have, how many internet users we have, what our true potential is, ironically they have not affected the outcomes of any ones true potential, its happened in spite of the PSEB. Their annual report had the workflow of their websites , redesign. You cant make up this shit, a national level institution whose institutional publication has the following:

This isn’t nostalgia: it’s structural failure. The Board’s export first, promotion heavy model has become a mismatch for an AI century that rewards domestic productization, R&D, data access and platform level adoption. The evidence is public, recent, and damning.

Pakistan’s IT export boom has been powered mostly by private initiative, freelancers and provincial incubators not by the Board. Meanwhile oversight bodies and national strategy reviews have bluntly noted that PSEB is “underfunded and less effective than necessary.”

This is not conjecture, its being covered in print media here, on Oct 9the 2025, A meeting of the Public Accounts Committee (PAC) subcommittee on Wednesday reviewed audit objections related to the Pakistan Software Export Board (PSEB).

Speaking on the occasion, Senator Saleem Mandviwalla said the PSEB was “not performing well”.The PSEB officials said there was a need to appoint technical business development experts in Pakistani embassies abroad.

Mandviwalla maintained that such professionals were needed “in the market, not in embassies”. He further noted that most freelancers were keeping their earnings abroad.

Essentially its the same debate every single time. No fix in sight. But lets step back first.

Origins and evolution: a 1995 idea that never fully pivoted

PSEB was established in 1995 as a government owned, guarantee limited company with a mandate to promote exports, help build software parks, support marketing and attract investment sensible priorities for the mid 1990s IT playbook.

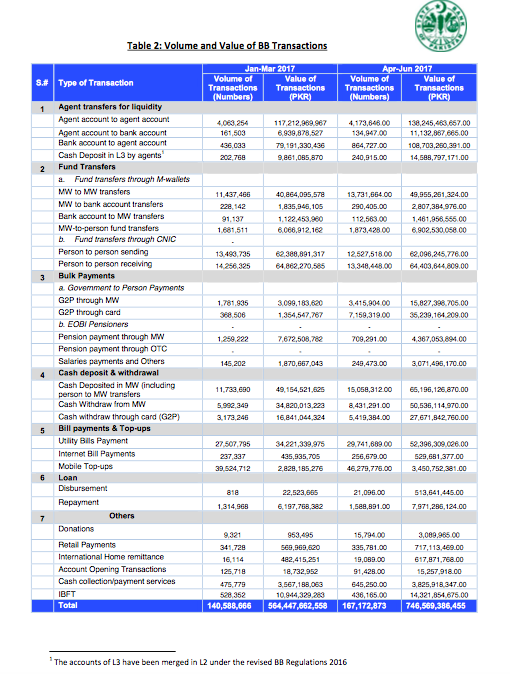

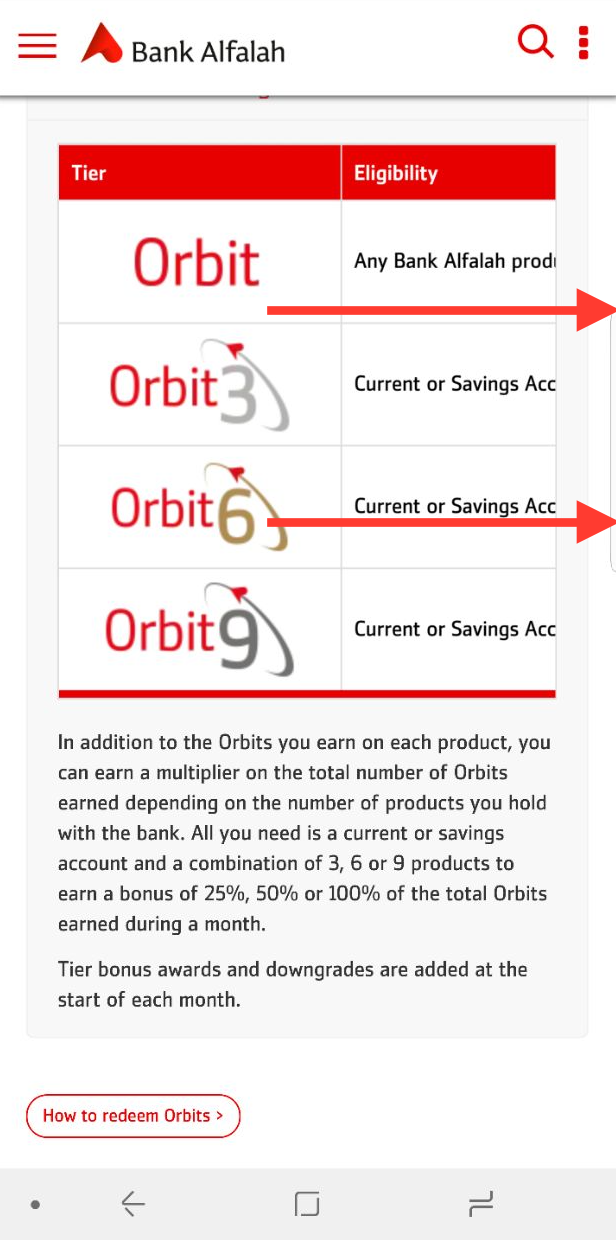

Over the decades the Board accumulated activity metrics it can publish: registered companies, call centre licenses, and lists of international events where Pakistan’s firms received participation subsidies. PSEB Annual Report (2024): registered companies, call centres, trade show participation details.

Those are tidy numbers for a brochure but they are not the same as audited, outcome oriented metrics (jobs created, startups scaled, patents, domestic pilots), which Pakistan needs if it is to compete in AI and platform based industries. The national URAAN plan and related reviews explicitly call for measures that go beyond export booth counting and urge scalable interventions in skills, R&D and domestic adoption. URAAN Pakistan: .

The inconvenient truth: growth happened in spite of the Board

Pakistan’s IT & ITeS exports reached a record $3.8 billion in FY2024–25 an 18% YoY rise that is rightly celebrated. Business Recorder: “Pakistan’s IT exports surge to all-time high of $3.8 billion in FY25” (Jul 18, 2025).

But who powered that rise? Freelancers, platform access, private product firms and incubators played outsized roles. Payoneer data shows Pakistani freelancers earned roughly $396.243 million in export revenue in FY2021–22 a material share of ICT export receipts generated outside the classic export house model. Payoneer: “Top 10 Freelancing Countries” (Payoneer freelancer revenue stat). This is not my data, this data is from a third party.

The official national review (URAAN) and parliamentary oversight both acknowledge the mismatch: public documents and hearings have noted that PSEB’s contribution is limited, and recommended broader institutional reforms focused on building domestic capacity for AI and deep tech.

The Board’s playbook: promotion, subsidies, registration and thin accountability

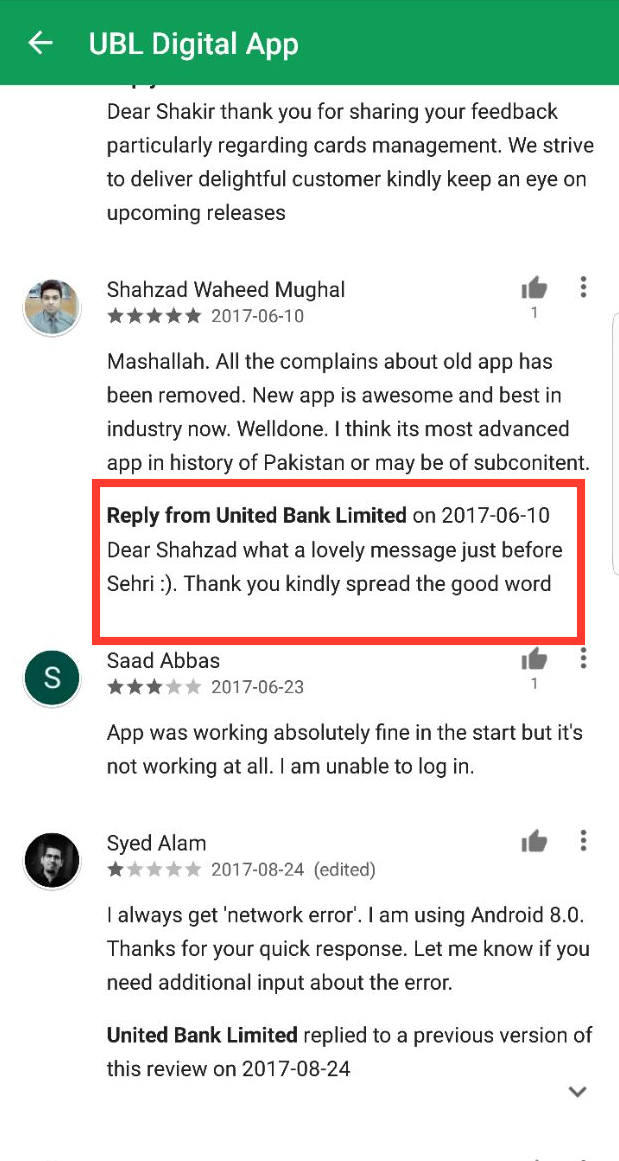

Open PSEB’s recent annual report and you’ll see glossy pages listing participation in international events, the number of “leads” generated, and the roster of registered IT firms everything you’d expect from an export promotion shop. + They paid for signage and billboards and took pictures of the said promotions and slapped it on their report. Made absolutely no contribution to industry growth, just some questionable marketing with crazy budgets.

But look for audited outcomes , sustained contracts won because of government matchmaking, domestic pilots that matured into exportable products, or measurable uplift in R&D output and the trail grows thin. URAAN and parliamentary reviews call for metrics that tie public spending to systemic outcomes rather than PR friendly tallies.

The Board’s subsidies , paying part of a booth cost at an international fair, or underwriting travel are easy to measure and easy to promote. They do not equate to building domestic cloud infrastructure, providing GPU access for AI teams, matching seed capital for deep tech startups, or reforming the tax and payments systems that freelancers and startups depend on. PSEB Annual Report: trade show subsidies & participation lists.

What peers did differently: ecosystem builders, not just export pushers

Export promotion was once a sensible starting point; the countries that have outpaced Pakistan on value capture moved beyond it.

• Bangladesh combined “Digital Bangladesh” with hi tech parks, e-government and mass skilling a program that explicitly targeted both exports and domestic digital adoption.

• Sri Lanka coordinates through an ICT agency and ties education, policy and market linkages; the ICT sector generated roughly $1.5 billion in foreign exchange in 2022 and employs a large skilled workforce, driven by more than 300 firms.

• Egypt turned ITIDA into an active industry development agency, coupling export promotion with R&D, startup support and CX seat growth Egypt’s digital exports were reported to have surged in recent years as part of a deliberate national push.

• The Philippines and Vietnam have consciously pivoted parts of their BPO/IT industries toward higher value services and domestic digital adoption, adding AI training, PPPs and cloud infrastructure programs to the classic export playbook.

The pattern is clear: agencies that now succeed in AI and advanced digital services are ecosystem builders they fund R&D, anchor domestic demand (procurement set asides), provide infra credits, and build clear talent pipelines.

Why the export only mindset fails in an AI era

- AI depends on domestic data, pilots and cloud/GPU access. Export booths and registration drives do not create anonymized government datasets, sandboxed procurement pilots, or national GPU pools, all of which fast track product innovation. (See URAAN’s emphasis on infrastructure and data as part of digital transformation.)

- Productization needs risk capital and matched public support. Seed grants, public co investment funds, R&D tax credits, and procurement channels that reward local suppliers are what scale product startups to Series A , not trade fair subsidies. URAAN and multiple industry voices recommend conditional public co investment and procurement reforms.

- Talent numbers alone don’t equal AI readiness. Graduates and coders are not the same as data engineers, MLOps practitioners, and model governance experts. National strategy documents and industry studies highlight a gap between graduate output and AI specific skills. Training at the Governor house in Sindh is not going to create dollarized leverage at scale. It does not work this way.

- Financial and regulatory plumbing matters. Freelancers routinely keep earnings abroad because payment rails, FX rules and tax complexity push them offshore that erodes formal revenues and prevents earnings from knitting into a domestic growth story. Nothing has been done for the last 2 years by policy makers. All changes come because of change it self.

The human story: talent flight and daily friction

Policy failures are personal. Engineers and founders live the consequence: missed payments, scrambling for foreign contracts, and a persistent sense that the state’s “support” means a camera friendly booth at an overseas show rather than contracts, infrastructure or capital.

PERSONAL ANECDOTE

This past summer, I reached out to senior leadership at the PSEB, offering to conduct free, on the ground sessions for gaming companies and studios, sharing proven ad tech industry monetization strategies. Essentially to give back and get registered members finally get some value. There was no commercial angle tied to this, I was going to be visiting, wanted to use their platform to share, amplify and help people make money, this was a forum as good as any.

Email 1: No response.

Email 2: Silence.

Email 3: More silence.

Why does this matter? Imagine an investor facing the same void of response. To be fair, through a mutual contact in a WhatsApp group, I did get rapid initial engagement and an in person meeting that I setup for a colleague in real time, but only because it was tied to a high profile event in the U.S. with diaspora involvement.

Yet, post event? Zero follow through on the offer to provide monetization training, despite persistent follow ups across the organizational cadres, from top to bottom, via email. The disconnect is stark: plenty of enthusiasm for optics, but no tangible outcomes. This article is not directed towards any individuals just on the incentives and structure of the org, that is pissing away the publics money.

There is a reason Gen Z doesn’t want to live or work or engage with Babus. They are happy with encashing the free lancer or remote worker lifestyle in USD. Babus make deck for other Babus, that even they don’t proof read. I wish, the PM who is touted by so many as genuinely wanting to hit 15bn$ in IT exports entrusts the right people to setup the program and policy around getting this done.

A focused reform agenda: replace brochure metrics with ecosystem KPIs

If Pakistan is serious about converting this export windfall into lasting tech capability, it needs a targeted reform program. Below are concrete, evidence based steps drawn from URAAN recommendations and international best practice:

- Create a Technology & Innovation Council with a clear mandate.

Replace PSEB’s export booth model with an agency focused on R&D grants, AI infrastructure (cloud/GPU credits), procurement set asides for local suppliers and coordination across universities, industry and provinces. - Measure the right outcomes.

Move from “companies registered” and “leads generated” to audited KPIs: startups funded to Series A, public procurement contracts awarded to local vendors, patents filed, domestic pilots launched, and MLOps/AIOps jobs created. - Make incentives product friendly.

Lower rigid export thresholds (e.g., reduce a 100% export requirement so firms can sell domestically without losing incentives), implement R&D tax credits, and set up a conditional public co investment fund to de risk early VC rounds. - Fix payment rails for freelancers and SMEs.

Establish a streamlined freelancer onboarding and payment mechanism (simplified tax withholding, easy FX conversions and a trusted payment intermediary) to encourage on shore banking of foreign income this brings revenue into the formal economy and increases tax receipts. - Invest in AI infrastructure & skills at scale.

Create national GPU pools, provide cloud credits for startups, fund anonymized public datasets and expand MLOps and data engineering training tied to industry needs. - Embed genuine market expertise in diplomatic missions.

If embassy based experts are used, make them accountable to deliver deals and partnerships (measured by contracting outcomes), not just attend trade fairs. PAC debate in Islamabad raised the embassy expert idea implement it properly or drop it. - Sunset or repurpose PSEB if it cannot deliver.

Institutions require mandate, budget and capacity. If PSEB cannot shift from a promotion office to an ecosystem builder within a set timeframe, repurpose its staff and budget into a new statutory body with a results based contract. Also look at the tools, budgets and resources under the IT Ministry, stop hiring more people to fix things that need re architecting because an other babu said so.

Hard choices, measurable returns

Transformation implies political difficulty: procurement insiders will resist set asides, fiscal ministries will squint at R&D tax credits, and trade ministries will miss an easy photo opportunity. But the alternative is worse: a brittle export model that looks good in brochures but fails to anchor high value companies, keep talent at home, or build sovereign AI capacity.

Pakistan’s current export surge , $3.8bn in FY24–25 , is a moment of leverage, not a justification for complacency. Use that leverage to build AI capacity, domestic demand, and financing instruments that turn talent into products and public value.

Final twist: appoint an Ambassador at Large for Digital Growth & Transformation

If PSEB is a fossil, then what Pakistan’s IT and tech talent urgently needs is not another brochure or another conference subsidy it needs a single, empowered, champion who can speak at the highest commercial and diplomatic tables and actually get deals done. But first some one who is not sending whats app messages for intros to folks in the valley or asking for email addresses of counterparts. We play the low influence game and get treated like entry level influencers.

Think of this role as a fusion: the external diplomatic and investment pull authority of an Ambassador at Large like Ali Jehangir Siddiqui (who served as Pakistan’s Ambassador at Large for Foreign Investment) combined with the mission level advisory model we’ve just seen used for emerging tech areas (the recent appointment of a Special Assistant to the Prime Minister on blockchain and crypto is an example of that rapid, targeted mode of engagement).

But this is not about creating another three headed ego machine or an extra layer of ceremonial power. It is a pragmatic device: a Special Representative for Digital Growth & Transformation (title flexible SAPM, Ambassador at Large, or Special Envoy but outcomes not flexible:-) , with a 3 year, results bound mandate from the Prime Minister. Housed administratively wherever makes programmatic sense (PM’s Secretariat for political clout; Foreign Office as Ambassador at Large for global access; or as a ring fenced directorate inside a reformed technology council), net net where ever they can do work without babus dislodging them, the post must have:

• Clear authorities: convening power across ministries, delegated procurement set aside authority for pilot projects, the ability to negotiate commercial partnerships and MOUs at ministerial level, and a modest, ring fenced budget for R&D co investment and infrastructure credits.

• Mandate and KPIs: measurable goals such as number of domestic AI pilots launched , GPU/cloud credits deployed to startups, percentage of freelancer earnings on shored, startups reaching Series A, and exports from productized services (not just services hours).

• Accountability: a quarterly public dashboard and a three year external review clause that can repurpose the seat if it fails to deliver. But before this a a 100 day period to frame the task, this is no easy task. This needs to be framed well.

• A diplomatic, commercial brief: the person must be able to open doors with multinationals, sovereign funds, and global platforms and sign commercial pilot agreements not merely pose for trade fair photographs. Bilal Bin Saqib’s recent appointment as Special Assistant on blockchain illustrates Pakistan’s new willingness to name targeted advisors to engage global stakeholders rapidly; an analogous, product focused envoy for digital growth would task these same channels toward AI, cloud, data and startup scale.

My special request to the Prime Minister is simple and modestly urgent: look both inside and outside government, identify one credible, proven leader and put the full weight of the office behind this project . That backing must mean authority to cut across ministries, a small operating budget, and a public mandate with quantified outcomes. This is not symbolic theatre; it is the single most levered institutional change that could convert Pakistan’s current export momentum into a sustained, product driven digital economy especially in the current positive geo political tide and its role as a global player.

We are late, perhaps twenty years late to some institutional shifts, but we do not lack the advantage of leapfrogging. Just as nations skipped landlines and moved straight to mobile, Pakistan can leap into an AI native approach: data pilots, cloud credits, local procurement that seeds scale, and a trusted, high level interlocutor who can sell that story to the world.

Do this, and the difference between PSEB’s brochure metrics and real national digital capability will become visible in exports, jobs, security and sovereign capacity not just in ribbon cutting photos.

If the government wants a starter blueprint, make the post 3 years, fund it for three tangible pilots (public sector AI use/access, a national GPU pool, and a freelancer on ramp), publish quarterly KPIs, and commit to an independent audit at the 30 month mark. If it works, roll it into the Technology & Innovation Council; if it fails, close it and move on. Either way, give Pakistan’s tech talent a serious, accountable advocate at a level the market respects not another brochure builder.

We are done with watching the same 100 episode serial, only to be remade with a new cast every few years. We need to transition to reels and shorts no more long form dramas! IYKYK